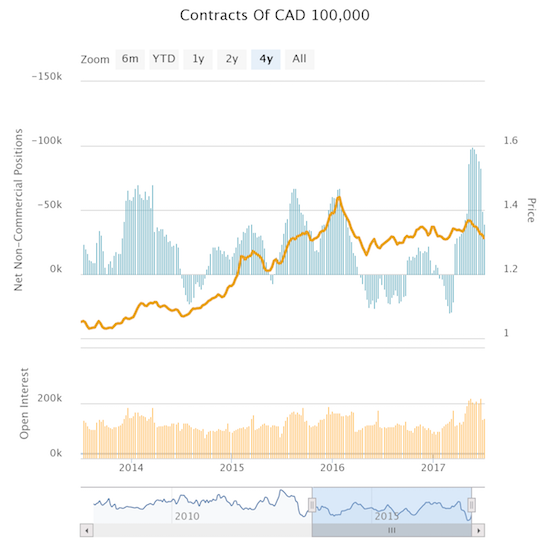

Going into last week’s report on Canadian employment, currency speculators retreated further from what was a record net short position against the Canadian dollar (FXC) less than two months prior.

Source: Oanda’s CFTC’s Commitments of Traders

This retreat is occurring in conjunction with a consistent strengthening in the Canadian dollar. For example, USD/CAD peaked in early May just as net shorts surged. I presume that the original driver of the acceleration in bearish sentiment accompanied negative expectations over the outcome of NAFTA policy talk.

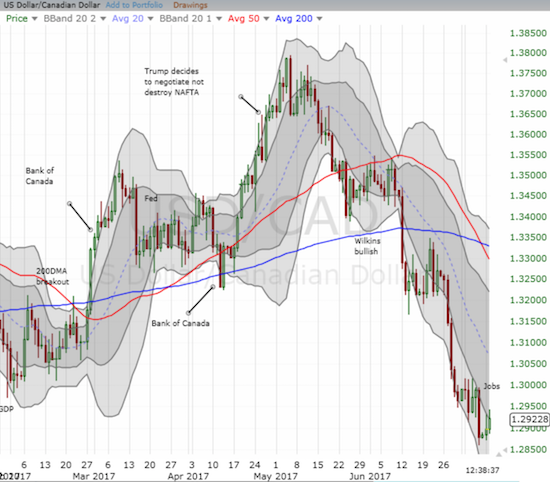

Source: FreeStockCharts.com

Since then, the Canadian dollar has enjoyed a series of positive catalysts. Senior Deputy Governor of the Bank of Canada Carolyn A. Wilkins delivered a very bullish speech on the Canadian economy that sent the Canadian dollar rocketing higher as the market started to consider the odds for an imminent rate hike. Governor Stephen Poloz followed up that performance with a reminder that rates cannot stay low forever. The odds of a rate hike sometime in 2017 quickly went from 22% to 72% mostly over the course of these events. The strong jobs report last Friday sent the odds of a rate hike at the NEXT meeting, July 12th, to a whopping 90%. These odds were 5% a month ago.

I am skeptical that the Bank of Canada will hike rates at this next meeting. Just like the U.S. Federal Reserve, the Bank of Canada will want to give markets sufficient time to absorb the implications of a rate hike without going nuts. Also like the Fed, the Bank of Canada will want to see an overwhelming amount of confirmation that both the economy and financial markets are prepared for a rate hike…and this is of course assuming the Bank of Canada really does want to hike soon. Upon hiking, I am further expecting the Bank to disabuse the markets of any notion that an extended tightening cycle is underway. After all, the Bank of Canada still wants to enjoy the presumed benefits of a tightening Fed (weaker Canadian dollar relative to the U.S. dollar). This messaging should also come through if the Bank of Canada chooses not to hike and instead decides to do more prep work for a future hike.

Given these dynamics, I still have a bearish bias on the Canadian dollar for at least a relief rally in USD/CAD. I have cycled through two recents attempts at going long USD/CAD. I was stopped out the first position which was actually an attempt to play a relief bounce for the U.S. dollar. I made a small profit on the second attempt after first watching USD/CAD oscillate around the 1.29 level. I now await the next entry signal. I am biased for long USD/CAD, but I will follow it downward if it cracks the recent low around 1.285.

Be careful out there!

Full disclosure: long USD/CAD

I was sceptical too but they have prepared the market in the last month. They would have said something this week if they were not going to hike. If they don’t hike it will be a huge miscommunication and stuff up. So I think they hike and I will cover the CAD long into that.

I think short CAD will be a great trade at some stage but after the rate hike talk is out of the way and after the current CAD shorts have been blown out of the water. Hopefully a nice spec long interest will have developed. Maybe in 3-6 months. They still have a housing bubble that will deflate at some stage.

It is also very hard to imagine a one and done hiking cycle if they do hike. I think something freaked them out this month that they were behind in hikes and they communicated this to the market.

So you are thinking more hikes on the way? I certainly was too skeptical. The statement to me seemed to indicate one-and-done for now given the outlook for economic performance.