(This is an excerpt from an article I originally published on Seeking Alpha on September 7, 2016. Click here to read the entire piece.)

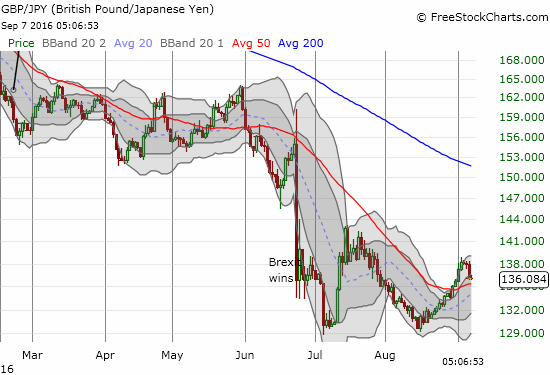

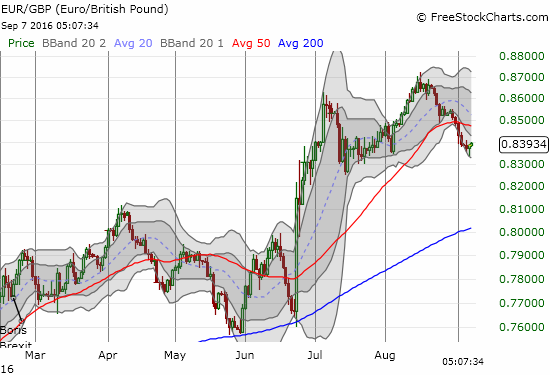

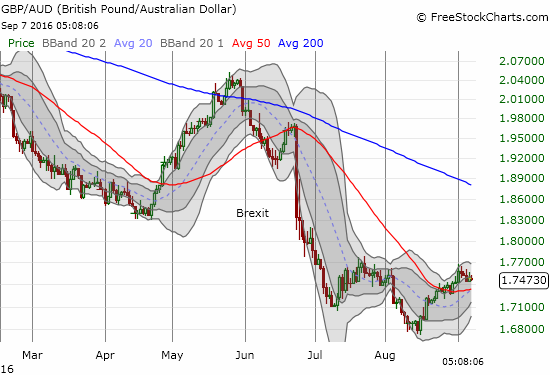

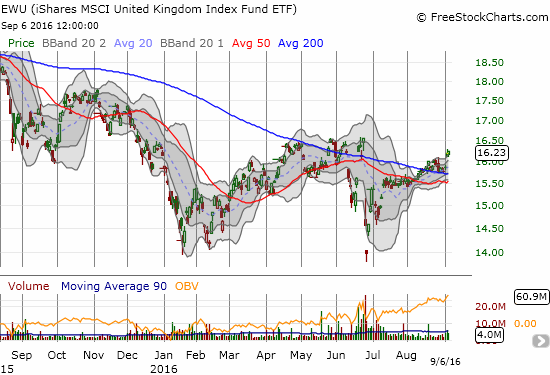

The theme was consistent for the Markit economic indicators for August: the UK economy rebounded sharply and strongly from the initial post-Brexit blues. Almost across the board, measures of economic activity and sentiment demonstrated resiliency and strength. The British pound (FXB) responded with an unmistakably firming that suggests the currency has shaken off the worst of the post-Brexit follow-through selling pressure for a while – perhaps even through any fresh hiccups in the numbers for September.

Source: FreeStockCharts.com

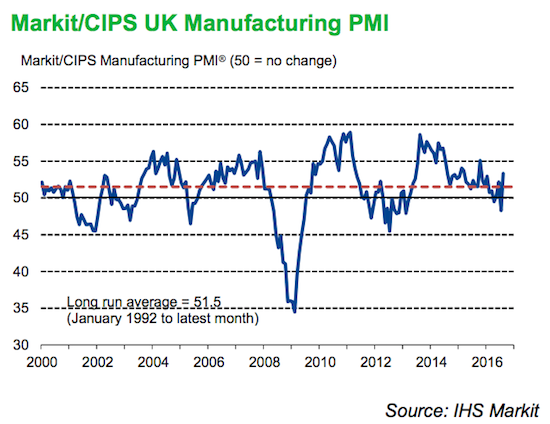

Here is a quick summary across three Markit PMI surveys of economic activity for August: manufacturing, construction, and services.

Strong rebounds in PMIs

{snip}

Source: Markit

Strong rebounds in confidence and expectations

{snip}

Inflationary pressures (mostly from the plunge in the British pound)

{snip}

Employment gains

{snip}

Other highlights

{snip}

Note well a lot of these big moves follow big losses in the immediate wake of the post-Brexit data in July.

Several times Markit cited the Bank of England’s swift and extensive reaction as a potential catalyst for the swift rebound and the support for the recovery in business confidence. The rhetoric from the August Inflation report certainly reinforced the impression that the Bank of England stood firm in supporting the UK through its post-Brexit adjustment. From Carney’s remarks:

{snip}

Indeed, the BoE projected a lot of confidence. In its own words, the extraordinary actions are well-understood and will have exactly the intended impact with no downside…

{snip}

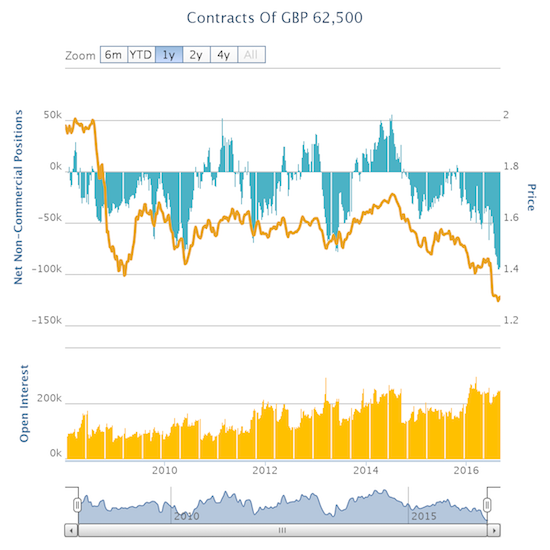

The recent spate of good economic news is undoubtedly pressuring the crowd of speculators who have amassed the largest net short position on the British pound since at least 2008.

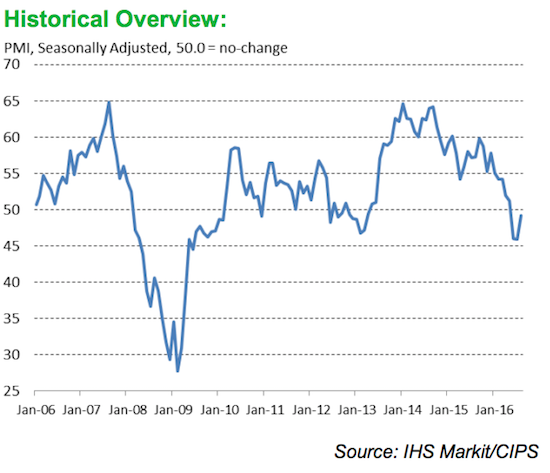

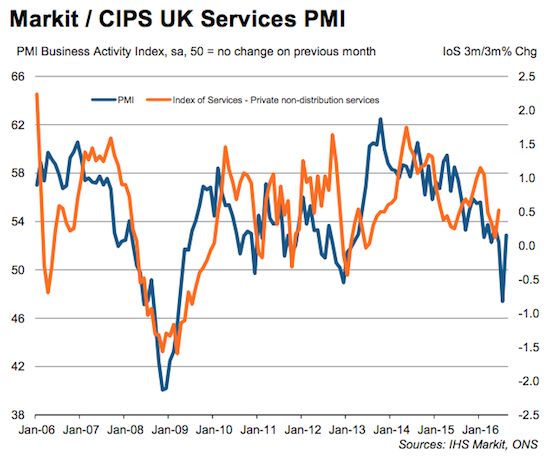

Yet, the challenge for optimists is that the current rebound just returns the PMI indicators to previous multi-year downtrends. Indeed, the Bank of England (BoE) consistently warned of economic woes in the UK’s post-Brexit wake. {snip}

On top of this, the BoE effectively promised to cut rates again and do even more accommodation if necessary. {snip}

Source: FreeStockCharts.com

The press conference for the August Inflation Report provided the background for the dramatic action and strong rhetoric of support for the economy…

{snip}

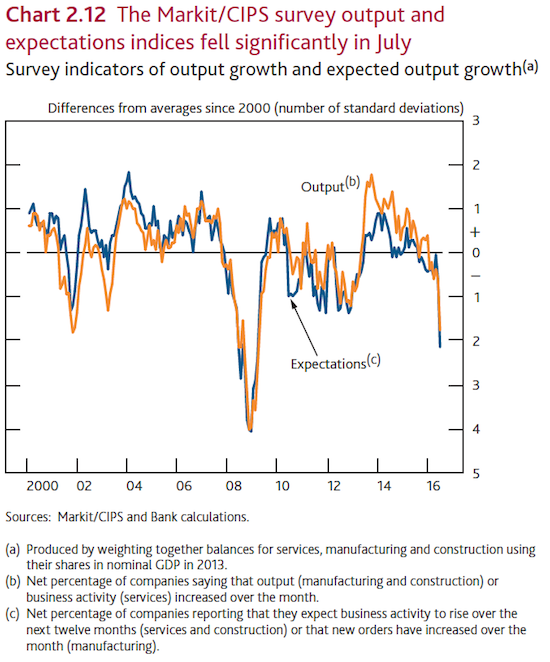

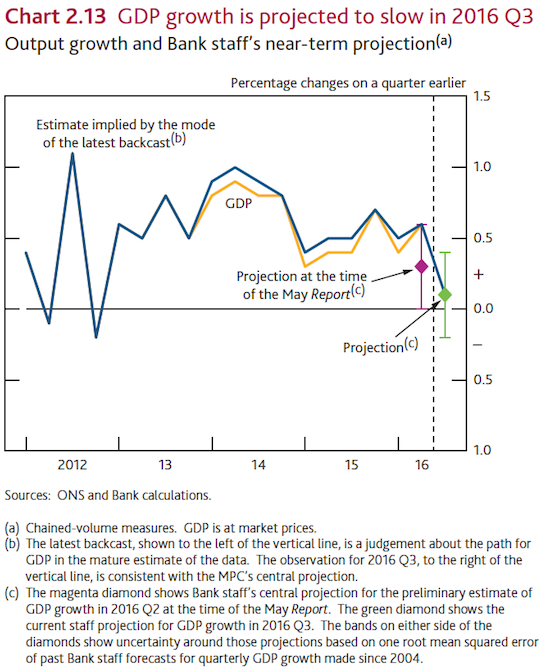

Here are the ominous charts that stared at the BoE…

Source: Inflation Report, August, 2016

In his remarks, BoE Governor Mark Carney called the downward revision in GDP the MPC’s (Monetary Policy Committee) largest in its near 20-year history. This comparison drew attention to the seriousness of the economic conditions.

The BoE also anticipated the heat-up in inflationary forces, so I think the current flare-up will not dissuade the Bank from its course of accommodation…

{snip}

Moreover, the BoE extended the horizon for hitting its inflation target:

{snip}

Parting Thoughts

The economic numbers for September, to be reported in early October, will be extremely important. If current momentum continues, the case for a bottoming in the UK economy will look even stronger. If instead the UK economy suffers any setback, it will appear that August’s rebound was more of a “dead cat bounce” where businesses and consumers were temporarily shaken into action by the projections of confidence and action from the bank of England. {snip}

(This is an excerpt from an article I originally published on Seeking Alpha on September 7, 2016. Click here to read the entire piece.)