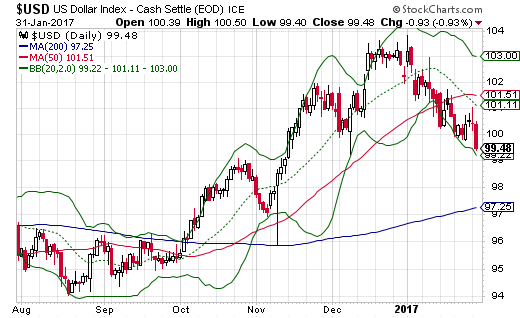

The U.S. dollar index (DXY0) has started 2017 on a notable losing streak. The index’s clean close today below 100 is the latest confirmation of that weakness. The U.S. dollar index continued its dribbling down the lower part of Bollinger Bands (BBs) that define the current downtrend.

Source: StockCharts.com

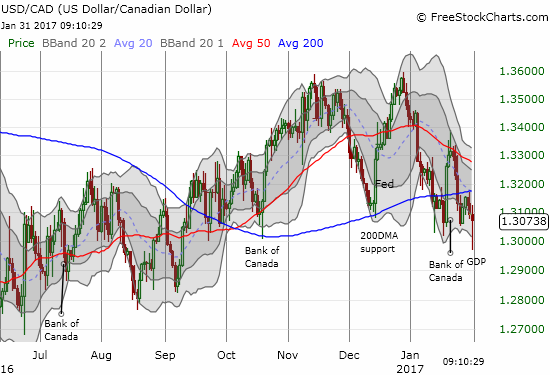

This extension of weakness has complicated my strategy to short the Canadian dollar (FXC) against the U.S. dollar (USD/CAD). Since July, the Bank of Canada’s pronouncements have launched USD/CAD into an extended period of strength. Thanks to the underlying downtrend in the U.S. dollar index, the latest post-Bank bounce in USD/CAD was the shortest bounce of the three.

Source: FreeStockCharts.com

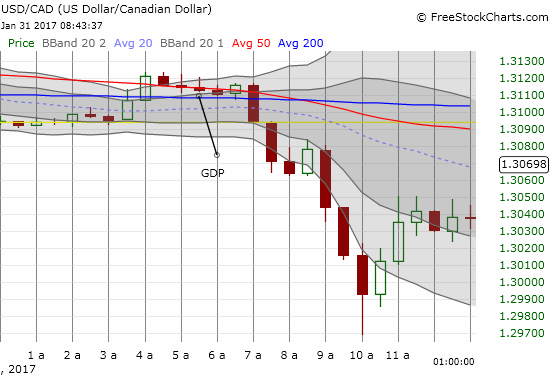

At first blush, I thought Canada’s GDP report for November was the culprit. It was a strong report but the 30-minute chart below confirms that the GDP had nothing to do with the relative strength of the Canadian dollar.

Source: FreeStockCharts.com

In fact, it was likely the decline in Chicago PMI and a small drop in U.S. consumer confidence reported at 7am Eastern that dominated trading.

This move stopped me out of my long USD/CAD and even flipped me around to short USD/CAD for now. The most recent weakness makes the 200DMA breakdown for USD/CAD on the daily chart much more convincing. I will stay short until/unless 200DMA resistance gives way (yes, I am crossing my fingers that I do not get caught up in a near endless chain of churn).

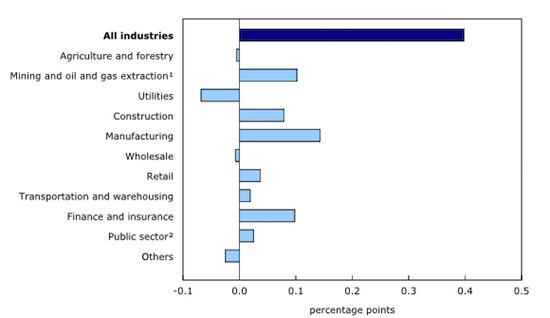

Canada’s GDP report was strong and will likely provide some modicum of support for the Canadian dollar for now. GDP increased for the fifth month out of the last six. The 0.4% monthly gain was driven by broad-based gains per the chart below.

Source: Statistics Canada

Of course, these strong data represent a past that may prove very different from the coming future. So, while the strength is encouraging, the more important considerations involve the issues now worrying the Bank of Canada: potentially protectionist trade policies of the Trump administration combined with increased competitiveness of U.S. firms through corporate tax cuts.

Next up, the U.S. Federal Reserve…which I expect to pedal very softly given the current increase in domestic and geopolitical tensions.

Be careful out there!

Full disclosure: short USD/CAD