I just interviewed Bill Sandbrook CEO U.S. Concrete. CA biz already solid, but he's on record predicting SB1 win in CA. More soon! $USCR

— Dr. Duru (@DrDuru) November 6, 2018

Sandbrook knows his business. SB1 passed the California legislature last year as a bill to pay for transportation infrastructure projects through a 12-cent and 20-cent increase on regular and diesel fuel, respectively, an extra $25 for regular vehicle registrations, and a $100 annual fee for zero-emission vehicles. Proposition 6 sought to repeal this bill and require voter approval of future gas taxes and vehicle registration fees. Californians soundly rejected the measure about 55% yes to 45% no.

Sandbrook made his prediction during my interview with him on November 5, 2018 after I asked about the potential fallout if Proposition 6 passed. He declared that a repeal of SB1 would have no material impact: business in California is already strong with major projects coming down the line. The Olympics are coming to Los Angeles in 2028. High tech businesses are not slowing down in the Bay Area with companies plowing money back into their businesses. The Polaris acquisition is fine with or without SB1.

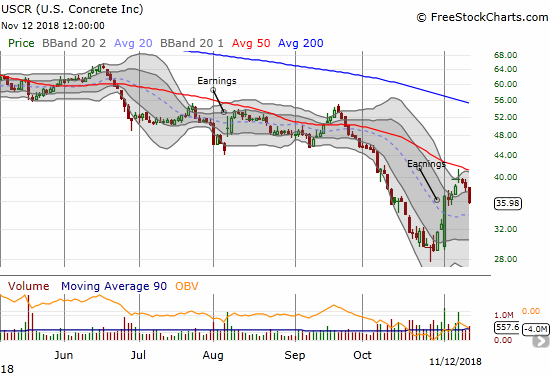

I interviewed Sandbrook twice before. In August, 2017 I described USCR as “A Strong Play on the U.S. Economy.” At that time, the stock was trading just under what would soon become all-time highs. In April, 2018 I stayed on-message with “U.S. Concrete: An Attractively Priced Bet On A Strong U.S. Economy.” That interview came on the heels of a large sell-off in the stock market. Unfortunately, the rebound in the stock market left USCR behind. The stock is currently down 57.0% year-to-date and that is after an impressive 23.3% bounce off an over 3 1/2 year low. So I had to start the interview asking about the elephant in the room: the poor performance of the stock in a year that was supposed to be very bullish for the company.

This year has delivered a confluence of headwinds on the stock. For starters, an unusually wet year threw off analyst models. The unfavorable weather conditions include record rainfall in March and three Northeasters in USCR markets; September also delivered record rainfall in the Dallas-Forth Worth market. Margins decline when product cannot get sold. USCR missed in its 4th quarter because of worker compensation costs. Analysts gave no credit for USCR’s increased self-sufficiency in and exposure to aggregates. Because of leverage, Moody’s downgraded the company one notch from B1 to B2 with a stable outlook on June 19th. Note that the two notch difference between S&P and Moody’s is the historical norm. Interest rates have gone up all year. All together a bearish narrative built up on the materials sector. This negative sentiment really catalyzed in May with the publication of a short thesis from Spruce Capital (answered point-for-point by Seeking Alpha author several days later). The herd that took down the materials sector particularly ravaged USCR given its lower trading liquidity.

Relatedly, I asked about the recent lack of love from CNBC’s Jim Cramer. An earlier supporter of the stock, the sell-off seemed to motivate Cramer to advise his audience to avoid the stock until the Federal government passes an infrastructure bill. Sandbrook has repeatedly explained that the strength of USCR’s business does not depend on a Federal infrastructure bill; he said the same on Cramer’s show. Sandbrook guessed that Cramer is simply following macro trends and is waiting for the tailwinds to turn favorable. Cramer has “capitulated” on the macro story and being “best in aggregates and margins and best in class in ready-mixed” are no longer enough for him.

Sandbrook’s bottom-line: a focus on short-term, temporary factors have created an extreme discount on the longer-term value of the business. There is a huge disconnect between public and private multiples. Private companies have never made as much money as they are making now. Yet, their cash flows and EBITDA do not compare to USCR’s. No company can even replicate USCR’s California positioning. If another company existed in the market with USCR’s fundamentals, Sandbrook would buy it.

I asked for more details on the impact of inclement weather. I wondered whether a continuation of the pattern might impact the way construction projects get managed. Sandbrook cautioned about the dangers of extrapolating weather out 1 or 2 years. Moreover, bad weather only defers construction; it does not cancel projects. Good weather might facilitate a faster drawdown on the backlog. Privately held companies do not care about weather forecasts or even the resulting period to period rescheduling of projects. It is in public markets where weather dynamics impact valuations.

I asked for more details on the operating differences between private and public companies in this sector. Sandbrook explained that private companies do not operate in the world of margins. Once they achieve break even, they focus on adjusting the business according to their ability to funnel profits away from the business and their desired family lifestyle. They are not in continuous improvement mode. Most of these businesses were losing money in 2010 and 2011, and they know they are now in a sweet spot. Because USCR has to drive margins, the company has to produce a good umbrella over pricing. USCR grows backlogs that are better than the previous year, not just bigger.

Given the very different operating model for private companies, I next wondered about the challenges presented to USCR when it acquires one of these companies. Sandbrook explained that, for starters, these companies know nothing about Sarbanes-Oxley, the Federal regulation that expanded reporting and accounting requirements for public companies. The members of these companies have to adjust to a different competitive model. They must work with a larger team, sometimes even people they formerly competed with for 10, 20, maybe 40 years. They need reminders that they can now buy cement for $10 less. Human emotion, traditions, and the entrepreneurial spirit are powerful forces that USCR must carefully guide through the integration process.

Despite the challenges, these integrations are very important to USCR’s business model. Permitting is tough. Greenfields are difficult in markets like New York City, San Francisco, and Philadelphia; productive capacities in these markets are pretty much set. Thus, these acquisitions are very accretive. Very few companies even approach USCR’s ability to execute these integrations.

USCR has grown fast from its acquisitions over the past few years. The company will next look inward for “self-help” programs. Some excess overhead is kept to maintain customer service levels after an acquisition. USCR must make sure concrete keeps getting produced and money gets collected. Billing and dispatch systems need to catch up. Over time, USCR can reduce that overhead, operating costs, SG&A, and increase margins. Fixed costs are more difficult to reduce as the company already has a pretty optimal footprint.

During the Q3 earnings conference call, Sandbrook indicated contractor capacity would not impact 2019 results. I asked for more color on this statement. Sandbrook first acknowledged the economy is pretty much at full employment and crews are difficult to expand. However, assuming more normal weather patterns, existing labor will get more productive. The same crews could get a 10-15% bump in productivity. If an infrastructure bill gets signed, extra people may be needed by 2020. Some wage inflation could also increase the labor participation rate. Even an increase of 1 or 2 percentage points would have a significant impact. Some entitlement reform could also make it more rewarding for some people to go back to work.

Fortunes may finally be changing for USCR’s stock, and investors may finally be hearing the message. For the Q3 earnings report on November 1st, Sandbrook was able to hold out July and August as months without weather impairments that demonstrated the strong underlying demand in the business. USCR reported record results for its Q3. For the second straight quarter, USCR reported “all-time quarterly highs in consolidated revenue and aggregate products volume and revenue.” Although the stock initially gapped down at the post-earnings open, the stock finished with a resounding 12.7% gain on the day (technical chart readers will notice the resulting bullish engulfing pattern in the chart above). The stock continued higher from there although it stalled at its downward trending 50-day moving average (DMA). Still, USCR trades at just 8.2 forward earnings and with a 0.4 price/sales ratio. Accordingly, I still think USCR looks like a strong and attractively priced way to bet on a strong U.S. economy.

Be careful out there!

Full disclosure: long USCR