(This is an excerpt from an article I originally published on Seeking Alpha on October 19, 2016. Click here to read the entire piece.)

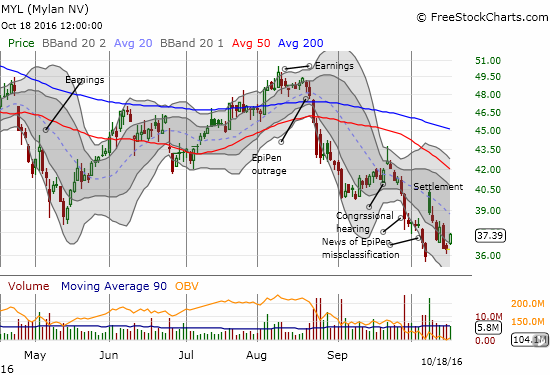

Mylan (MYL) is down 13% (and as much as 17%) since I argued the company was “out of tune” with an angry chorus that promised to place a lot of short-term pressure on the stock. {snip}

A week ago, the Annals of Internal Medicine published an article extremely critical of Mylan’s attempt to classify the EpiPen as a preventive service. {snip}

{snip} So what we have is a pharmaceutical company which paid a consulting company to write an opinion piece which was given a veneer of credibility through the authoring of a medical doctor. This setup alone is not particularly egregious given all the clear disclosures. However, the setup is troubling when combined with the goal of convincing the U.S. Preventive Services Task Force (USPSTF) to grant the EpiPen a status which would eliminate patient co-pays, force health plans to cover 100% of the cost, and thus allow Mylan to continue sheltering much of its soaring price hikes away from public scrutiny.

{snip} If Mylan’s argument prevails, an appendectomy could be considered preventive because it avoids more serious issues if an appendicitis is allowed to go untreated (the Annals article made this point).

If Mylan’s effort had won the day early enough, the EpiPen outcry may never have occurred or at least been delayed much further. Insurance plans would have been forced to eat Mylan’s price hikes and look to transfer these costs in the forms of higher premiums and/or higher deductibles for other treatments. {snip}

In an October 5, 2016 letter to Senator Ron Wyden, Acting Administrator Andrew M. Slavitt described how Mylan failed to take action after the Centers for Medicare & Medicaid Services (CMS) identified the issue. {snip}

Mylan’s press release announcing the settlement included earnings guidance. {snip} I pointed out in my last Mylan post that this target provides a reason for sticking by MYL over the longer term. At this point, belief in management’s substantial incentive to hit this target forms the fundamental or core thesis for investing in the company.

The reaction in Mylan’s stock to the settlement and guidance has been revealing. {snip}

Mylan is a cheap stock getting even cheaper {snip}

Mylan also suffers from industry-wide overhang. {snip}

Source for charts: FreeStockCharts.com

Having said all this, I think MYL’s quick settlement with the government is the first positive sign in this EpiPen mess. As a result, I changed my trading strategy in the wake of the mess. {snip}

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on October 19, 2016. Click here to read the entire piece.)