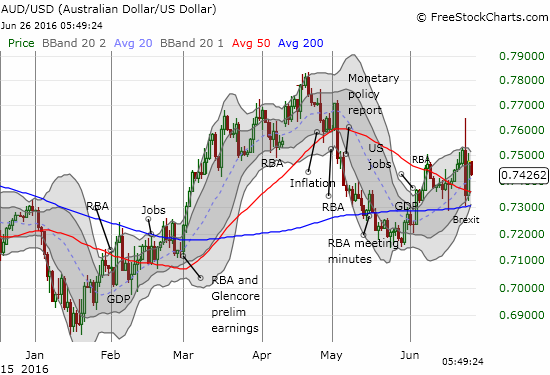

As the smoke started to clear from Friday’s post-Brexit carnage, one currency rose particularly well from the ashes: the Australian dollar (FXA). For example, against the U.S. dollar, the Aussie bounced perfectly off support at its 200-day moving average (DMA) and even maintained its earlier 50DMA breakout.

Source: FreeStockCharts.com

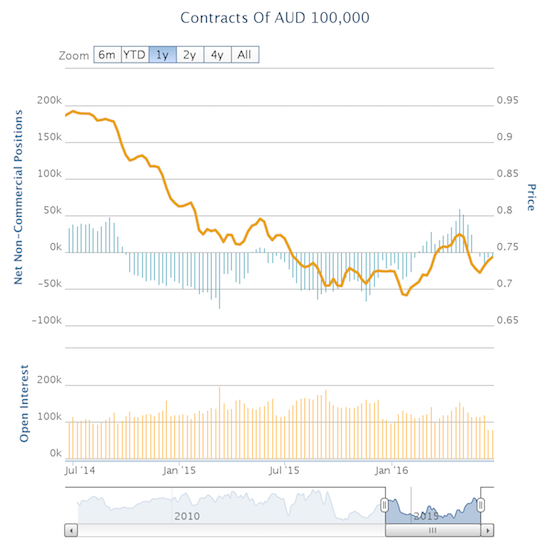

AUD/USD traded around 0.76 around the time polls closed in the UK (for a specific timeline see my post “A Failed Hedge Underlines Potential For A Bottom In The British Pound“). The ability of the Australian dollar to bounce so strongly indicates that the market is not quite as scared of risk as we might think given the turmoil that Brexit wrought. Indeed, while speculators finally returned to bearish positioning against the Australian dollar in recent weeks, net shorts are nowhere close to levels seen in past bearish cycles.

Source: Oanda’s CFTC’s Commitments of Traders

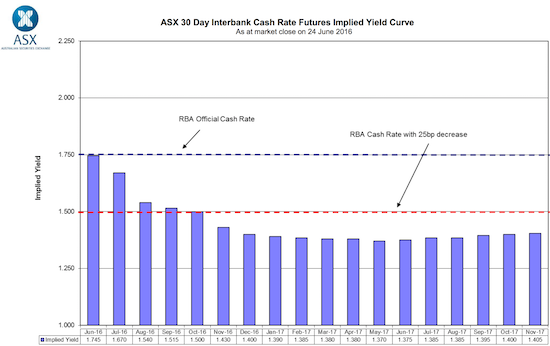

The Australian dollar proved resilient even with the odds rising of an imminent rate cut form the Reserve Bank of Australia (RBA). In the wake of Brexit’s victory, futures markets hiked up the odds of yet another rate cut from the RBA from 12 to 38% for the next meeting. The odds favor a rate cut somewhere between August and October (inclusive).

Source: ASX RBA Rate indicator as of June 24, 2016

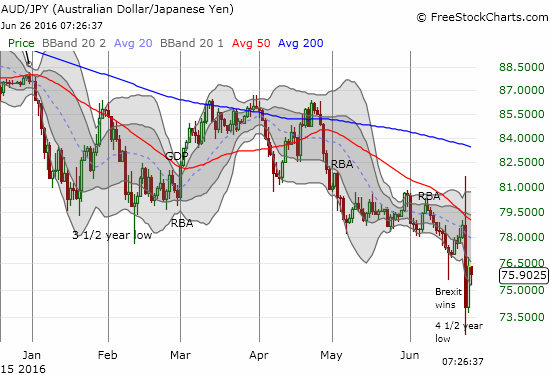

These expectations seem out of step with an Australian dollar that is as strong and resilient as it is. Yet, it is also dangerous to try to fade the currency in this environment given central bank intervention at anytime could greatly increase the market’s risk appetite. So I prefer a strictly technical approach to trading the Australian dollar here despite my fundamental bearishness. If the currency manages to erase ALL its post-Brexit losses, I will have no choice but to join the bullish camp. I will only resume an aggressively bearish stance upon seeing AUD/USD break 200DMA support. In between is just limbo and subject to BOTH bullish and bearish trades. In the meantime, my favorite play remains fading rallies in AUD/JPY for very short-term swings.

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: short the Australian dollar