Gold, and by extension the SPDR Gold Shares (GLD), has had a rough year. However, based on a historic flip in speculative positioning in gold futures, a bottom is likely in for GLD. According to the tweet and chart below, the net speculative positioning in gold recently went net negative for the first time in almost 17 years. Assuming this is about as negative as the market can get, the persistent selling pressure on gold is likely coming to an end.

For those gold watchers such as myself, the net spec position in gold for the week ended Tuesday went NET short for the 1st time since December 2001 when gold was at about $275 an ounce. pic.twitter.com/qUe5TKnqQv

— Peter Boockvar (@pboockvar) August 17, 2018

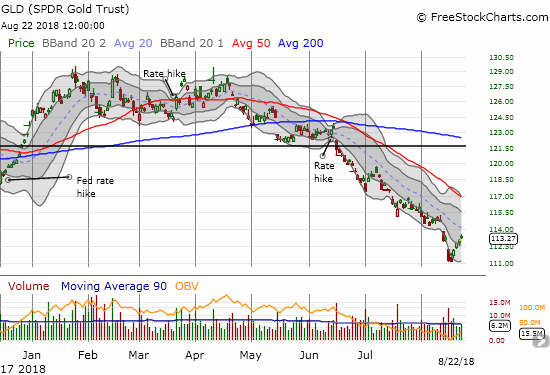

GLD has rallied over the last four trading days off a 1 1/2 year low. In the process GLD reversed its latest gap down. While GLD remains below its steeply downtrending 20-day moving average (DMA), this trading action could indicate the beginnings of a sustainable bottom for gold (when combined with the net speculative positioning in gold futures). Buyers have not shown this much enthusiasm in GLD in four months or so.

Source: FreeStockCharts.com

While GLD is starting to look promising, I have to temper my enthusiasm based on what happened to silver in March of this year. At that time, I pointed out that silver reached “maximum bearishness” as speculators flipped net bearish for the first time in about 10 years. As the chart below shows, the bottom in iShares Silver Trust (SLV) only lasted three months before a new breakdown took SLV down its current steep path. Along the way, SLV even had two false breakouts which each looked very promising at the time they occurred.

Source: FreeStockCharts.com

The U.S. dollar index (DXY) is also tempering my enthusiasm. When the dollar last broke out two weeks ago, I reiterated my bullishness but noted the currency was over-stretched technically; it was not a time to chase the dollar higher. That breakout has now fully reversed and transitioned into a retest of uptrending 50DMA support. I am a buyer here.

Source: TradingView.com

Assuming the dollar is poised to rebound again, GLD and SLV will once again face strong headwinds. Given SLV has yet to reverse its latest breakdown, I suspect it will suffer more from the dollar’s lack of cooperation than GLD.

The moves in the U.S. dollar have created interesting and tradable technical patterns across various currency pairs. For example, the trade short the Swiss franc (FXF) recaptured my interest. USD/CHF fell away from its 50DMA pivot and now trades at the bottom of its recent range. I am still targeting a sustained breakout above parity for USD/CHF and am content to reaccumulate a position here and collect carry while I wait for my thesis to play out.

Source: TradingView.com

Source: TradingView.com

On the other side of the ledger is the Mexican peso. As expected, USD/MXN was not up to the task of breaking out above 50/200 DMA resistance. I faded the pair several times around resistance and have already taken profits. With a NAFTA deal apparently looming between the U.S. and Mexico I do not want to bet on the capricious nature of the currency markets to trade any particular direction on the news or in the immediate aftermath of the news.

Source: TradingView.com

Be careful out there!

Full disclosure: long GLD, SLV shares and calls, net long the U.S. dollar index, long USD/CHF