(This is an excerpt from an article I originally published on Seeking Alpha on August 30, 2014. Click here to read the entire piece.)

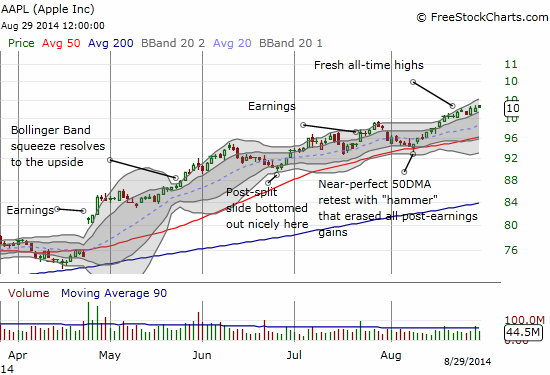

In early May, soon after April earnings, I presented a case predicting Apple’s stock would hit fresh all-time highs. This was essentially a follow-up to a piece a year prior predicting a bottom for Apple (AAPL). It only took AAPL under four months to deliver the fresh all-time high.

Source: FreeStockCharts.com

A review of sentiment has formed a key component of my analyses of AAPL, so it makes sense to do another check-in on sentiment now that AAPL has reached the targeted all-time highs. As one would expect at this point, the turn-around from the previous negative sentiment is now essentially complete. This means that improving sentiment is no longer a part of the bullish case going forward. In fact, with AAPL officially announcing to the media a September 9th product event with the teaser “wish we could say more,” the stage is set for another sell-the-news event.

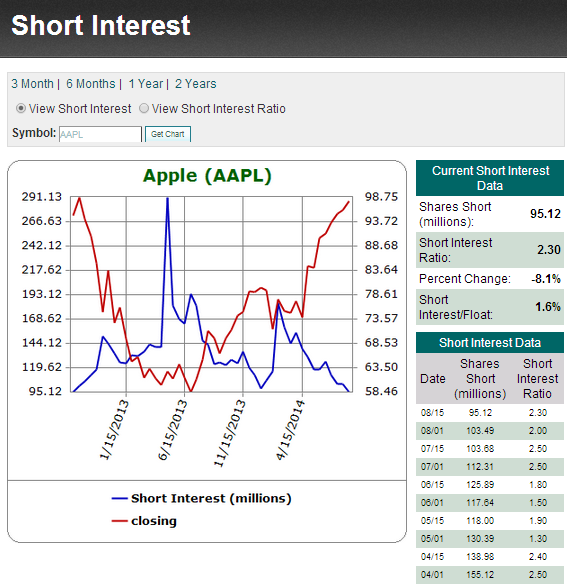

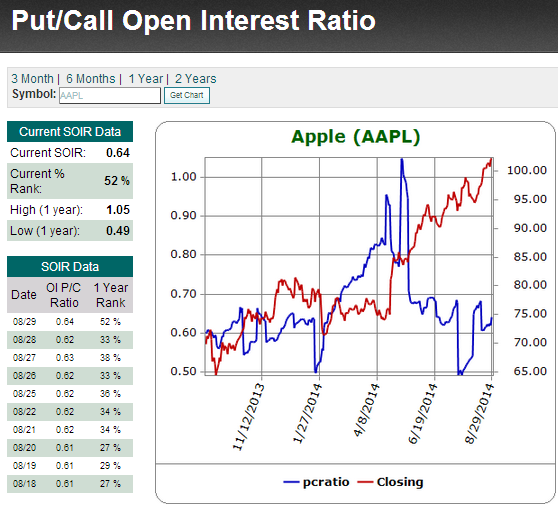

I have four key reasons Apple is likely to take a pause and pullback somewhere around this announcement: short interest is at recent lows, options trading is relatively bullish, valuation is at 5-year highs, and Apple’s stock is reaching the median of analyst price targets.

Short interest

{snip}

Source: Schaeffer’s Investment Research

Options trading

{snip}

Source: Schaeffer’s Investment Research

Valuation

{snip}

Analyst price targets

Apple is reaching the median analyst price target of $106. {snip}

Conclusion

In other words, AAPL is missing a strong catalyst for significantly more upside from current levels. {snip}

The market is of course abuzz trying to guess what Apple will announce. These guesses form the expectations that Apple will need to beat in order to catalyze an immediate post-event extension of the rally. Here is the “rumor roundup” as reported by CNBC’s Fast Money:

Source: CNBC from Yahoo! Finance

The Fast Money segment debated how and when to fade Apple post-event. {snip}

The CNBC Fast Money crowd discusses catalysts for a traditional post-announcement disappointment, including a shortage of glass for producing a crop of larger iPhones.

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on August 30, 2014. Click here to read the entire piece.)