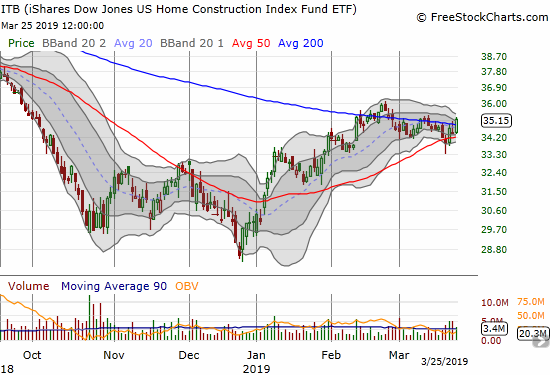

On March 25th, CNBC’s Fast Money discussed very active options trading in the iShares Dow Jones US Home Construction Index (ITB). Call option volume was triple put option volume. Of note, some trader purchased 5000 April 12 $35 weekly calls with ITB trading at $34.60 and just under its 200-day moving average (DMA). That trader paid $0.63 and quickly clocked a 50% gain when the calls closed at $0.90. I assume the trader rushed for the call options in anticipation of a 200DMA breakout and/or to hedge a short position ahead of potential technical and fundamental catalysts.

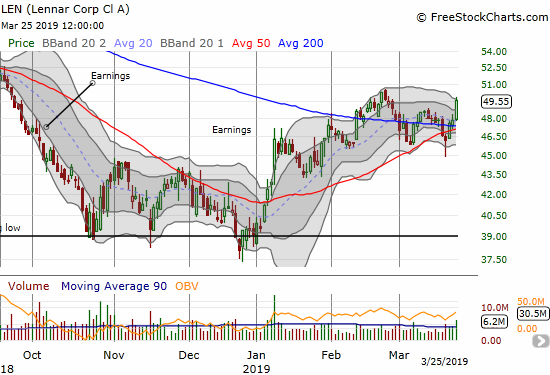

This trade is particularly interesting given two key earnings reports from home builders are coming up this week: KB Home (KBH) on Tuesday and Lennar (LEN) on Wednesday.

Traders are clearly trying to anticipate strong earnings results. According to Fast Money, the options market is pricing in a +/- 8% post-earnings move for KBH and +/-7% for LEN. With interest rates falling, I can see a scenario where any earnings news will get a positive spin in anticipation of stronger, rate-driven demand for new homes. Still, with the seasonal trade on home builders winding down (runs from November to March/April) and my growing bearishness on the overall stock market, I am looking for exits from my trading positions on home builders.

Accordingly, I took profits on my LEN call options given they carry the highest risk of the current holdings. I sat pat on my ITB April $35 call options. I accumulated the ITB position with a plan to hold it as a core home builder position through April monthly expiration if needed. Monday’s big trade on weekly $35s provided extra motivation to hold through the earnings reports.

Be careful out there!

Full disclosure: long ITB calls