(This is an excerpt from an article I originally published on Seeking Alpha on October 16, 2016. Click here to read the entire piece.)

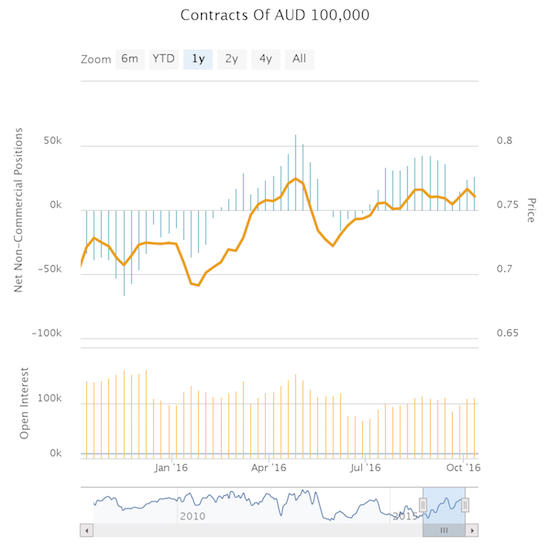

Three weeks ago, I was clearly premature in declaring an “ominous sentiment shift” in the Australian dollar (FXA). Since then, speculators have buckled down and returned to growing net long positions in the commodity-dependent currency.

Source: Oanda’s CFTC Commitment of Traders

{snip}

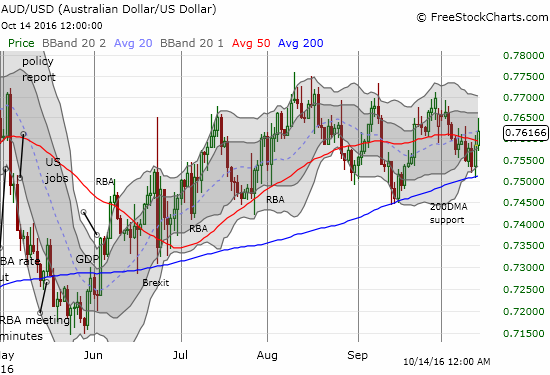

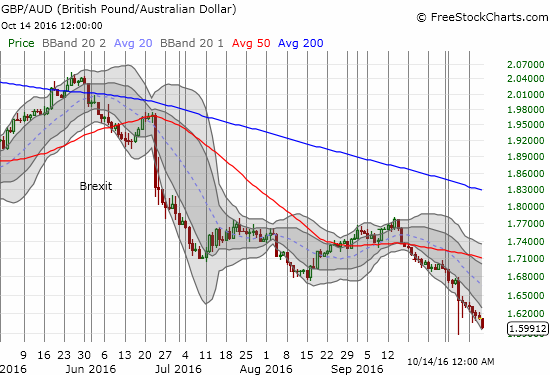

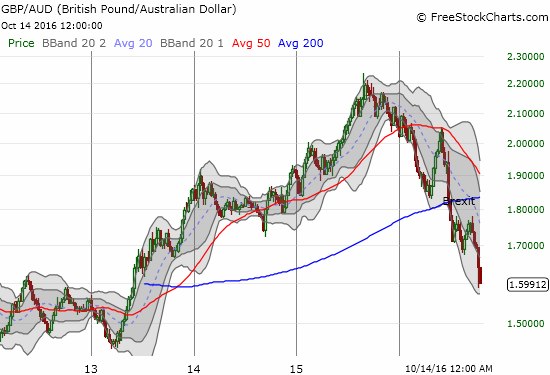

Source: FreeStockCharts.com

{snip}

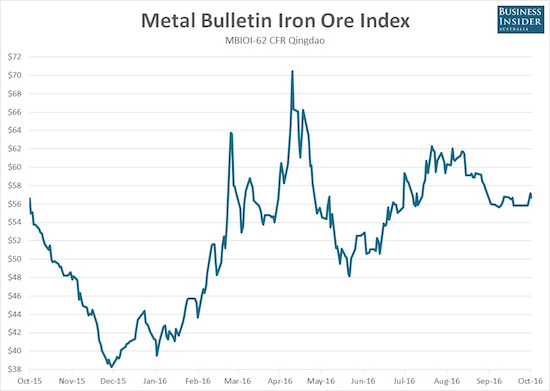

Iron ore prices do not quite explain the Australian dollar’s resilience and resurgence. {snip}

Source: Business Insider

There was also nothing from the Reserve Bank of Australia (RBA) in its October pronouncement on monetary policy that provided a catalyst…unless traders are guessing that the RBA is finally finished cutting rates for the foreseeable future. {snip}

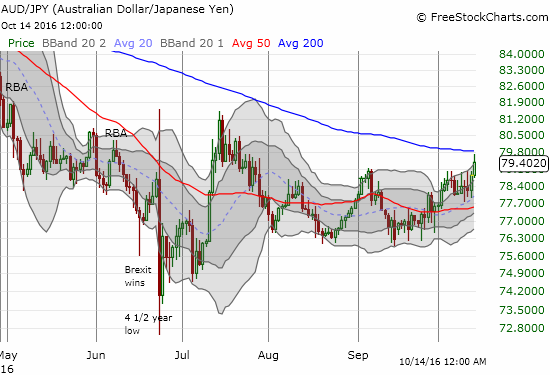

Whatever the reason for the return of speculative longs, the Australian dollar has become a handy currency for me to use to hedge on other plays. {snip}

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on October 16, 2016. Click here to read the entire piece.)