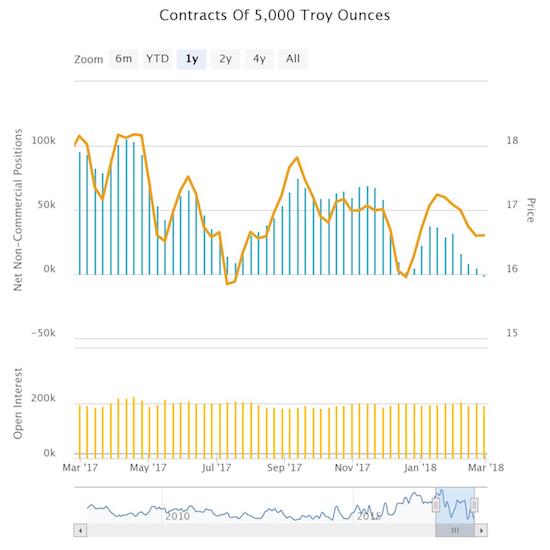

For the first time since at least 2008, speculators flipped bearish on silver.

Source: Oanda’s CFTC’s Commitments of Traders

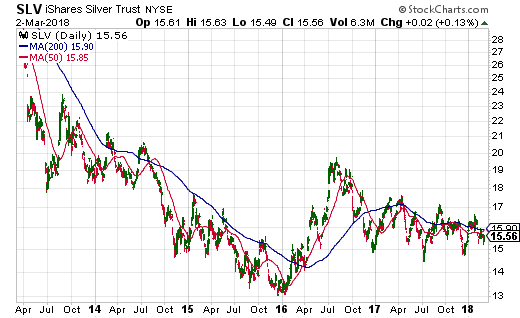

Speculative net contracts have trended downward for about a year and approached zero in December around the time the Federal Reserve last hiked rates. Yet, I did not think it was “possible” for positioning to go net short since it has not happened since at least 2008. So now I am wondering whether this extreme represents “maximum” bearishness on silver or is the negative sentiment just getting started? This bearish positioning comes at a time with U.S. interest rates on the march higher and the iShares Silver Trust (SLV) languishing in a near 2-year trading range.

Source: Stockcharts.com

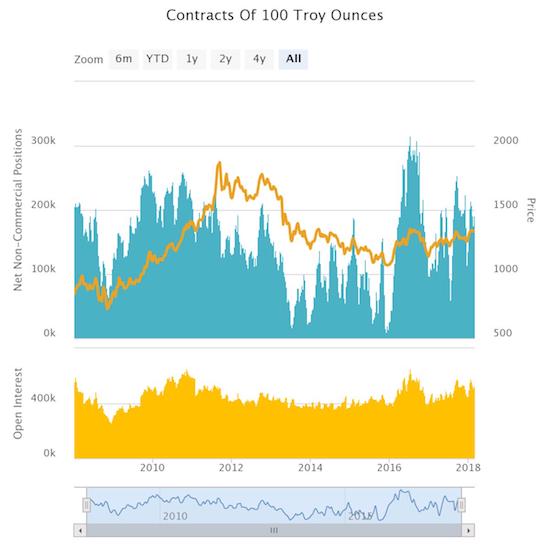

What makes the change of sentiment on silver particularly stark is that speculators are still quite bullish on gold.

Source: Oanda’s CFTC’s Commitments of Traders

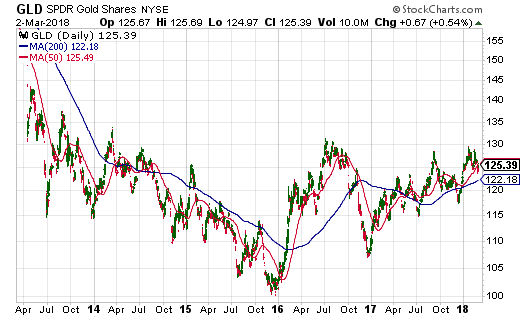

The SPDR Gold Shares (GLD) is also faring better than SLV. GLD bottomed in late 2015 and is trading just a bit off its recent highs.

Source: Stockcharts.com

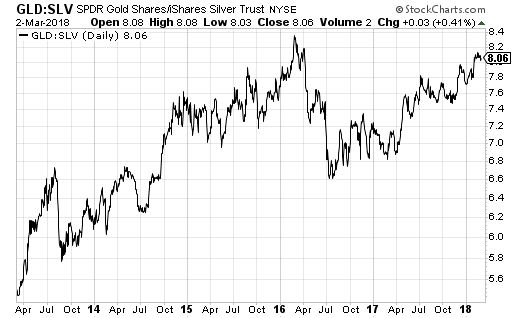

The result is a GLD/SLV ratio that is reaching a 2-year high.

Source: Stockcharts.com

At this point, I think a pairs trade is in order going long SLV and short GLD to layer on top of my core positions in both ETFs. While I am loathe to short gold in any form, I think a pairs trade makes sense given the abiding uncertainty around how traders and speculators will position precious metals versus all the macro catalysts in the market: trade wars, rising rates, stronger inflation, stronger global growth, tightening monetary policies, and elevated volatility in financial markets. If the big move is to the upside for precious metals, I think SLV will play serious catch-up and offer outsized upside potential.

Be careful out there!

Full disclosure: long GLD and SLV shares

Suggestion: have a look at platinum versus gold and versus silver. I’ve seen lots of mentions of it lately, in places it has never been mentioned before.

You might also look at Google Trends interest in all three…

There is unfortunately no ETF for platinum. Looks like platinum spot prices have gone nowhere for over 2 1/2 years. So not sure what is hiding in the relationships?

The Google Trends on the precious metals are tough because the terms are used in so many different ways. So I append “buy” and “sell” in front. But again, the Google Trends across the three don’t suggest anything of note to me…