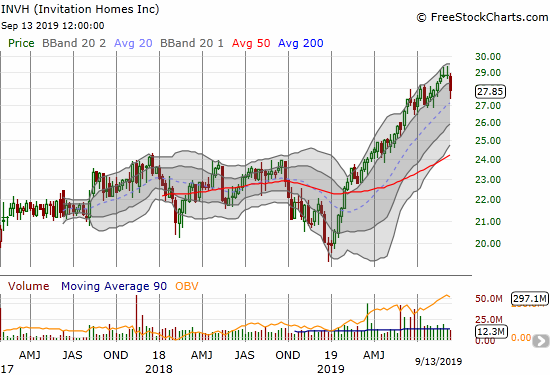

I have periodically made the case for investing in Invitation Homes (INVH) since its debut in the public markets in February, 2017. The stock was slow-going for two years and even dropped to an all-time low in last year’s stock market sell-off. INVH finally broke out this year.

I perked up while watching Nightly Business Report when Portfolio Manager John Hyun from Adelante Capital Management restated his case for Invitation Homes. The case was simple and concise.

- Invitation Homes is the largest single-family rental REIT in the U.S.

- The rate of household formation in Invitation Home’s largest markets in the West is three times higher than the national average, yet housing supply has failed to keep pace.

- An average tenant stays in an Invitation Home for more than three years.

The dividend yield of just under 2% is not a direct part of the investment thesis.

(Video below should start at the 13:32 point)

I used the previous two years of churn as an opportunity to accumulate shares in INVH. This year’s breakout turned that stubborn exercise into a validation.

Be careful out there!

Full disclosure: long INVH