So often I see “value investors” who equate the conviction of their position and alacrity of their analysis for being able to pick a bottom in a hapless stock. If the bottom fails, sometimes these investors will continue accumulating stock with each buy delivering the welcome opportunity to lower their cost basis. Meanwhile, losses keep growing and momentum continues delivering greater and greater discounts. I have never been a value investor, but I have been on this losing end of an argument with the market. I have learned the hard way that my opinions and analysis mean nothing if the market sustains its disagreement with me.

Instead of arguing with sellers, bottom-fishers should celebrate with buyers. A bottom cannot happen when the most interested participants are sellers. It takes buyers to turn the tide of downward momentum. So, it makes sense to wait for signs of buying interest before making a move. It makes even more sense to let buyers PROVE that something fundamental has changed in a stock.

I have some charts of current trading situations to demonstrate these concepts.

Solar City (SCTY)

I have been pounding the table for SCTY for a while now. A month ago, I included SCTY in “Some Bullish Solar Stock Setups.” I cautiously pointed out that buyers finally showed up in the stock in volume. Given the large short interest in the stock, it was entirely possible this volume surge represented a rapid convergence of short-covering to lock in profits. At least the move printed a clear stop-loss at a new low. SCTY has not looked back since.

This is the power of waiting out a downtrend until buyers make a convincing showing. In this case, two days of high volume buying was followed by a sharp day of selling that failed to generate follow-through or a new low. The momentum was shifting. At the end of November, a Bollinger Band (BB) squeeze appeared. A BB squeeze occurs when volatility suddenly compresses to create a stalemate between buyers and sellers. The resolution of this squeeze often creates fresh momentum. SCTY broke out to the upside. In three days, SCTY gained 29% and tested resistance at its 50-day moving average (DMA). The stock stumbled around its 50DMA for 5 trading days before resuming the upside push. I did not stick with my bottom-fishing trade through the 50DMA breakout; with hindsight, I am of course kicking myself bigtime.

Today’s 34.1% gain looks like it could be a climax, like a buyer’s panic. However, as long as the 200DMA holds as support, SCTY will remain in good shape. I am positioning to re-enter this trade with a hedge. I started by buying put options. If SCTY closes at a fresh high, I will begin making small purchases with some comfort my backside is covered in case it turns out I am over-chasing. Even if SCTY breaks down below its 200DMA, there are points for buying the dip at or near natural supports. The best case would be the lower part of the former trading channel that defined SCTY’s upward thrust from the BB squeeze.

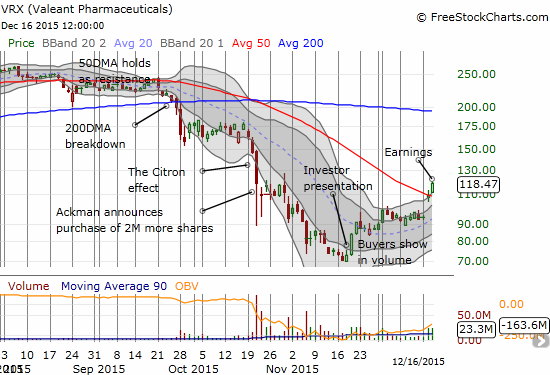

Valeant Pharmaceuticals (VRX)

VRX is a very controversial company. Like SCTY, VRX has the attention of some notable short sellers. I will not get into all the complexities of VRX’s drama. I will just point out that VRX’s potential bottom came in an even clearer signal than SCTY. Buyers showed up in volume for three days. Subsequent selling was barely able to reverse the gains of the third day of the rally. Sellers never showed up in force again. Now, VRX is working on a breakout. Like SCTY, I sold out my position at the test of 50DMA resistance. I am now preparing for a new play using call options if VRX can successfully test its 50DMA as support.

Whole Foods Market (WFM)

WFM is TRYING to bottom. M&A speculation is providing the catalyst for buyers. The latest spike is a bit more convincing than the first given it was preceded by a surge in call buying. I bought into the pullback from the first M&A spike. I was hoping that the 50DMA would hold as approximate support. That shows what hope will get you. I should have waited for buyers to PROVE the 50DMA had transitioned from resistance to support – like now. The proof may have arrived. Buyers now need to power through a breakout from the presumed resistance from the last M&A spike. I am holding long-term call options, so I have dug in my heels on this one. I like the call options in this case because I have an automatic and tight cap on my losses with a lot of potential upside if (when?) WFM finally breaks out.

Lumber Liquidators (LL)

LL is yet another controversial stock with a lot of attention from short sellers. LL has not confirmed a bottom, but it is working on one. In the chart below I drew an approximate trading channel at important closes. This channel helps show how sellers have failed to renew LL’s downward momentum.

During this channel – sometimes called a “base” for its potential to serve as a launching pad for upward momentum – on-balance volume (OBV) has steadily increased. This kind of increase means buying volume is dominating selling volume: shares are being transferred from weaker hands to stronger hands. Now that Whitley Tilson has apparently closed out his short position, buyers will likely become more emboldened. They have taken LL right to the top of the trading channel which closes the big gap down in August for a second time. A close above resistance will confirm a likely change in momentum. The downtrending 200DMA looms overhead as even more important resistance to overcome. I am watching this one closely for a breakout (or breakdown!).

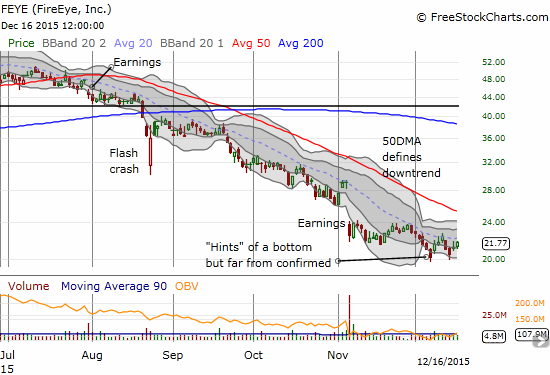

FireEye (FEYE)

Not all bottoms are created equally. FEYE is fighting a major struggle. The current bottoming pattern is very weak and unconvincing. Buyers are not showing up in volume. No major line of resistance has broken. A significant downtrend represented by the 50DMA is well intact and looms directly overhead. If FEYE can even stretch out a trading channel for a few months, the stock will earn some glimmer of hope. Until then, I am not even thinking about touching FEYE as a potential bottom. What happened to all that hype about cybersecurity stocks?!

Source for charts: StockCharts.com

Be careful out there!

Full disclosure: long WFM call options, long SCTY put options

thanks for Great article! May I request you to please give your views on DDD charts from long point. I think it has put in a bottom.

I agree. DDD looks like it has bottomed for now. However, I would wait until the odds improve a little more. I would buy on a CLOSE above the recent congestion around 50DMA resistance…say around $10.75. Given this stock has suffered a major decline, call options might be the best way to play this. DDD also looks like good candidate for plying the traditional January bounce for such stocks.