Source: CNBC

Ever since LongFin Corp. (LFIN) soared astronomically four days into its stint as a publicly traded company, I have been fascinated by the story. At the time I covered the story, I wrote: “The trading in recent IPO LongFin Corp. (LFIN) may go down as iconic in this era of frenetic trading in almost anything related to cryptocurrencies and blockchains.” Since then, LFIN has become more iconic than I could imagine: the stock and the company are hyper-emblematic of the tremendous distortions that can occur in the middle of manias.

Source: FreeStockCharts.com

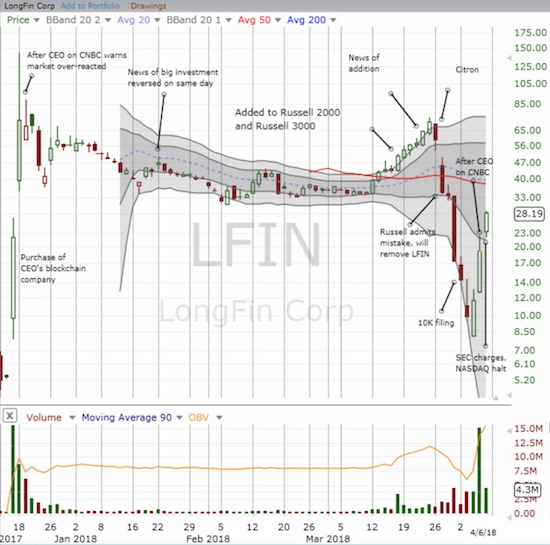

Just over a month into being a publicly traded company and then 70% below its intraday all-time high, LFIN proudly announced a major investment in the company that it promptly retracted the very same day. This behavior was strange enough – the CEO after all earlier admitted the company was overvalued at its lofty levels. The willingness of investors to sit on the company’s post-news premium struck me as even more strange. Some semblance of “normalcy” seemed to get going as LFIN drifted lower for 2 weeks. Yet, soon after options began trading on LFIN, the stock stabilized for another month until the news got bizarre all over again. THIS spate of news may be spelling the final throes of this company.

Russell unravelling

LFIN announced on March 22nd that its stock was added to the Russell 2000 and Russell 3000 small-cap indices. The addition apparently happened on March 16th. All of us who watched in amazement as LFIN marched steadily higher on no news suddenly understood what was driving the stock. Index funds were adding LFIN to their coffers to prepare for the index change. The news seemed to herald LFIN’s undoing. LFIN caught the attention of short-sellers, like the infamous Citron, and LFIN’s story quickly unravelled from there.

The day after Citron’s hit, Russell admitted its mistake in adding LFIN to its small-cap indices. That news caused an implosion of LFIN’s stock. In one day, ALL the gains of the March breakout were erased. Next up came a 10K filing on April 2nd that disclosed an SEC investigation. While that alone was bad enough, the immediate reporting in the financial press skipped over other troubling elements of this report: 1) LFIN blamed short-sellers for the trading woes in its stock, 2) LFIN claimed a Seeking Alpha article convinced FTSE to remove LFIN from its small-cap indices, 3) LFIN established that its cryptocurrency token has no intrinsic trading value, 4) the company described the volatile trading in its stock through March 30th as a “trading bubble,” 5) LFIN disclosed material questions over whether it can continue as a going concern, and 6) LFIN admitted lax financial controls. Points #1 and #2 above are mere deflections from the serious issues contained in points #5 and #6. Points #3 and #4 further undermine the rationality of the LFIN’s current stock price.

In a section titled “Techniques employed by manipulative short sellers in cyptocurrency[sic] stocks may drive down the market price of our common stock,” LFIN explained how short-selling works and how it works against a small company like LFIN. The company blamed the attack on its company as the result of an unregulated ability of short-sellers to publish their claims. LFIN warned: “You should be aware that in light of the relative freedom to operate that such persons enjoy, in case of a short-seller attack, our stock may suffer from a temporary, or possibly long term, decline in market price should the rumors created not be dismissed by market participants.” I would have thought the company would rely on itself, and not market participants, to defend the business against false claims.

LFIN’s claim that the FTSE was in error for removing the company from the Russell indices was particularly bizarre: “…a report published on the Seeking Alpha website on March 23, 2018 alleged that the addition of our Class A Stock to the Russell 2000 index was in error, which led to our Class A Common Stock being removed from the Russell 2000 index.” In LFIN’s view, the article was responsible for the index removal and not the recognition of a legitimate mistake. LFIN CEO Venkat Meenavalli promptly told CNBC that the company would reapply for inclusion based on the increase of its free float “…above the minimum 5 percent as of March 11 due to the expiration of a lockup period on a consultant’s stock holdings.” Of course inclusion in an index may be the least of the company’s concerns with an SEC investigation underway.

No (Crypto) Value

Presumably, the trading hyper-premise for LFIN was its entry into the cryptocurrency/blockchain world two days after its IPO. Traders have jumped quick, fast, and in a hurry into anything blockchain on the hopes that they could get in on the ground floor before a particular token/cryptocurrency soared in value. So I took great interest in the irony of LFIN explaining that its ZidduWC token has no intrinsic value in order to avoid categorization as a security by the SEC and all the regulations that would come along with such a designation:

“The speculative fever surrounding cryptocurrency means that buyers of it often expect profits arising from value of the appreciation of cryptocurrency just as has historically happened with gold and silver. As holders may only acquire the ZidduWC in order to exchange it pursuant to smart contracts designed by Longfin to implement our fintech solutions, as described elsewhere in this report, and there is no exchange on which their ZidduWC may be resold for profit in the form of price appreciation, we do not believe the “expectation of profit” test is met in the case of the ZidduWC…

As a result of failing to meet the foregoing prongs of the Howey Test, we believe that the ZidduWC does not constitute an investment contract and is not a security.”

On this basis alone, LFIN is extremely over-valued assuming that investors in LFIN hoped specifically that this ZidduWC token could one day be worth a lot of money.

Questionable trading

The first headline that got the market worried over the 10K was the disclosure of an SEC investigation into “the Matter of Trading in the Securities of Longfin Corp.” The 10K provides no details on the charges except to say that there are questions about potential violations of federal securities laws…

“On March 5, 2018, the Division of Enforcement of the SEC informed the Company that it is conducting an investigation In the Matter of Trading in the Securities of Longfin Corp. and requested that the Company provide certain documents in connection with its investigation, including documents related to our IPO and other financings and the acquisition of Ziddu.com. We are in the process of responding to this document request and will cooperate with the SEC in connection with its investigation. While the SEC is trying to determine whether there have been any violations of the federal securities laws, the investigation does not mean that the SEC has concluded that anyone has violated the law. Also, the investigation does not mean that the SEC has a negative opinion of any person, entity or security.”

I grant the company that there is no reason to panic on news of an investigation since the conclusions could lead anywhere. Still, the stock sold off another 17.1% on the news. The next day the stock gapped down 22%, filled the gap, and the closed the day with a 31% loss. The stock finally stabilized the following day after gapping down and then finishing the day with a gain. On the third day of the recovery, the SEC had finally had enough. It announced what must be the conclusions of the investigation that launched in March. The SEC made the following serious charge in a release titled “SEC Obtains Emergency Freeze of $27 Million in Stock Sales of Purported Cryptocurrency Company Longfin” (I duly noted the choice use of the term purported!):

“The Securities and Exchange Commission has obtained a court order freezing more than $27 million in trading proceeds from allegedly illegal distributions and sales of restricted shares of Longfin Corp. stock involving the company, its CEO, and three other affiliated individuals.

According to a complaint unsealed today in federal court in Manhattan, shortly after Longfin began trading on NASDAQ and announced the acquisition of a purported cryptocurrency business, its stock price rose dramatically and its market capitalization exceeded $3 billion. The SEC alleges that Amro Izzelden “Andy” Altahawi, Dorababu Penumarthi, and Suresh Tammineedi then illegally sold large blocks of their restricted Longfin shares to the public while the stock price was highly elevated. Through their sales, Altahawi, Penumarthi, and Tammineedi collectively reaped more than $27 million in profits.

According to the SEC’s complaint, Longfin’s founding CEO and controlling shareholder, Venkata Meenavalli, caused the company to issue more than two million unregistered, restricted shares to Altahawi, who was the corporate secretary and a director of Longfin, and tens of thousands of restricted shares to two other affiliated individuals, Penumarthi and Tammineedi, who were allegedly acting as nominees for Meenavalli. The subsequent sales of those restricted shares violated federal securities laws that restrict trading in unregistered shares distributed to company affiliates.”

The SEC said it acted just in time to prevent these potentially ill-gotten gains from going offshore and out of the easy reach of the U.S. government. The implication of the CEO in this scheme is of utmost importance and threatens whatever legitimate business LFIN was actually conducting. Whenever the stock resumes trading, it will likely open in the single digits or in quick order trade toward single digits, perhaps close to its price on opening day before the whole cryptocurrency “trading bubble” kicked off.

Questionable viability

I cannot be fully confident the stock will crater upon a resumption of trading because traders were willing to buy up the stock despite LFIN admissions in the 10K regarding a lac of financial controls and material issues of solvency. While the stock initially sold-off following the 10K disclosures, the stock still soared from its low to the trading halt for a whopping 185% gain. Sure, a lot of this action could have come from the rush of short-sellers to cover stock, but I still find astounding the scale of the surge given the thick haze surrounding the company.

Here is what LFIN said about its ability to continue operating (emphasis mine):

“The report of our independent registered public accounting firm that accompanies our audited consolidated financial statements for period from February 1, 2017 (inception) through December 31, 2017 includes a going concern explanatory paragraph in which such firm expressed substantial doubt about our ability to continue as a going concern…

We believe our existing cash and cash equivalents, together with cash provided by operations and the initial $5.0 million pursuant to the Financing, will not be sufficient to meet our needs for the foreseeable future.“

LFIN goes on to explain that its viability as a business is dependent on achieving profitability and additional financing. Since inception, LFIN has lost $26.4M, and it only has $2.1M in cash in the bank. The additional financing is related to the bizarre announcement, and then immediate retraction, on January 22nd of a major investment. Here is how LFIN now describes this investment:

“…the Company agreed to sell and issue (1) (i) Senior Convertible Notes to the Investor in the aggregate principal amount of $52,700,000 (each, a “Note” and collectively, the “Notes”), consisting of a Series A Note in the principal amount of $10,095,941 and (ii) a Series B Note in the principal amount of $42,604,059, and (2) a warrant to purchase 751,894 shares of Longfin Class A Common Stock, exercisable for a period of five years at an exercise price of $38.55 per share (the “Warrant”), for consideration consisting of (i) a cash payment of $5,000,000, and (ii) a secured promissory note payable by the Investor to Longfin (the “Investor Note”) in the principal amount of $42,604,059 (collectively, the “Financing”).”

LFIN completed this deal on February 13th and received a net $3.7M. However, the rest of its financing depends on achieving approval from the SEC to register the relevant shares or some other triggers which are all unlikely given the trouble LFIN finds itself in now. I am astounded LFIN was able to achieve this deal at an exercise price of $38.55 given its own assessment that its price was elevated and in the middle of a “trading bubble.”

A lack of control

In his last interview with CNBC, CEO Venkat Meenavalli claimed that he voluntarily issued the warning about the lack of financial controls in the 10K. These disclosures alone make the company’s shares toxic as it is hard to believe anything the company says about its financials until this situation gets straightened out. Perhaps the lack of controls helped convince the CEO he could issue restricted shares for immediate sale at tremendous profit on the open market? From the 10K…

“In connection with the audit of our financial statements beginning on page F-1, the Company identified several material weaknesses in its internal control over financial reporting…

- the Company lacks qualified personnel who fully understand GAAP reporting requirements, possess appropriate skills to identify and determine proper accounting for new, complex or unusual transactions or have a proficiency in the SEC reporting environment;

- the Company did not maintain sufficient personnel with the technical knowledge and skills to perform accounting functions for complex/non-recurring transactions and financial reporting functions;

- the Company exhibited an overall lack of sufficient knowledge, organized and sufficient audit support, documented positions and assessments, and policies/procedures related to the accounting treatment for both complex and non-complex transactions;

- certain segregation of duties issues exist (i.e., the same person performs the process and the control in certain areas);

- the Company does not have any formal or documented accounting policies and procedures, including with respect to intangible assets and monitoring related parties;

- senior financial reporting personnel have the ability to make journal entries;

- there is no formal review process around journal entries recorded.

LFIN goes on to admit (emphasis mine): “Neither we nor our independent registered public accounting firm has performed an evaluation of our internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act. In light of the material weaknesses that were identified, we believe that it is possible that additional material weaknesses and control deficiencies may have been identified if such an evaluation had been performed.”

These admissions are huge bombshells and completely undermine the company’s financial credibility. They make the stock untouchable even as the 10K makes promises to fix these deficiencies. This is a “show me” stock if there ever was one!

A stay of conclusion

This 10K is LFIN’s first annual report as a publicly traded company. It is obviously an extremely poor start, and the company’s legal troubles alone could force it into insolvency in short order. Still, the troubled story of LFIN is likely not over. At some point, the trading halt will end and the mania in the stock recommence. If anyone dares to trade this stock, it has to include options as a way of tightly managing risk. Whether going long or short, traders risk the potential for rapid losses on the heels of extremely sharp and abrupt moves. The risks remain high, up OR down, as long as questions loom over the company’s valuation, credibility, and viability.

Was this the last time we will ever see LFIN CEO Venkat Meenavalli speaking in public about his seemingly ill-fated venture as a publicly traded cryptocurrency/blockchain company?

Source: Longfin Corporation

Be VERY careful out there!

Full disclosure: no position

Up 47% today. I’m going to rush out and buy some.

Seriously though, from everything in your article, this couldn’t even be considered a real company. It smacks of all the dot-bomb companies of the Y2K era which initially sold for astronomical prices, until the world ‘suddenly’ realized they were, uh, worthless. You have to wonder who was buying over 4M shares of this stuff today…..

And not only does this one seem to be worthless, if it weren’t apparently illegal, what they’ve been doing is comical(assuming you don’t own the stock).

They must have been watching Marx Brothers movies before putting this ‘company’ together.

Having said that, it could continue to defy common sense, and go higher….

Ooops, my mistake. It didn’t trade today. As you’ve shown, that was last week’s close.

But you have to wonder what all those new shareholders are thinking…..now…..

I definitely don’t own it (see my disclosure at the bottom of the post). I am fascinated by the story nonetheless, and have been watching for an angle to make a trade.

Your observations are correct. This hardly seems like a real company, especially not real enough to deserve publicly traded status on the NASDAQ!