(This is an excerpt from an article I originally published on Seeking Alpha on April 5, 2016. Click here to read the entire piece.)

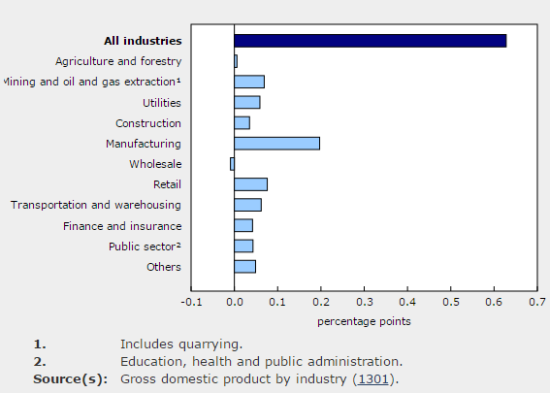

Canada’s GDP report for January, 2016 confirmed renewed strength in the Canadian economy. {snip}

Source: Statistics Canada

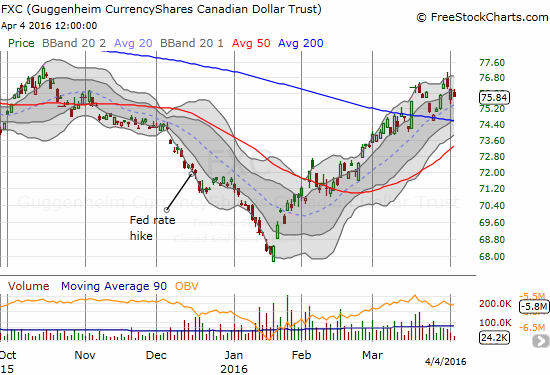

Now that the Canadian economy has apparently stabilized, the weakening in the Canadian dollar has come to a dramatic end. I argued last month that “the Bank Of Canada is done with rate cuts.” The rapid reflation of the Canadian dollar (FXC) coupled with Canada’s improving economic performance seem to confirm that the Bank of Canada is running out of excuses for outright dovishness…except of course to try to encourage traders to get back to shorting the currency. {snip}

Source: FreeStockCharts.com

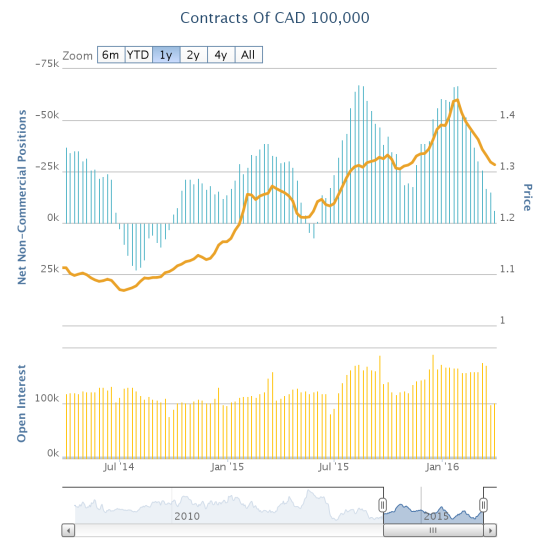

{snip}

Source: Oanda’s CFTC’s Commitments of Traders

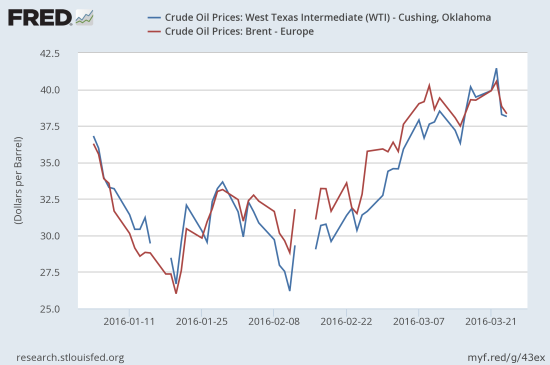

Oil is of course a big part of the story for Canada. This part of the economy has been humming even as oil groped its way to January’s bottom. The month of January lodged a fourth straight month of solid overall performance. {snip}

Source: US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, April 4, 2016.

US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, April 4, 2016.

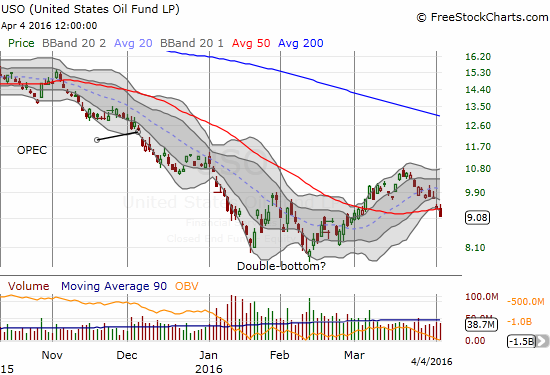

The above chart has data through March 28th. SINCE then, oil has continued a decline off its recent peak. The weakness has been pronounced enough to drive the United States Oil fund (USO) through its support level at its 50DMA.

Source: FreeStockCharts.com

The consistent decline in oil off its recent peak brings darkening clouds over the Canadian dollar’s strength. {snip}

Be careful out there!

Full disclosure: long FXC, short USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on April 5, 2016. Click here to read the entire piece.)