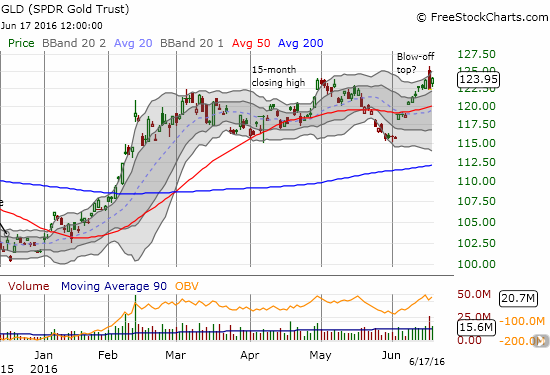

Two days ago I defined and described the case for a blow-off top in SPDR Gold Shares (GLD). Speculators have provided a confirmation of a top, yet there is now a caveat based on GLD’s ability to comeback a bit on Friday (June 17th).

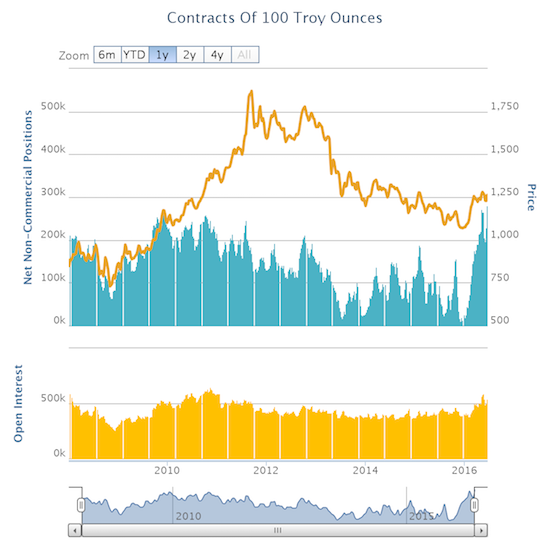

After pulling back the reins for three weeks on net longs in gold, in the last week speculators managed to ramp up net longs to new 8+ year highs. This move means that the gold trade is once again extremely crowded. This crowd may have grown to capacity and thus provides the recipe for a blow-off top: willing buyers are likely getting scarce. So I assume that this expansion of net long positions provides a confirmation for the case of a blow-off top in gold.

Source: Oanda’s CFTC’s Commitments of Traders

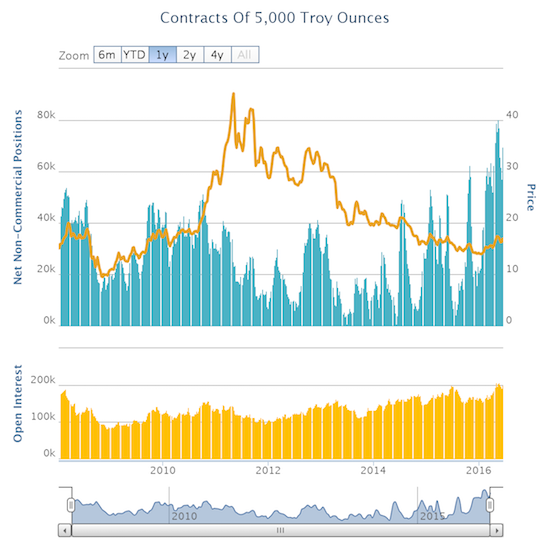

For reference, here are net longs for silver. Note that even with the recent pullback, speculators are well above earlier accumulations over the past 8 years.

Source: Oanda’s CFTC’s Commitments of Traders

This confirmation has a major caveat: sellers did not return to GLD in the wake of Thursday’s major fade. Instead, buyers rushed back in on Friday. In fact, the buying was on above average volume and maintained the current upward trend through the channel defined by the upper-Bollinger Bands (BB). This bold move raises the prospect of a possible invalidation of the blow-off top: a fresh 2-year high.

Source: FreeStockCharts.com

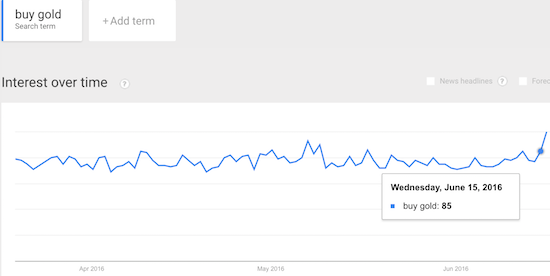

While I wait for the technicals to resolve, I am watching developments in sentiment on a daily basis. Sentiment as expressed through Google Trends is the final piece of the puzzle. The weekly and monthly views remain unchanged from my last post. However, the DAILY view is even more interesting. On Thursday, the day of the potential blow-off top, interest in “buy gold” ran up to a fresh daily high. As a reminder, a surge in sentiment at the same time as a surge in trading typically singals the end of the current move (whether up or down).

Source: Google Trends

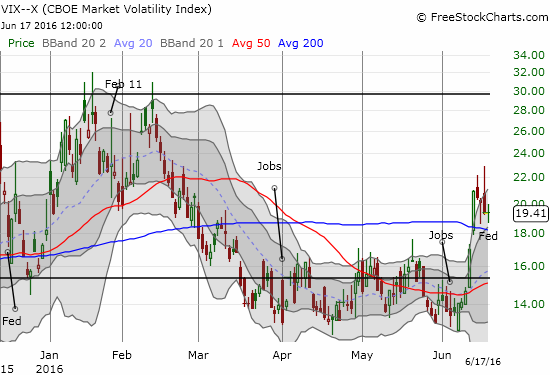

The ingredients are in place for sentiment to confirm a blow-off top in gold. If the volatility index, the VIX, says anything about the fear factor that is a part of gold’s appeal, a top must certainly be in place. Last Thursday, volatility experienced its own fade and blow-off type of move in parallel with GLD. On Friday, the VIX barely held flat. Still, the 200DMA breakout remains in place…the tensions are high!

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long GLD, long UVXY shares and call options