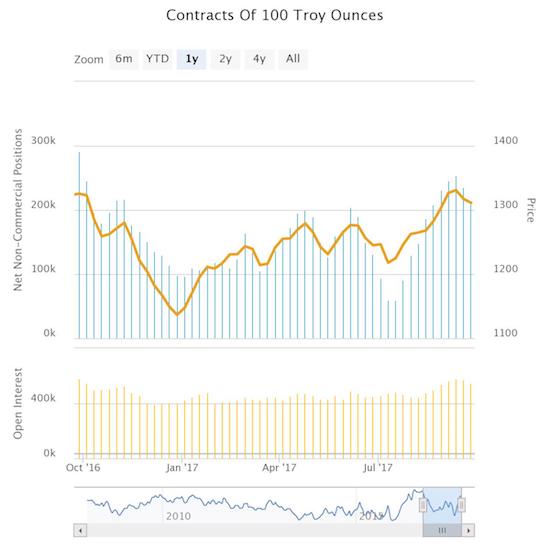

A month ago, I wrote about the near seasonal pattern of speculators accumulating net long contracts in gold and silver from July troughs to October peaks. THIS year, the speculators started up on schedule but aborted the mission as net longs peaked well ahead of October.

Source: Oanda’s CFTC’s Commitments of Traders

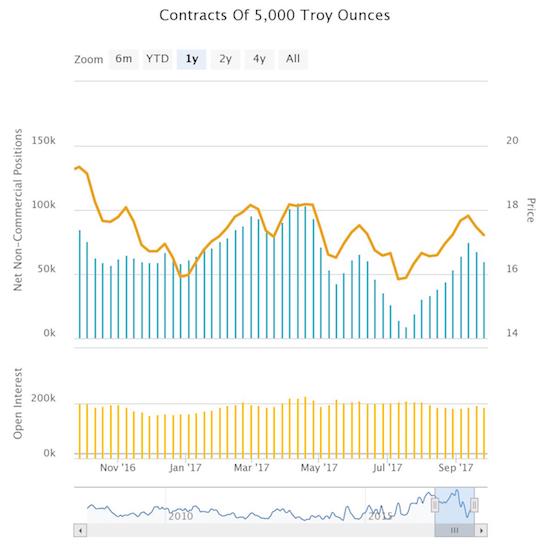

So seasonal patterns work until they don’t (granted, the month is just beginning). In THIS case, the Federal Reserve’s tightening cycle is a key differentiator. Speculators ended their run-ups ahead of the Fed’s pronouncements on monetary policy on September 20th. The market generally interpreted the resulting policy statement and accompanying press conference as freshly hawkish. The change in sentiment was so sharp that expectations for a December rate hike rushed toward “near certainty.” Just 9 days earlier, the market practically dared the Fed to wait to raise rates until March or May of next year!

Source: CME FedWatch

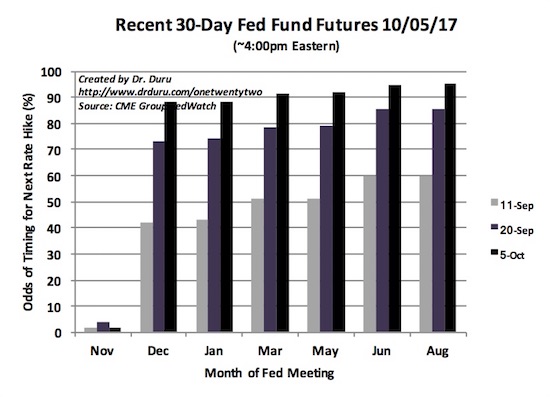

The market’s shift had a predictable impact on the price of SPDR Gold Shares (GLD) and iShares Silver Trust (SLV): down. What started as a small pullback from a strong run-up turned into a full rout. Both GLD and SLV once again broke down below key lines of support.

Source: FreeStockCharts.com

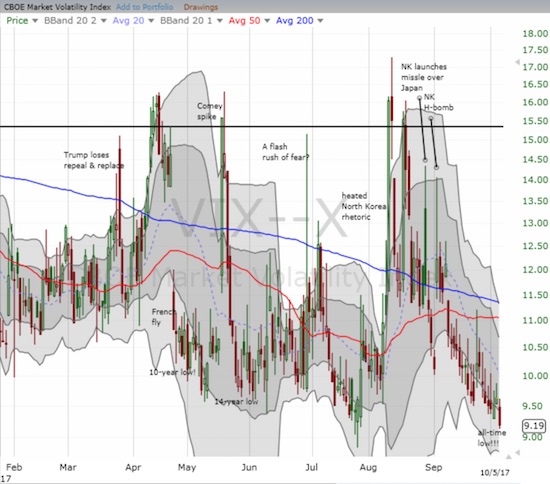

Needless to say, my last tranche of call options on SLV were unprofitable. I am tempted to load up again, but I have no immediate catalyst to motivate such a move. The volatility index, the VIX, is adding to my reluctance. While GLD and SLV sell off, the VIX is also “selling off” albeit more slowly. Today (October 5, 2017), the VIX made fresh history. The VIX reached its lowest recorded close (data available since January 2, 1990). The former all-time closing low of 9.31 was set on December 22, 1993, almost 24 years ago. After that, the next lowest close was set on July 22, 2017 at 9.36, just over 2 months ago.

Source: FreeStockCharts.com

While I avoided reloaded on SLV call options, I celebrated the occasion by doubling down on my call options on ProShares Ultra VIX Short-Term Futures (UVXY). I figure there is no better time to hedge than when complacency has reached record levels! I will continue this discussion in the next edition of “Above the 40.” There are other important developments such as the percentage of stocks trading above their respective 40DMAs reaching heights last seen in January of this year as an extended overbought rally is well underway. In parallel, the S&P 500 (SPY) and the NASDAQ hit fresh all-time highs. I sold my fistful of call options on PowerShares QQQ ETF (QQQ) into the rally, but I am still holding my bushel of call options on the Financial Select Sector SPDR ETF (XLF).

Be careful out there!

Full disclosure: long GLD and SLV, long UVXY call options

That is odd that there has been much of a dollar move lately. There hasn’t been any new information other than the fed not walking back expectations from futures pricing when it jumped to 70% plus for the Dec meeting. My base case scenario is weakening in the dollar around the meeting or after but I could be wrong. I hold a very small silver position still.

What is very interesting is where the VIX has gotten to. Having missed the steering fall lately which was pretty obvious, I am wondering if I should scale into a long VIX trade from here with perhaps 10% of the position size here and 10% every 2 months until a spike. I think the main thing would be risk control and position sizing. It would be unexpected to not have a spike for 20 months but how to size that so it is profitable and from what level.

What broker do you use by the way DD ? I was looking at the offshore oil sector for post bankruptcy possibilities this weekend like ORIG but didn’t find anything compelling. But that is an interesting space as is any space where the larger players are removed from participating.

Damn spellchecker, that should have been sterling fall not steering !

I think scaling into long VIX for October makes sense but for the rest of the year your odds are pretty bad from there. Remember November launches the seasonal strength of the stock market.

I mainly use ETrade for short-term trades.

Let me know your ides in the oil sector. I recently sold my XLE call options. It made a great run from the lows, but is now struggling at it 200DMA resistance.

For the dollar, think of there being a lack of additional downside catalysts.

I’m starting to seriously wonder whether I got in a few days too early with the log dollar trades. Starting to sweat about the NZD long trade. I think I might hedge it with a long VIX hedge. The main thing that would throw a spanner in the works in the reflation narrative is a bit of risk off.

Yeah. The dollar is not cooperating all the sudden. Something in the Fed minutes? EUR/USD about to trade over its 50DMA again, so perhaps the euro is leading the latest march against the dollar? At the same time, the dollar is still rallying off its lows against CAD and the peso.

I missed that you went long NZD….seems like you were bearish just yesterday! 😉