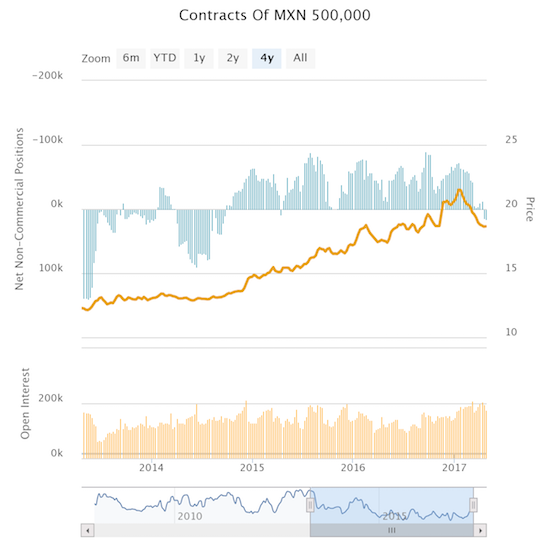

On April 17, 2017, speculators turned bullish on the Mexican peso for the first time in 2 years. That point 2 years ago was a brief 1-week relief from on-going bearishness against the peso. The latest data on net non-commercial positions (speculators) show that the nascent bullishness in the peso carried over into a second week. Speculators have not stayed bullish on the peso for two weeks in a row since September, 2014, a little over 2 1/2 years ago when oil prices hit a major peak just ahead of a major collapse.

Source: Oanda’s CFTC’s Commitments of Traders

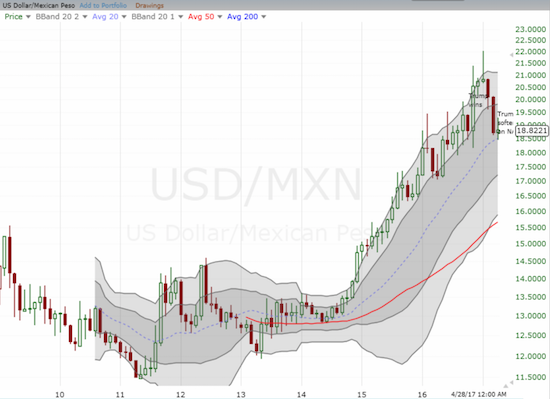

This switch to peso bullishness comes on the heels of the peso’s complete recovery from its post-election losses. The chart above shows how speculators gradually and then VERY quickly closed out their net short positions against the peso as it became increasingly clear that post-election momentum had topped out for USD/MXN.

Source: FreeStockCharts.com

With President Trump softening his stance on the North American Free Trade Agreement (NAFTA), the Mexican economy, and thus the peso, can heave a sigh of relief. I assume that the peso’s rally in 2017 was a general anticipation of President Trump approaching NAFTA differently than candidate Trump. While these are the early days of the President’s shift to renegotiation from the campaign rhetoric of complete pull-out, I think the market will continue to maintain a slight bullish bias on the peso going forward (meaning fading rallies in USD/MXN will likely be the better risk/reward rather than buying dips).

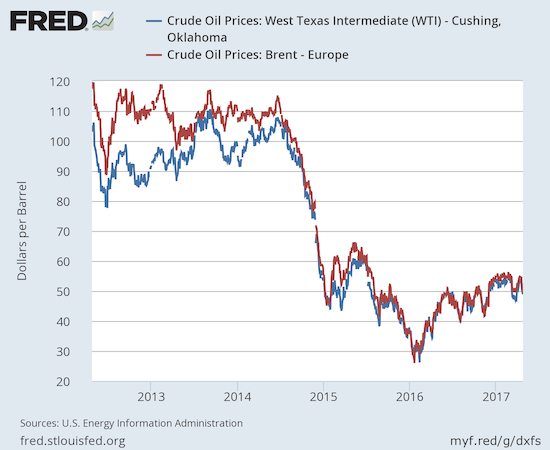

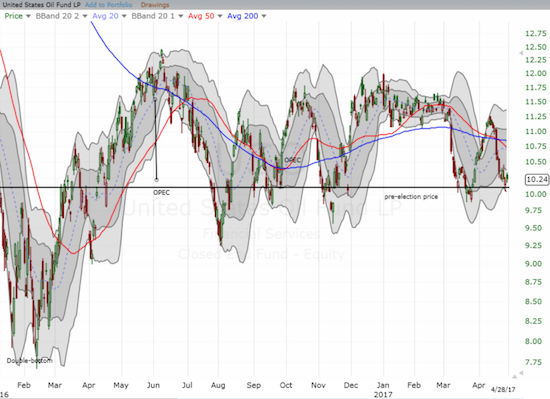

Still, the current relief for the peso sits within a larger context of an extended losing streak since oil topped out in 2014 ahead of a subsequent collapse.

Source: FreeStockCharts.com

Even after oil bottomed in 2016, the Mexican peso failed to benefit.

Source: U.S. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis; April 29, 2017.

Source: FreeStockCharts.com

So the jury is out as to whether the peso will require definitive positive economic and/or political catalysts to continue its path of recovery. Based on the past record of peso speculators, I will look to their positioning for key clues.

Be careful out there!

Full disclosure: short USO put options