(This is an excerpt from an article I originally published on Seeking Alpha on May 30, 2016. Click here to read the entire piece.)

KB Home (KBH) last reported earnings on March 23, 2016 for its Q1 2016 results. Perhaps in anticipation of poor results, traders sold the stock ahead of the report and sent the stock below the critical resistance (at that time) at its 200-day moving average (DMA). However, KBH calmed fears with solid results and the stock completely reversed the loss. A fresh 200DMA breakout ensued.

Source: FreeStockCharts.com

I took a fresh look at KBH because May delivered some relatively solid data on the housing market. These data suggest the seasonal trade on home builders may not be over as I had originally thought. {snip} KBH will likely need to provide surprise upside guidance to gain more traction to the upside.

Here is a summarized list of KBH’s guidance for the second quarter and the full year (data from the Seeking Alpha transcript for the conference call):

{snip}

{snip}

KBH’s main accomplishment in the Spring earnings report was a confirmation that recession fears rampant during the Winter earnings report were unfounded. As a bonus, KBH did not surprise the market with any new operational issues as has been the case in too many earnings reports in the recent past. {snip}

KBH’s low valuation keeps the company on my radar for buys whenever negativity hits the housing market or KBH in particular. {snip}

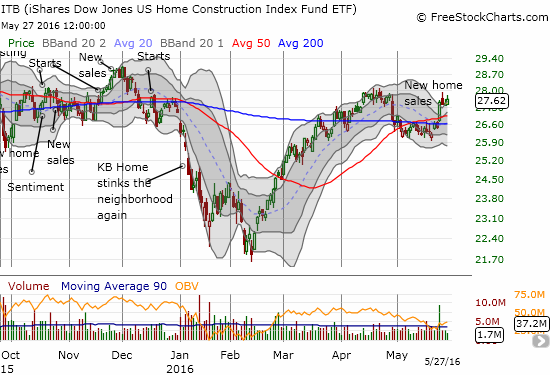

Source: FreeStockCharts.com

The potential irony of KBH’s out-performance among home builders is that it likely makes ITB the better trade on near-term momentum for housing-related stocks. I highly doubt KBH will manage any upside surprises later in the year without the same good news applying across the sector. {snip}

{snip} It seems BUYING options on KBH provides a better risk/reward balance than selling them. The market clearly does not expect much out of KBH in the near-term. Again, I ultimately prefer to play ITB over KBH at this juncture. Either way, I suspect there is no need to rush into positions.

I took notes on the KBH earnings call. I provide a quick summary below of what most caught my interest. All quotes and data come from the Seeking Alpha transcript of the call:

{snip}

(Click here for recent pictures of KBH’s Patterson Ranch development)

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on May 30, 2016. Click here to read the entire piece.)