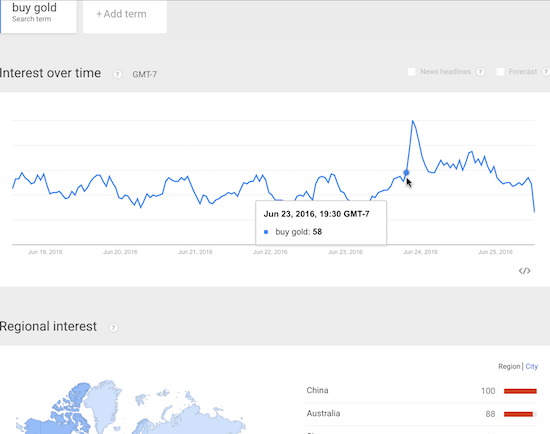

+500% spike in searches for "buy gold" in the past four hourshttps://t.co/pmMsRUcAwK

— GoogleTrends (@GoogleTrends) June 24, 2016

Regular readers know that Google Trends has become my favorite sentiment indicator for assessing gold at the extremes. So I hopped up when I heard about the above tweet on the latest podcast of “Slate Money.” (That podcast was a great review, even if very slanted toward the Remain side, of the political and social underpinnings of the Brexit vote). The trend surge was mentioned as an aside, but I think this observation is a key confirmation of the power of Google Trends in shining light on mass sentiment. In this case, gold was clearly top of mind for a group of traders and investors who likely feared the fallout of Brexit. Interestingly, this spike was very short-lived and started right after polls closed (I think I have the correct time window in GMT).

Source: Google Trends

Surprisingly, CHINA led all searches. Typically, Australia and Singapore are the top regions for searches on “buy gold.” The United Kingdom came in at a distant 5th place with an index of 46. The United States, where people generally think Brexit has nothing to do with them, came in 8th place with an index of 40. Overall, I am not sure what to make of China’s rush for gold except that I know the European Union is China’s #1 or #2 export market; the U.S. overtook the EU for top honors in 2012. A Brexit-led decline in economic prospects in the EU plus the UK will have serious repercussions in China.

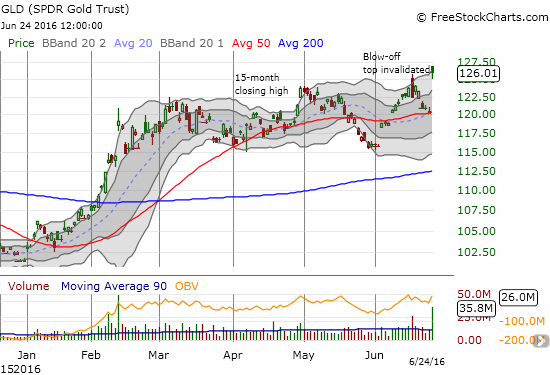

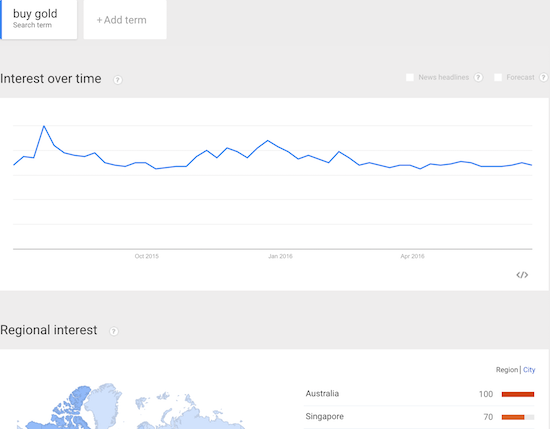

I use “buy gold” to assess whether an extreme in gold prices is sustainable. So far, these searches are not yet large enough overall to confirm a blow-off top in gold. Indeed, when I last looked at this question, all the technicals, volatility, and speculative activity ALL seemed lined up for a blow-off top and just needed a confirmation from a breakdown below support at the 50-day moving average (DMA). Instead, this line held as support and a new extreme in price is on hand.

Source: FreeStockCharts.com

Granted, this extreme is only marginally higher than the last one. So, I am not nearly as excited as I was about the last extreme move in GLD. Moreover, “buy gold” on a weekly basis is still showing barely a blip: mass sentiment is still not rushing out for gold.

Source: Google Trends

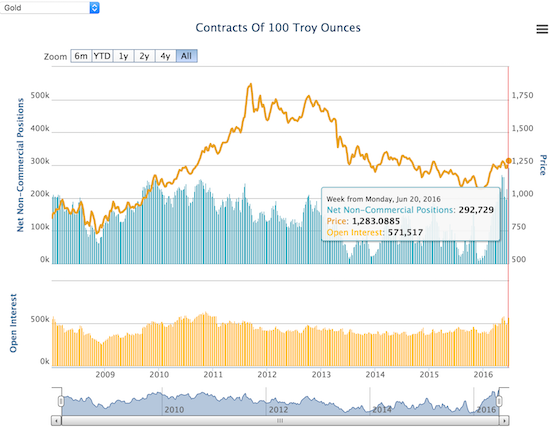

In other words, all of the sudden, it looks like gold has more room to run all over again. Bullish speculators are also sticking to their guns on the gold trade. Going into Brexit, speculators increased their bets to a fresh multi-year high. These levels have not been seen since at least 2008.

Source: Oanda’s CFTC Commitment of Traders

Although I managed to get on the right side of a lot of pre-Brexit trades, I completely missed the trade on gold. I am still of course sitting pat on my core GLD position, but I did not play the test of 50DMA support. I avoided any fresh short-term trades because I thought a blow-off top was about to get its final confirmation. NOW, going forward, I will return to bullish short-term trades on gold as long as the current gap up holds.

{Note: I purposely use GLD and gold interchangeably even though the two are not the exact same thing}

Be careful out there!

Full disclosure: long GLD