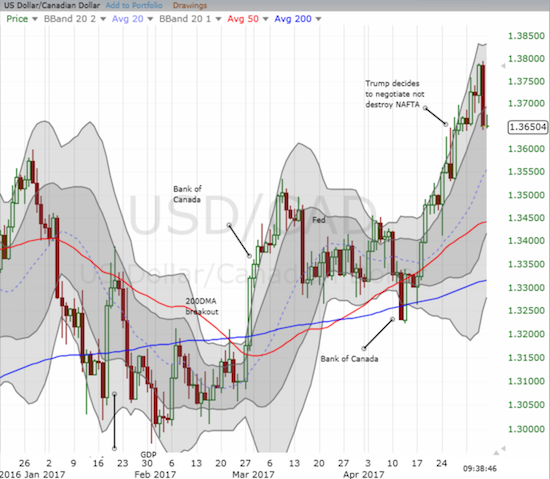

Canada and the U.S. reported jobs numbers for April at the same time last Friday (8:30am Eastern). From the surface, it looks like traders thought MUCH more highly of the Canadian report. The U.S. dollar plunged against the Canadian dollar (FXC) and erased the entire week’s gain for USD/CAD.

Source: FreeStockCharts.com

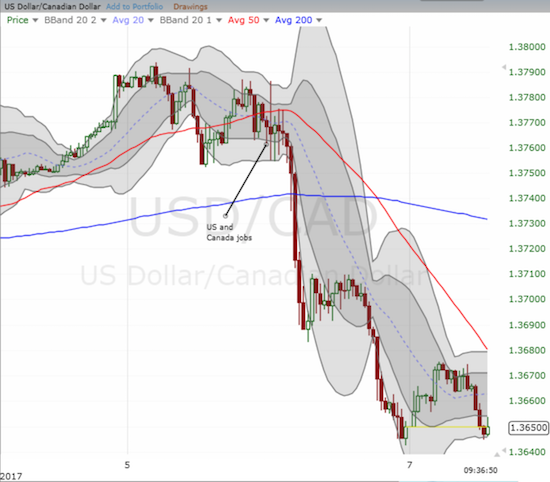

Interestingly, traders took a while to decide that the Canadian dollar was the winner. The 15-minute chart below shows that traders spent about the first hour bouncing up and down in indecision. Once the U.S. stock market opened for trading, the decision went to the Canadian dollar. Note that the open of U.S. trading brings a higher level of liquidity that can often deliver the decisive blow for a move in a given currency pair.

Source: FreeStockCharts.com

The headline number on the Canadian job report was pretty good, but I am overall neutral on it. Although employment stayed relatively flat from March to April, the 0.2 percentage point decline in the unemployment rate to 6.5% set a new 8 1/2 year low. However, the month-over-month decline occurred mainly from a reduction in job searches by Canadian youth. Year-over-year, unemployment dropped 0.6 percentage points.

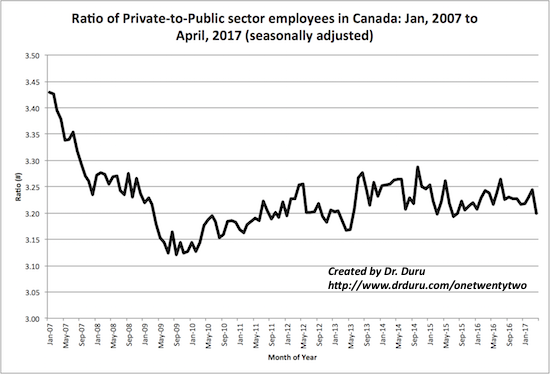

I took particular note of a large disparity between private and public sector job growth. The private sector shed a whopping 51,000 from March while the public sector surged by 31,000. Year-over-year, the private sector grew by 1.6% while the public sector grew by 2.3%. This disparity reminded me of a critique I made of the Canadian job market several years back where I noted how much better the public sector was faring than the private sector at that time. I claimed this disparity was unsustainable support for the economic recovery. So I decided this time to compare the two sectors since 2007 to see what happened during the recession versus the recovery. Sure enough, the ratio of private sector to public sector jobs has yet to recover to pre-recession levels. In fact, the relative recovery in private sector jobs stalled out from late 2013 to 2014…just ahead of the collapse in oil prices.

Source for data: Statistics Canada

I guess Canada is doing well with this ratio remaining stable as oil prices collapsed. For additional perspective, public sector employees have grown 16.4% from January, 2007 to April, 2017. Private sector employees have grown 8.6% over this time. The ranks of the self-employed have grown 9.2%.

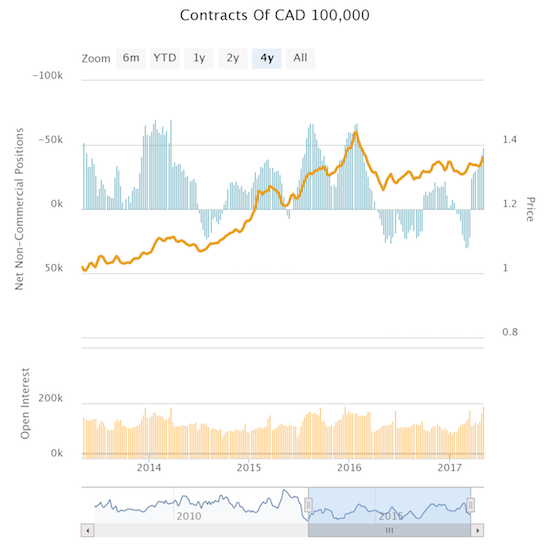

Overall, I do not think the latest job report was a reason on its own to bet for or against USD/CAD. So I next turn to currency speculators. The latest Commitments of Traders (CoT) data show that speculators increased net shorts against the Canadian dollar to levels last seen in early February, 2016 when speculators were coming off the heights of their bearishness against the currency.

Source: Oanda’s CFTC’s Commitments of Traders

I think this level of bearishness is “high enough” where a sudden change in sentiment can cause a dramatic move in favor of the Canadian dollar. Even if the jobs data was not the catalyst, an assumption that oil prices have reached a low point could move the needle. With oil in the mid-40s, I think the rubber band is likely getting stretched a bit. For reference, the United States Oil Fund (USO) is reaching the lows of its post-recovery trading range. On Friday, USO bounced back sharply by 2.1%.

Source: FreeStockCharts.com

Taken together, I think USD/CAD is due for some kind of pullback to let off the steam of the relentless push higher since the Bank of Canada’s April pronouncement on monetary policy temporarily encouraged traders to pile into the Canadian dollar one more time. With the channel from the upper-Bollinger Band (BB) breached, I suspect a test of the 20DMA uptrend is now in play. I already have a small short USD/CAD that represented a premature play on such a pullback (I will quickly close out the position at that point). The Canadian dollar benefited ever so briefly from Trump’s retreat on NAFTA (which generated a nice counter-trade for me). So if anything, a more extended rally for Canada should is overdue…even with the higher tariffs on Canada’s softwood lumber.

Be careful out there!

Full disclosure: short USD/CAD