New Federal Reserve Chair Jerome Powell had his say with Congress this week and some of the conventional financial media and pundits have been shrill with speculation about the potential for four rate hikes in 2018 as a result of Powell’s word choices and tone. This number of hikes is reportedly one more hike than financial markets priced in based on smoke signals from the Fed coming into 2018.

Yet, the 30-Day Fed Funds Futures are not pricing in 4 rate hikes this year. Not even close. Assuming the Fed will continue to hike at the snail’s pace of 25 basis points (bps) at a time from the current 125 to 150 bps range, the futures imply only a 27.8% chance of 4 rate hikes this year. These odds should not be ignored, but they are also far from the 51% level at which point the market would be telling us the odds barely favor 4 rates hikes over 3 for 2018.

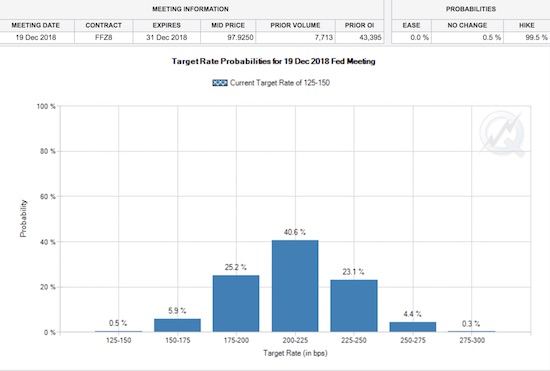

Source: CME FedWatch

The above chart should be read from left to right. Each bar represents the probability that the Fed at its December meeting will set its target rate to the given level. So starting with the far left bar, the odds are only a paltry 0.5% that the Fed will leave rates at the 125 to 150 bps range in December. The likelihood for rates to be set at the 200-225 bps range is 40.6%. However, given the markets thinks there is a non-zero chance for rates to be set even higher, it is more appropriate to frame the answers as the likelihood for rates to be AT LEAST 200-225 bps is 40.6% + 23.1% + 4.4% + 0.3% = 68.4%; sum up the odds starting from the target range and everything higher. Similarly, the likelihood for the Fed to set rates at least 225 to 250 bps in December is 27.8%.

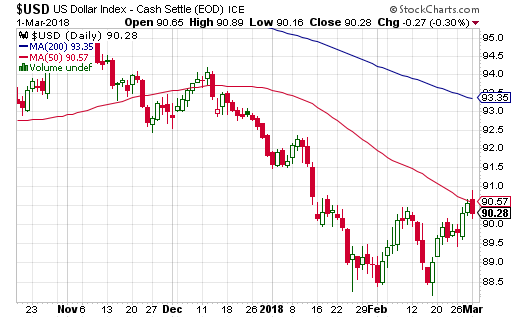

I prefer to follow the market on this topic instead of the speculations of the punditry, so to the extent that events in financial markets are understood to be a result of expectations of 4 rate hikes in 2018, I want to create a fade. Technically, that strategy implies fading the U.S. dollar index (USD). Today, the U.S. dollar index fell back from resistance at its 50-day moving average (DMA).

Source: StockCharts.com

However, I am not yet ready to fade the dollar as I strongly suspect it is finished declining. Instead, my “fade” is more like a confirmation that the current period of angst in the stock market over a hawkish Fed is overdone. I am incrementally more confident in playing the oversold periods from the long side even as I am preparing for the potential that the stock market has topped out for the short to intermediate term.

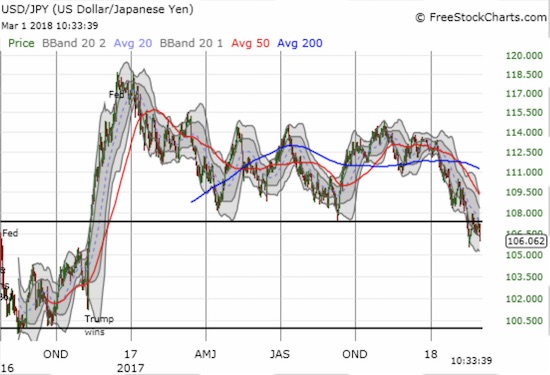

For now, I think the Japanese yen is the best currency to use to bet against the U.S. dollar. USD/JPY broke through a critical technical level and yet speculators remain exceptionally bearish on the yen.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long and short various currency pairs with the U.S. dollar

{March 21, 2018: I corrected the first mention of the odds of four rate hikes from 26.5% to 27.8%}