“The Central Bank of the Republic of Turkey (CBRT) closely monitors the excessive volatility in the markets and will take necessary measures against unhealthy price formations that are inconsistent with economic fundamentals.

Banks’ borrowing limits at the Interbank Money Market established within the CBRT have been lowered to TL 22 billion to be effective as of 11 January 2017.

Moreover, foreign exchange reserve requirement ratios have been reduced by 50 basis points for all maturity brackets. With this revision, an additional liquidity of approximately USD 1.5 billion will be provided to the financial system.

Developments in markets are monitored closely and if deemed necessary, additional steps may be taken in order to maintain price stability and financial stability.” – The Central Bank of Turkey, January 10, 2017

The Central Bank of the Republic of Turkey must be getting desperate.

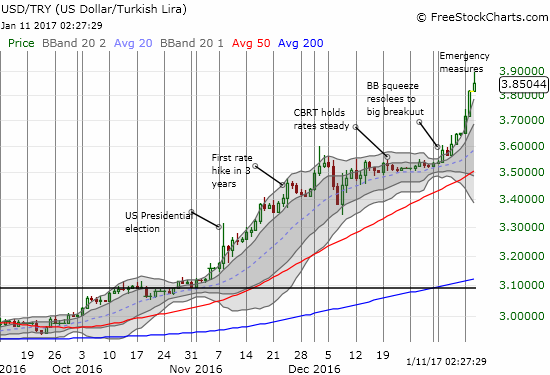

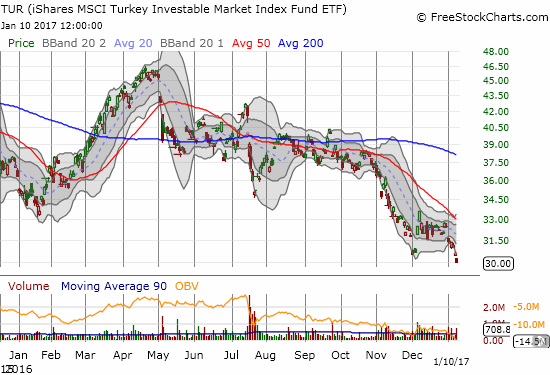

Five weeks ago, I noted how the CBRT’s first rate hike in three years failed to stem losses for the Turkish lira. The U.S. dollar has gained an additional 10.3% over the Turkish lira (USDTRY) in that time. The euro (EURTRY) has motored ahead for a 9.9% gain. The interest rate hike clearly did nothing to stem the rush for the exits. The CBRT did the currency no favors after it decided to hold rates steady at its December 20th meeting after getting spooked by weak economic data. The central bank is also under pressure from Turkish President Recep Tayyip Erdogan to hold down borrowing costs. The latest measures are designed to increase liquidity in the currency market (forex) and inspire some modicum of confidence in the currency.

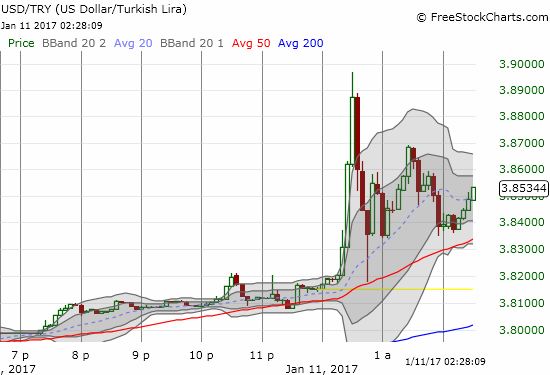

My strategy for trading the Turkish lira had been to fade USD/TRY in anticipation of a relief rally for the Turkish lira and a technical “cooldown” period after such an intense run-up at the time. Amazingly, USDTRY came tumbling down very soon after I wrote that piece. However, the pullback lasted just three days and spent little time around my first target of 3.35. I tried again to fade after the bounce was underway, but the upside resolution of the Bollinger Band (BB) squeeze (see chart above) proved too much for my hedge going long EUR/TRY. The recent three-day run up is the classic definition of a parabolic move, so I fully expect a notable pullback. If nothing else, it makes sense for longs to book substantial profits ahead of the next CBRT meeting.

For now, I am making very short-term and small trades long BOTH USD/TRY and EUR/TRY. After (if?) USD/TRY breaks below a critical technical level, then I will short USDTRY while keeping the small long position in EURTRY as a partial hedge. At the time of writing, the key support sits at the base of the last breakout.

The CBRT next meets on January 24th. Traders will undoubtedly be watching carefully: if the CBRT fails to act forcefully, I fully expect a bout of fresh weakness for the Turkish lira.

Also see Reuters “Turkish lira tumbles to fresh lows, central bank provides support” for the latest related news.

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long USDTRY, long EURTRY

Dear Doc, CB has done some tweaking this morning with repo lending time frames forcing lenders to a higher rate. Thus usd/try is now below 3.80. Do you think this is the start of the “notable pullback ” ? BIST is also up by 3%. Thanks for your insights.

From a technical standpoint, I would say “yes.” This looks like the classic blow-off from a parabolic (and unsustainable) move. HOWEVER, a huge caveat is that if sellers do not follow-through after today, what could happen instead is a period of consolidation before the next move higher. From a fundamental standpoint, we already know the Turkish Central Bank is now actively trying to protect its currency. So, shorting the lira is going to have a lot more event and news risk that usual. That means if you remain bearish on the lira, you have to stake out very clear and disciplined levels for entry and exit.

Thanks for reading!

Thanks, Doc. I’m not so sure the CB will be given free rein to outright increase the rate, though. With the looming referendum/election during the spring don’t you think remaining bearish on the lira is the more sensible choice, the current drop notwithstanding?

By the way, any suggestions for an entry point if the drop carries over tomorrow and beyond?

Thanks.

You’re right. And I have been too slow in accepting that the longer-term view has the lira pinned for weakness. Please stay tuned for another short piece on this topic where I lay out some more trading strategy. I am now trying to focus most of my forex attention on this one. A LOT of money being made here!