The Bank of England (BoE) released its latest pronouncement on monetary policy on April 14, 2016. As has been the case for what feels like forever now, the BoE kept policy the same with Bank rate at 0.5%, and it maintained the stock of purchased assets at £375 billion.

The BoE concluded that the outlook for the UK economy and inflation have “little changed” from February’s Inflation Report. This conclusion includes an expectation for global growth “to be somewhat subdued by historical standards.” So the BoE’s commentary regarding the British pound (FXB) interested me the most. I interpret the BoE’s currency commentary as indicating a desire to maintain a weak British pound.

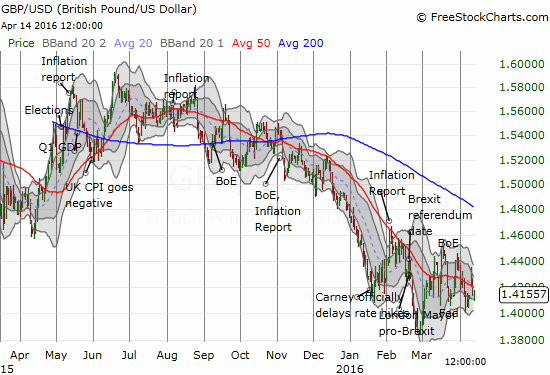

First, the BoE is still blaming subdued core inflation partially on the appreciation of sterling. Yet, the British pound stopped appreciating against the U.S. dollar (UUP) in the summer of 2015. Ditto for the euro (FXE). Weak global inflation and “restrained domestic cost growth” seem like more salient explanations at this juncture.

Source: FreeStockCharts.com

The BoE made plain its preference for a depreciating currency when it connected the weakness to a stronger economy:

“Sterling has depreciated further over the past month. Risk-free interest rates in the United Kingdom and elsewhere have also declined. Together with rises in the prices of many risky assets, these movements should support economic activity.”

The BoE also included a depreciating currency as part of the catalyst for strengthening inflation in coming months:

“Domestically, growth has been steady, and the MPC continues to expect CPI inflation to rise over the next year. The pickup in the price of oil and sterling’s recent depreciation will support that rise.”

Yet, the BoE is concerned that market fears over the potential for the UK to exit the European Union (“Brexit”) are the main drivers of currency weakness. Thus, the BoE should be particularly loathe to do anything between now and the June 23rd referendum on EU membership that could support the currency:

“…the likelihood that much of the fall in sterling reflects uncertainty surrounding the forthcoming referendum on the United Kingdom’s membership of the European Union raises questions regarding whether the lower level of sterling will persist and its net economic impact.”

In other words, if voters approve the status quo EU membership, subsequent strength in the pound could act as a brake to UK economic activity. The impact could be particularly abrupt given the pound could substantially increase all at once.

Moreover, the uncertainty surrounding the referendum is itself dampening growth and making the BoE even MORE cautious (of course, the BoE did not mention how a resolution of Brexit uncertainty could provide an immediate economic boost):

“There are some signs that uncertainty relating to the EU referendum has begun to weigh on certain areas of activity, as some decisions, including on capital expenditure and commercial property transactions, are being postponed pending the outcome of the vote. This might lead to some softening in growth during the first half of 2016…

referendum effects are likely to make macroeconomic and financial market indicators harder to interpret over the next few months, and the Committee is likely to react more cautiously to data news over this period than would normally be the case.”

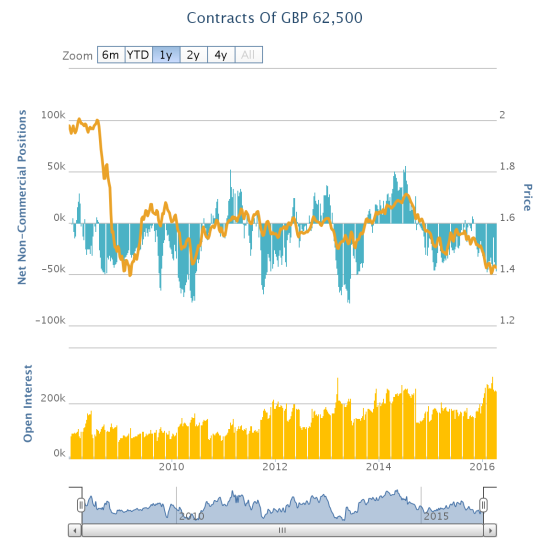

Between traders placing selling pressure on the British pound and Brexit-laden economic results, all signs still point downward for the British pound. For trading, I remain focused on fading rallies on the British pound.

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: short the British pound