The deconstruction continues in material stocks. The culprit this time around was a poor reading and interpretation of construction spending. Per AP News:

“U.S. construction spending dropped 1.7 percent in March, the biggest setback in 11 months, with weakness in a number of sectors including the biggest plunge in home building in nine years.

The March decline was the first monthly drop since last July and the biggest contraction since a 1.8 percent fall in April 2017, the Commerce Department reported Tuesday. Spending on residential construction was down 3.5 percent, the worst showing since a 4.2 percent decline in April 2009.”

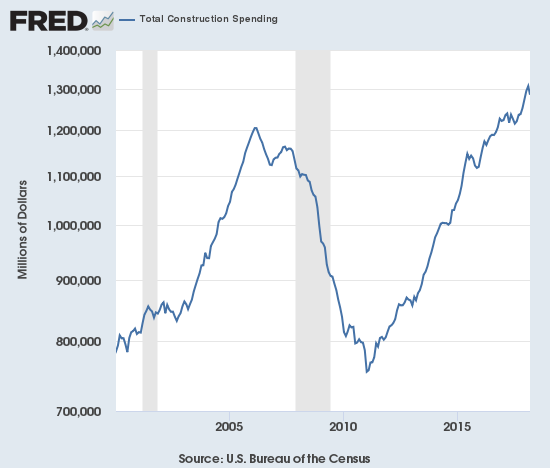

While these numbers seem dire, they lose a lot of significance for me when taken in context. For example, here is the chart of total construction spending since 2000; it makes March’s drop look like a pebble dropping in a lake. (I put all the spending charts on log scale given the wide range in spending from trough to peaks).

Source: U.S. Bureau of the Census, Total Construction Spending [TTLCONS], retrieved from FRED, Federal Reserve Bank of St. Louis; May 1, 2018.

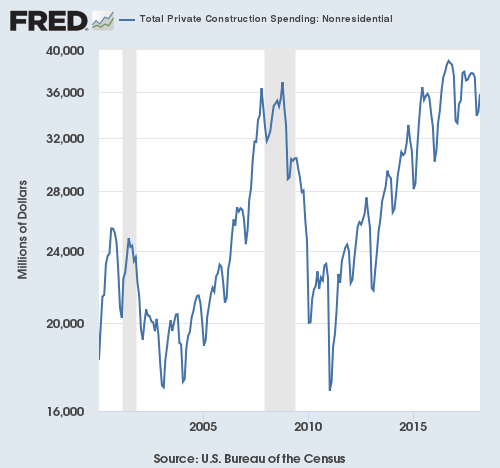

Breaking down the picture is a little more informative. Private non-residential construction spending peaked September, 2016 but March’s number was significantly higher than February.

Source: U.S. Bureau of the Census, Total Private Construction Spending: Nonresidential [PNRESCON], retrieved from FRED, Federal Reserve Bank of St. Louis; May 1, 2018.

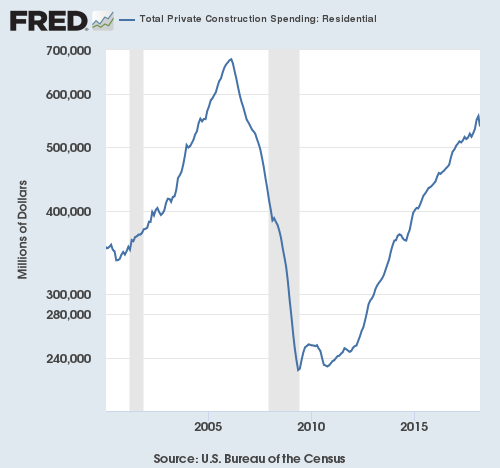

Private residential construction spending took a nasty tumble in March relative to the peak. Still, relative to the on-going trend, it looks like a blip that is simply taking the numbers down from what looks like a swift pick-up in the trend over the last several months.

Source: U.S. Bureau of the Census, Total Private Construction Spending: Residential [PRRESCONS], retrieved from FRED, Federal Reserve Bank of St. Louis; May 1, 2018.

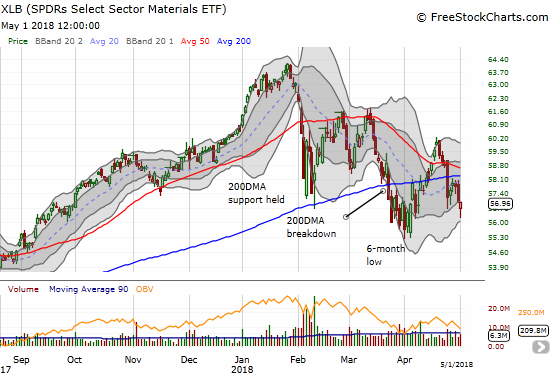

The overall numbers did not matter for material stocks though as the Materials Select Sector SPDR Fund (XLB) gapped down and sold down to levels last seen a month ago. Fortunately, buyers stepped into enough of the components to almost close XLB flat on the day.

Source: FreeStockCharts.com

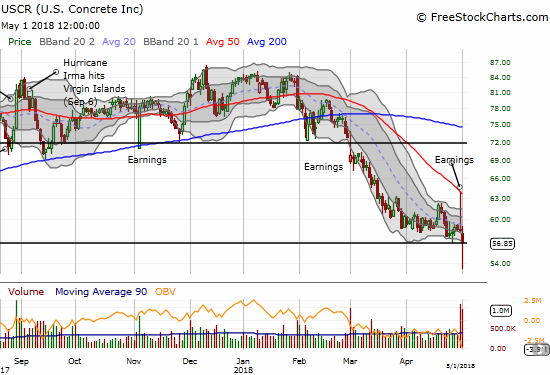

A few individual material stocks REALLY got slammed. For example, one of my favorites, U.S. Concrete (USCR) was down as much as 8.8% and a new 18-month low before buyers stepped in. The losses were too great to get back to even though – USCR closed with a 2.7% loss. Today’s response to the construction numbers was the mirror image of the distorted post-earnings move yesterday which took USCR up as much as 9.4% and a test of downtrending 50-day moving average (DMA) resistance before sellers faded the stock all the way to flat. These are some extreme moves for a concrete company that is still reporting strong numbers! I will probably buy my second tranche of USCR and just wish I was on top of the action when it was down even 6%!

Source: FreeStockCharts.com

Acuity Brands, Inc. (AYI) also lost big on the day. AYI gapped down and lost 4.9%. AYI provides lighting solutions for non-residential building and has struggled for almost two years after hitting an all-time peak. AYI has been reporting challenges in the private non-residential construction market and its peak coincides with the peak in spending in the sector. Still, I am wondering whether selling is finally reaching a crescendo. (Note AYI also announced an acquisition this day that the company said would not impact 2018 results).

Source: FreeStockCharts.com

Any way you slice it, investors and traders are on a cliff’s edge with materials stocks. Bad news greases the skids and good news is examined with skeptical scrutiny. It is a tough environment for investing. Still, at least for USCR, as long as I am interpreting the reports as strong, I see opportunity.

Full disclosure: long USCR

I agree, this is opportunity. Year-over-year and month-to-month spending comparisons involving March 2018, as I have commented elsewhere, should consider that it featured horrible weather over the entire northern US, and significant flooding in the IL/IN/OH/PA belt.

Right. The weather! Crazy the analysts didn’t take that into account enough in their estimates. It was the “miss” that really got markets roiled. USCR has complained about the inability of analysts to take weather into account in expectations.

USCR zipped up 7.4%. Amazing how wildly this stock is moving right now day-to-day.