I greatly under-estimated the confidence of the Bank of Canada (BoC) when I mapped out the possibilities for a currency market that highly anticipated a rate hike from the Bank.

In its latest statement on monetary policy, the BoC increased its target for the overnight rate by 25 basis points (bps) to 0.75%. The Bank cited its growing confidence in the Canadian economy:

“Recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy. The Bank acknowledges recent softness in inflation but judges this to be temporary. Recognizing the lag between monetary policy actions and future inflation, Governing Council considers it appropriate to raise its overnight rate target at this time.”

The opening statement to press conference elaborated on this confidence:

“Since April, we have also seen further evidence of a broadening of growth in Canada. Along with stronger-than-expected growth, this has bolstered Governing Council’s confidence in the outlook for the economy and inflation. The economy is absorbing excess capacity more rapidly than we projected in April, and it now appears that the output gap will close around the end of this year.”

This brimming confidence came through during the questioning in the Q&A period as well.

I was initially focused on the Bank’s reduced expectations for GDP growth: “The Bank estimates real GDP growth will moderate further over the projection horizon, from 2.8 per cent in 2017 to 2.0 per cent in 2018 and 1.6 per cent in 2019.” I also took note that the BoC seemed a bit wary of the potential impact of higher rates on the economy (part of my original expectation): “Governing Council acknowledges that the economy may be more sensitive to higher interest rates than in the past, given the accumulation of household debt. We will need to gauge carefully the effects of higher interest rates on the economy.”

Instead of expressing concern, I think the market is too busy preparing for the Bank to finish reversing the emergency rate cuts enacted in response to the collapse in oil prices: “Interest rates were lowered in 2015 in order to help the economy adjust to lower oil prices, and much of that adjustment is now behind us.”

The BoC also spoke bullishly on business sentiment and the prospects for future investment. In particular, Canadian businesses are reportedly no longer worried about the Trump administration getting anything done in the near future that will impact Canada’s economy: “While uncertainties remain, delays in decision making in the United States seem to have moved some of those concerns more into the background.”

With this decision to hike rates and talk bullishly about the economy, the Bank of Canada effectively confirmed the tightening trend gripping the world’s major central banks. The Bank of Japan now sticks out as a notable exception. These Banks are no longer concerned with how much further they may need to ease policy to accommodate growth; they are much more concerned with how to navigate their way to some kind of policy normalization. Easy money ain’t gettin’ no easier for now!

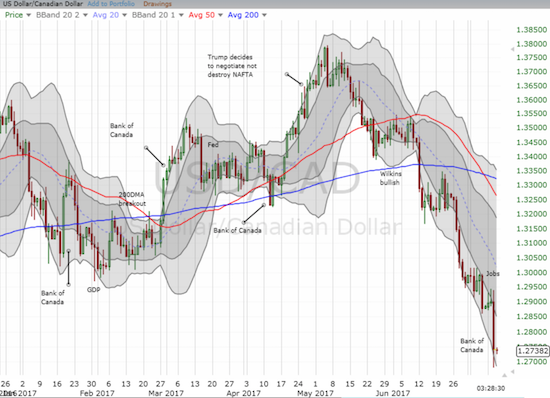

The Canadian dollar (FXC) greatly strengthened in the wake of the policy decision. In my previous post on the Canadian dollar, I noted that if I incorrectly called the market’s reaction, I would go short USD/CAD once the pair crossed below the 1.285 level. As I watched this level slowly give way, I was reluctant to pull the trigger: I kept expecting buyers to show up in force at any moment. As the chart below demonstrates, USD/CAD delivered plenty of additional downside from the 1.285 trigger point.

Source: FreeStockCharts.com

My hesitation greatly limited my profits from playing the USD/CAD sell-off. I got back into a short position near the end of the trading day as USD/CAD bounced off its low (I used a limit order). I am now looking at accumulating a short position all the way back up to 1.285 if the market provides that opportunity. In the short-term I expect the lower-Bollinger Bands to continue guiding USD/CAD lower.

Be careful out there!

Full disclosure: short USD/CAD

I wonder how far the trend has to go with CAD. I got out yesterday after the rate hike. Too hard to say whether they will have a follow up rate hike in the next 6 months. It is now priced reasonably. If they do hike again that would be just silly as the rate hikes will start biting Q2 2018, just when the fed and everyone else’s tightening will start to slow growth, particularly in China.

I used the pop to short nzd today. I was surprised by how much nzd rallied through-up to 1.3% at one stage. I guess people think this means NZ will raise but I think this will not occur for a while. The next rbnz Mpc is Aug 10. There is a general election in Sept so there is very little chance of NZ hiking next meeting I would think so the rate hike expectations being built into NZ is not sustainable I tend to think. Also the BOC move has caused the long spec interest on NZD to reach a huge level. I would estimate it is 25k contracts or more. This is a crazy level as the NZ economic my is 10% of Canada and the population is 4M. The spec long interest in NZD is pretty nuts compared to the size of the economy. Anyway, it is pretty one sided now and I am pretty happy to build short NZD.USD and NZD.JPY positions at current rates. CAD I am

Not sure about anymore. To me it will probably range trade for a while. I don’t think it will be in play for a while. NZD and JPY are more interesting going forward. NZD in a he immediate term – next 2 months. Jpy in the next 3-6 months.

With Cad, they are probably done for a while but there will be speculation they do follow up, so it will move around current levels is my guess. Not particularly tradable except for a scalp here and there if you’re so inclined.

I am good with scalping. I just need to know the bias. In the case of CAD the bias should continue to be for strength as traders speculate about another rate hike as well as shorts continuing to exit. Maybe once speculators are finally net bullish on the contracts, the bias might change a bit.

On NZD – as you know I don’t follow but always fascinated to hear about the dynamics on that small island nation!