(This is an excerpt from an article I originally published on Seeking Alpha on October 12, 2017. Click here to read the entire piece.)

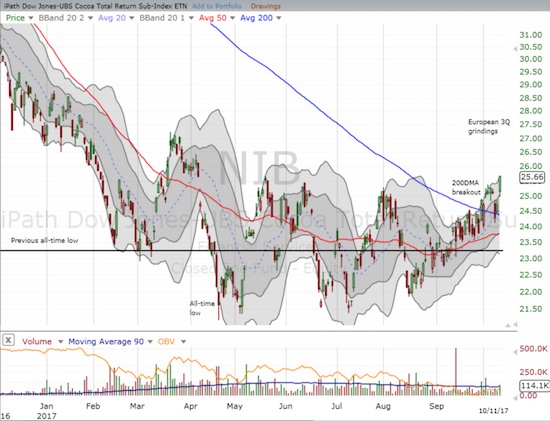

Looks like my rotational trade on iPath Bloomberg Cocoa SubTR ETN (NIB) is coming to an end.

{snip}

Source: FreeStockCharts.com

{snip}

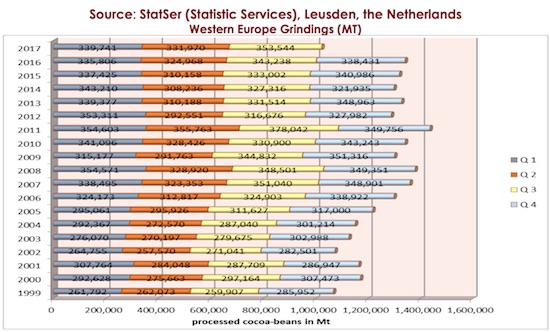

The headline driver for this strong move was the European Cocoa Association (ECA) which released very strong numbers for cocoa grindings for the third quarter. European grindings increased 3.0% year-over-year to 353,544Mt, a bullish 6-year high.

Source: European Cocoa Association (ECA)

Since the large dip in 2012, European grindings are in a slight uptrend. This year’s increase in grindings does not soak up the production surplus, but it does provide a bullish signal. The increase likely reflects well upon the broader European economic recovery and suggests that low prices could be motivating incremental demand. Such price-driven buying is a good marker for a bottom. My interest in cocoa has long been the secular growth story in demand buffeted by the occasional supply constraints. Perhaps now the secular demand story for cocoa can start to dominate the headlines of production surplus.

Be careful out there!

Full disclosure: NIB

(This is an excerpt from an article I originally published on Seeking Alpha on October 12, 2017. Click here to read the entire piece.)