Two weeks ago I expressed concern about the poor performance of the materials sector. The sector was under-performing the general market which seemed particularly ominous given the generally strong outlook for the economy. At the time, I expressed my hope that another interview with Bill Sandbrook, CEO of U.S. Concrete (USCR), would clear the air and provide some reassuring data points. I talked to Mr. Sandbrook on April 9th, and he did not disappoint.

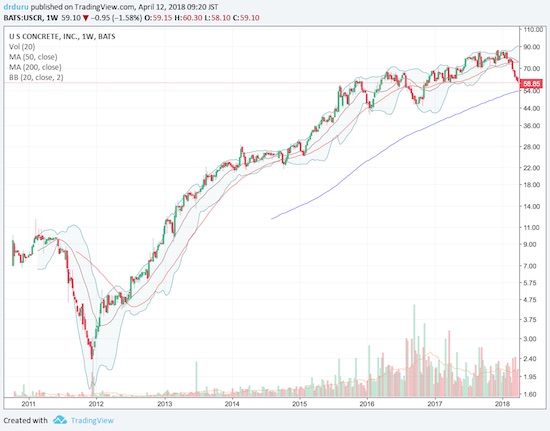

I noted that since we last talked, USCR had lost about 22% in value, including a sharp pullback after reporting earnings on March 1st. The current sell-off is USCR’s steepest and longest in duration since a similar pullback in 2016 (weekly chart below).

Source: TradingView.com

Earnings and Expectations

The post-earnings sell-off was puzzling given the company reported “new highs in volumes, revenue and profit” and “…a sixth straight year of adjusted EBITDA margin expansion” (earnings call quotes from Seeking Alpha transcript).

Sandbrook responded that the entire materials sector has been “soft and weak” and has pulled its constituent stocks down toward 52-week lows. USCR experienced a very strong run-up going into its recent highs so the drive to 52-week lows meant a large percentage drop for the stock. For example, Vulcan Materials (VMC) is bouncing off 52-week lows. To get there from recent highs, it dropped 21%. Eagle Materials (EXP) fell by a similar amount which took it to a 7-month low and a bottom. Martin Marietta Materials (MLM) flirted with 52-week lows and dropped about 18% to get there from recent highs. USCR’s relatively dramatic decline meant a reversal of extremely high expectations.

These high expectations were not adjusted for the likely impact of very bad weather conditions in two of USCR’s core markets. The Dallas-Ft. Worth area experienced its wettest year in 100 years. The poor weather in February caused a decrease in shipments. The Northeast suffered from four extremely heavy snowstorms (Nor’easters) in a row. Sandbrook depicted a NY-centric investor base that looks “…out the window, sees the poor weather, and makes the connections” to reduced cement business. In other words, there is a lot of short-term sentiment trading in the stock. From the earnings call:

“…during the fourth quarter of 2017, results in the Northeast and Texas markets were significantly impacted by weather. In the last two weeks of the year alone, we estimate we lost approximately 100,000 yards of concrete sales, which would have generated an estimated $12 million of incremental revenue and $2 million of incremental EBITDA for the quarter.”

Sandbrook was also not able to give as much color on the financial impact of the acquisition of Polaris Materials Corporation on November 17, 2017. This is how Sandbrook described the deal at the time:

“This acquisition will enable us to self-supply a majority of our current Northern California aggregate requirements and to further expand our footprint into other supply constrained markets along the West Coast, including Southern California…The addition of Polaris to the U.S. Concrete family is further evidence of our commitment to increased vertical integration into aggregates to capitalize on attractive long-term growth opportunities for our shareholders.”

And from the last earnings report (Seeking Alpha transcript):

“Everybody has to think about Polaris as the California quarry basically. The dynamics that go along with California quarries on the commercial side would be definitely in play for that asset. And as California aggregate pricing and inflationary pressures creep in, we will obviously be able to partake in that.”

Sandbrook indicated to me that in the next earnings report he will more completely describe the new opportunity delivered by Polaris. In the last earnings call he could only reference Polaris’s own earnings report as a baseline and say he was “optimistic from there”. Given California is a supply-constrained market, this acquisition IS a big deal for USCR. Polaris is the largest acquisition in the company’s history. Sandbrook further explained that Polaris assets contain more than 80 years of reserves. Note well that USCR is trading 21% lower than where it traded when USCR first announced the deal in late September.

Sandbrook noted that the company “lives and dies” by the expectations of 6 or 7 analysts. If they miss the weather impact, the company gets punished. The stock chart above shows several years since 2012 where USCR pulled back in the wake of severe of weather periods; each seasonal episode was a buying opportunity.

Infrastructure Spending

I next asked Sandbrook whether changing expectations on infrastructure spending could help explain the weakness in the stock. Sandbrook noted that his heavy aggregate peers have been waiting for a robust federal infrastructure bill, like highway programs. However, the “Trump bump optimism” for a massive infrastructure bill has faded significantly. The effort was first pushed back because of the fight over health care and then tax cuts. Moreover, Trump’s main two infrastructure proponents have left the administration. Increasingly, it appears an infrastructure bill will get punted to post-2018 mid-term elections. Fortunately, USCR has not baked into its business any expectations for an infrastructure bill. Sandbrook has delivered this message for two years, and he mentioned it in our last discussion as well.

The most critical driver for USCR is a strong economy. GDP growth of 3% is more important than infrastructure bills.

Inflationary Pressures

Finally, I referenced the frequent discussion of inflation pressures in the last earnings report. I asked Sandbrook for more specifics on the drivers of inflation in diesel and labor.

Diesel prices are simply going up alongside the increase in gasoline prices.

The higher cost of labor comes from a shortage of qualified truck drivers. (This shortage has become chronic. Nightly Business Report covered this shortage in 2014, 2015, and in 2018 a piece on the rising demand for trucking.) Sandbrook explained that truck drivers tend to leave for a better pay package, and competitors are willing to pay up. The labor shortage extends to the trades, like drywall contractors and electricians. Hurricane-related recovery efforts are adding to strains on the supply of labor. Wages for white collar workers are not going up as much as those of the hourly wages.

I pressed for more details wondering whether the labor shortage is more than a cyclical issue; I was wondering about structural factors. Sandbrook offered some observations on the nature of work in today’s America. He lamented that there are more able-bodied people NOT working than at any other time our history. A lot of people are finding it unattractive to work and thus creating a shrinking pool of available workers. He also noted that construction sites that relied on immigrant labor are suffering from immigration reform; they have difficulties in attracting replacement laborers. USCR is impacted indirectly by the labor shortages on construction sites. For some background on one way to look at the structural forces reducing the supply of willing workers see “Edward Glaeser on Joblessness and the War on Work” on EconTalk, March 26, 2018.

Conclusion

I ended my interview with Mr. Sandbrook with a renewed sense of opportunity. I liked USCR last summer, and I like it even more here. I wrote in other posts about the technical factors weighing on the market that ever so subtly seem to be lifting. Once that tide recedes, I think it will reveal pearls like USCR. The industry itself remains highly optimistic; once again from the earnings conference call:

“The U.S. Chamber of Congress Commercial Construction Index increased once again in the fourth quarter showing continued strength in overall backlog levels, new business opportunities and revenue forecast with a reported 99% of contractors feeling confident in the demand for new commercial construction over the next 12 months.”

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long USCR