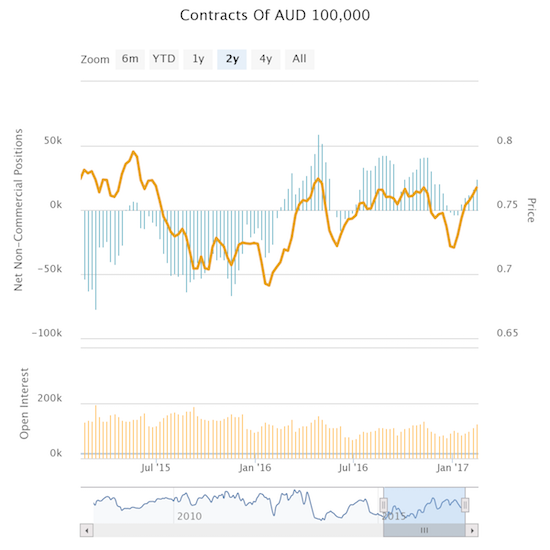

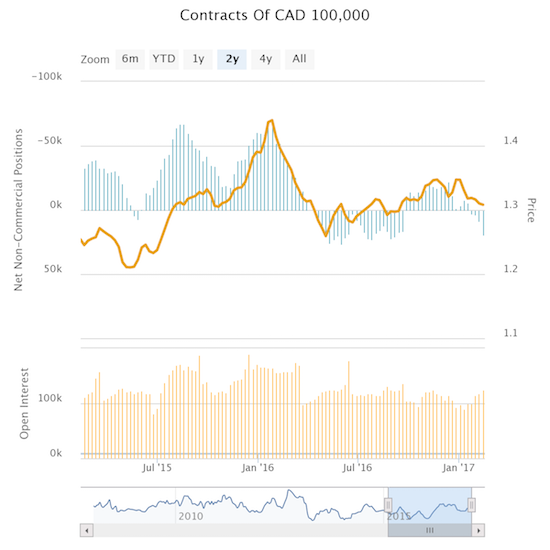

Currency traders spent much of 2016 cycling through bullish and bearish periods on the Australian dollar (FXA) and the Canadian dollar (FXC), the Western world’s two biggest commodity currencies. In particular, bullishness on both currencies waned rapidly going into the U.S. Federal Reserve’s rate hike in December. Speculators adjusted positions to net flat and then spent four weeks with small net bearish positions on both. For the last five weeks, speculators have rebuilt net bullish positions on the Australian dollar. The same has occurred over the last four weeks for the Canadian dollar.

Source: Oanda’s CFTC’s Commitments of Traders

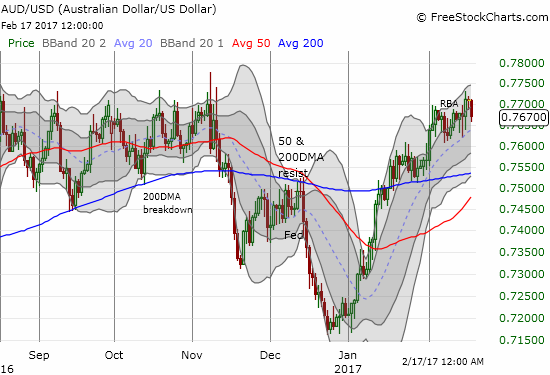

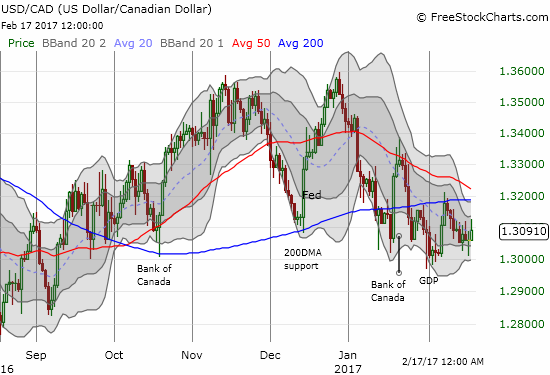

The Australian and Canadian dollars have directly benefited from this rising bullishness. In 2017, AUD/USD has rallied sharply to print a very healthy 6.4% gain. Over this same time, USD/CAD has fallen 2.6%.

Source: FreeStockCharts.com

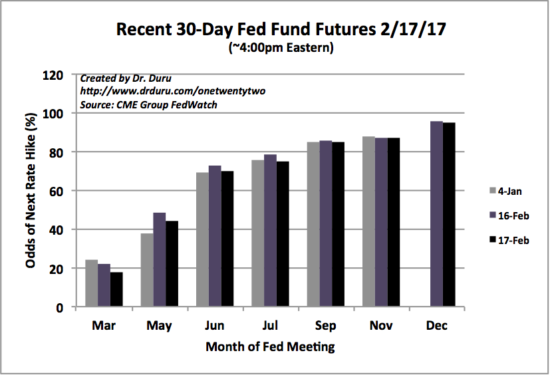

Interest rate expectations gave space for the commodity currencies to run. The futures market remains fixated on June as the next month for the next Fed rate hike despite a heavy load of FedSpeak in 2017. I strongly suspect that, like the weeks going into December, both the Australian dollar and the Canadian dollar will experience fresh weakness going into the June meeting if not earlier.

Source: CME Group FedWatch Tool

I was quicker to adjust to the more bullish tone on the Canadian dollar than the Australian dollar. I am still hanging onto a short of AUD/JPY as a hedge on the bullish tone in financial markets. I also have put options on CurrencyShares Australian Dollar ETF (FXA). AUD/USD sits right at the high that held as tough resistance for AUD/USD from August to November, 2016, so I cannot help but stay skeptical the Australian dollar can rally much more from here.

When I trade USD/CAD, I wait for good entry points to go short instead of long. I am very focused on the behavior of USD/CAD around its 200DMA which is converging with its 50DMA. I fully expect these moving averages to serve as important pivot points for the coming bull versus bear battles.

The Federal Reserve next graces the headlines with a pronouncement on monetary policy on March 15th. The behavior of USD/CAD and AUD/USD in the weeks going into that day should be VERY telling…

Full disclosure: long FXA put options