Last week, I noted that silver speculators returned to “maximum bullishness” but warned…

“Just like the plunge on March 2nd, the key for SLV is the follow-through. On March 3rd, a small relief rally fell short of 200DMA resistance; two days later SLV gapped down on its way to a 50DMA breakdown. I am guessing that SLV could at least retest the March low in the current move.”

As a result of my wariness, I noted that my typical response to this setup would be to implement a pairs trade going long SPDR Gold Shares (GLD) and short iShares Silver Trust (SLV). However, since I never short gold or silver, I stood pat with my core GLD and SLV shares and my shorter-term GLD trade with call options.

In the subsequent week, silver speculators received major vindication with very bullish follow-through. SLV bounced neatly off support at its 20 and 50-day moving averages (DMAs), invalidated the bearish engulfing pattern that made me wary, AND, perhaps most importantly, definitively cleared the hurdle of its election-day close. The breakout for SLV to a new 5-month high, definitely leaves its post-election malaise in the rearview mirror (yes, yet one more effect of President Trump’s election has completely reversed).

Source: FreeStockCharts.com

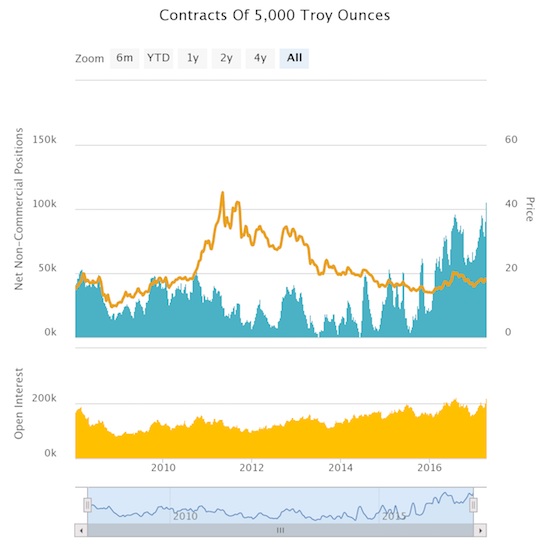

Along with this breakout, silver speculators set a new level of maximum bullishness. Net futures contracts set a new record high (counting from 2008).

Source: Oanda’s CFTC’s Commitments of Traders

With SLV breaking out above its 200DMA, cleanly clearing its post-election losses, and receiving full support from silver speculators, I am now inclined to trade around my core SLV position with call options or new shares in silver miners (Pan American Silver Corp. (PAAS) remains my favorite silver mining play). Alongside my refreshed bullishness on SLV, I am now even more bullish on GLD. I had to lock in my profits on my GLD call options because they were a week away from expiration, but I am looking to reload. Starting next week, I will start in on SLV call options and look to buy dips in SLV and GLD down to their respective 200DMA support lines.

Continuing the theme of erasing the impact of President Trump’s election, GLD just completed its own reversal of post-election losses.

Source: FreeStockCharts.com

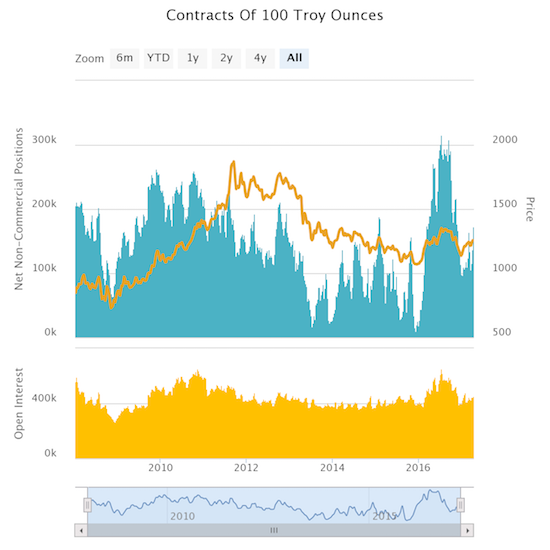

Gold speculators still lag silver speculators, but at least they are finally waking up to the on-going momentum off the post-election lows. I am hoping this means plenty of upside remains in GLD as speculators continue to rev up their engines toward maximum bullishness.

Source: Oanda’s CFTC’s Commitments of Traders

Besides the technicals and sentimental support, SLV and GLD make great plays in a world where President Trump keeps reiterating his preference for a weaker U.S. dollar (the latest was an April 12th interview in the Wall Street Journal) alongside increasing geo-political risks. I find it particularly ironic that the Fed’s rate hikes seem to further strengthen, not weaken, the precious metals. The chart of GLD above clearly shows the NET impact of the last two rate hikes has been increased buying interest in GLD. The winds seem to favor strongly the precious metals. The 200DMA provides a convenient line to stop out of downside risk for shorter-term trades.

Be careful out there!

Full disclosure: long GLD and SLV shares