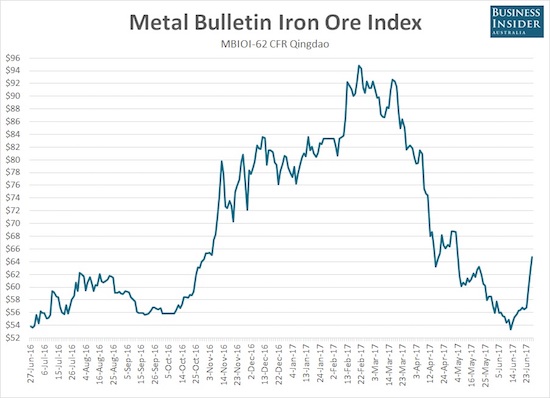

I have been bearish on the Australian dollar (FXA) for quite some time now. My main driver was a reversal in fortunes for soaring iron ore prices that in turn weighed down the currency. Iron ore prices rebounded so much since hitting one-year lows last month that the raw ingredient for steel is now technically in a bull market.

Source: Business Insider

Even if iron ore pulls back and cools off a bit from here, I think this spike in buying interest looks strong enough to create a fresh bottom for prices. On that basis alone, I need to drop my bearishness on the Australian dollar.

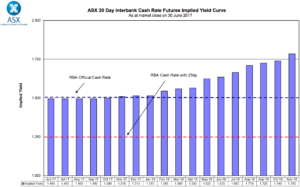

Interest rate expectations also opened my eyes on the Australian dollar. The ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve shows that market participants no longer expect any further rate cuts. Instead, they are expecting a small rate hike sometime in 2018.

Click image for a larger view…

Source: ASX RBA Rate Indicator

John Edwards, a director of the Committee for the Economic Development of Australia (CEDA) and former board member of the Reserve Bank of Australia (RBA), recently went as far to suggest that 2018 to 2019 will deliver EIGHT rate hikes from the RBA in 25 basis point bites. Writing at the Lowy Institute in a piece titled “Rising interest rates and the RBA“, Edwards makes the simple argument that the RBA needs to hike by 2 percentage points based on the Bank’s own economic projections:

“If inflation does indeed return to 2.5%, as the Bank now expects, if growth does indeed return to 3% ‘within a few years’, as the minutes of the June board meeting predict, if the world economy is indeed picking up, then a policy rate of 1.5% is too low.

Let’s say for argument the RBA wants to start next year and get to 3.5% in two years, which is surely within the range of outcomes it would think about. If each increase is 25 basis points, it needs to make eight of them, or say four a year. This implies that within three years Australia’s economic world has returned to more-or-less normal, with wages growth of 3.5%, inflation of 2.5%, and output growth of 3%. But this is, after all, exactly the forecast that both the Bank and the Australian Treasury publicly offer.”

When I add these observations to a macro-environment where major central banks seem convergent on the notion that rates are too low, it makes sense that the RBA going forward will be thinking about how to hike rates and not cut them.

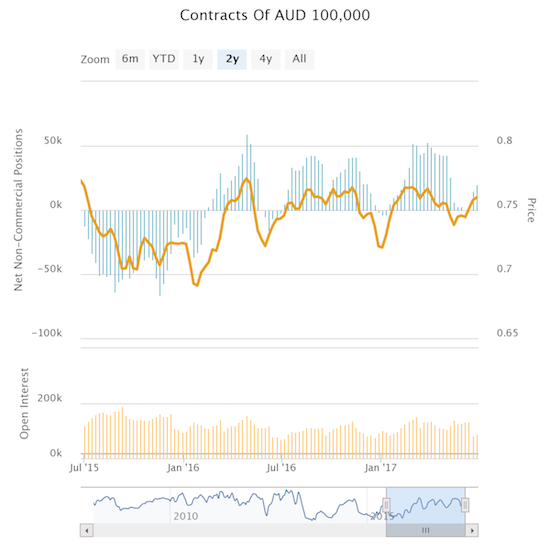

Relieving myself of bearish tidings for the Australian dollar is also a concession to the speculators who have stayed stubbornly bullish the Australian dollar since early 2016, before the recovery in iron ore really took off. Speculators have wavered along the way, including five weeks from May to June, but the bullishness is unmistakeable. The recent rebound in net long contracts is likely responding to the sharp surge in iron ore prices. Hawkish opinions like those of Edwards are likely to put a floor under this bullishness.

Source: Oanda’s CFTC’s Commitments of Traders

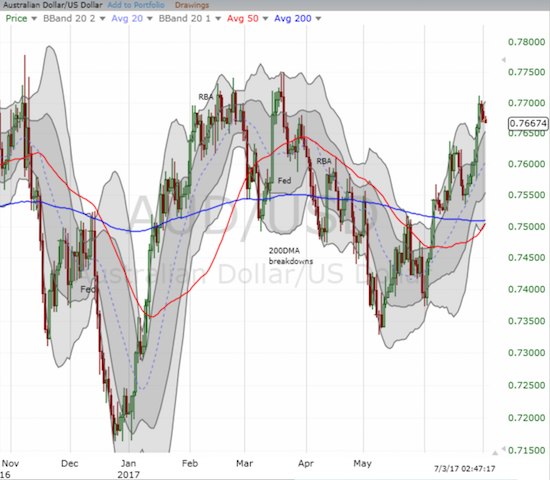

Note well that while I am no longer bearish on the Australian dollar, I am also not bullish. For example, in the immediate term I think the RBA will be content to let major central banks close the gap with Australia and reduce the pressure to use the Australian dollar for carry trades. The RBA seems to watch AUD/USD the most closely, so it must be very disappointed so far. While the U.S. Federal Reserve closes in on RBA rates, AUD/USD clings to an upward bias.

Source: FreeStockCharts.com

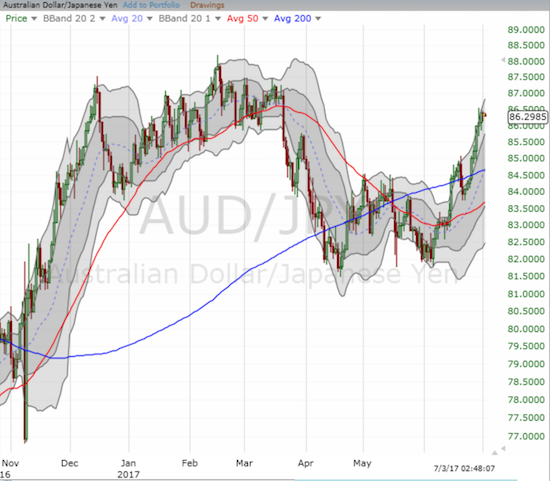

My only current position on the Australian dollar is a bearish bet against the Japanese yen. Although AUD/JPY broke out in mid-June above its 200DMA and then confirmed that breakout in late June, I have held onto my short as a partial hedge against my current bullishness on the stock market. I fully expect any near-term hiccups in financial markets to revitalize strength in the Japanese yen and shake-out risk takers from the likes of the Australian dollar.

Source: FreeStockCharts.com

For other Australian dollar currency pairs, I plan to trade as opportunistically as possible.

Be careful out there!

Full disclosure: short AUD/JPY