(This is an excerpt from an article I originally published on Seeking Alpha on November 1, 2015. Click here to read the entire piece.)

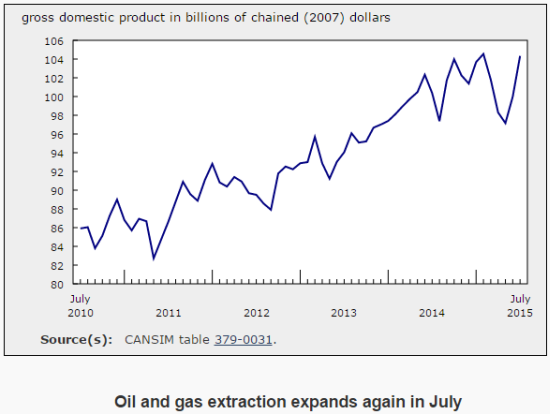

For the third straight month, mining, quarrying, and oil and gas extraction in Canada expanded. According to Statistics Canada, this commodity and energy based category of economic output has now grown 0.4% in August, 2.4% in July, and 2.6% in June. This 3-month expansion follows seven straight months of contraction. Here is a chart that focuses on oil and gas extraction from the previous month’s GDP report:

Source: Statistics Canada

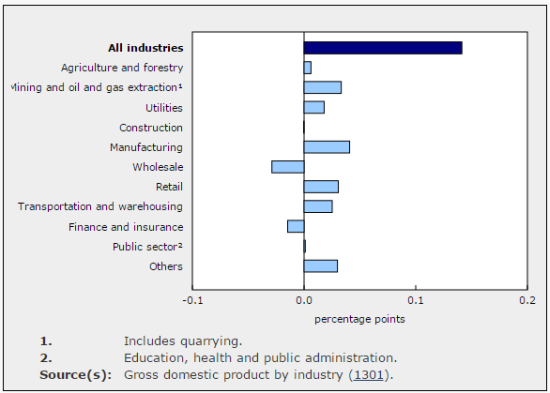

The general rebound in energy and commodities contributed to a small gain in Canada’s GDP for August. GDP grew by 0.1% in August. Given the gain, a 0.4% increase in June, and a 0.3% increase in July, talk of a recession in Canada can be placed back on the shelf for now.

Source: Statistics Canada

{snip}

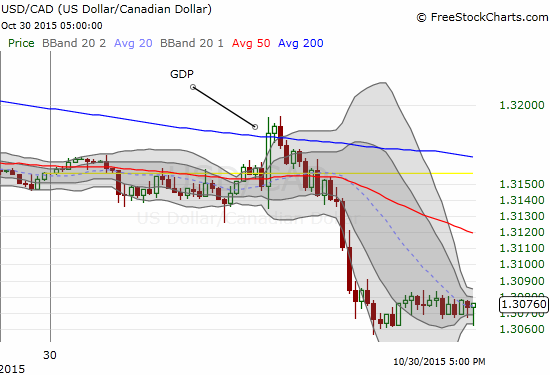

Source: FreeStockCharts.com

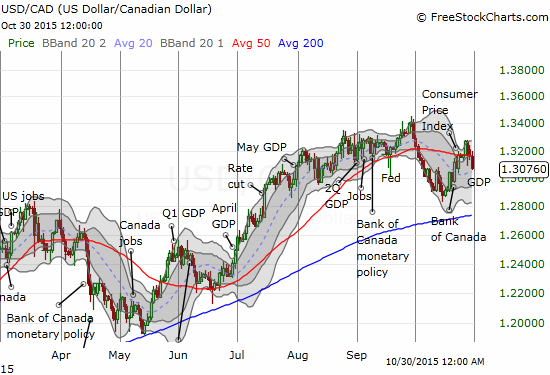

As long as the Bank of Canada is dovish and leaning toward more easing while the Federal Reserve continues to lean toward hiking rates, I am maintaining a long bias on short-term trades for USD/CAD. {snip}

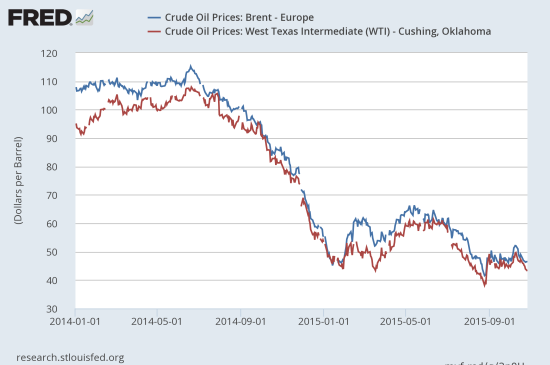

Source: US. Energy Information Administration, Crude Oil Prices: Brent – Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis, October 31, 2015.

US. Energy Information Administration, Crude Oil Prices: West Texas Intermediate (WTI) – Cushing, Oklahoma [DCOILWTICO], retrieved from FRED, Federal Reserve Bank of St. Louis, October 31, 2015.

Be careful out there!

Full disclosure: long FXC (longer-term), long USD/CAD (short-term)

(This is an excerpt from an article I originally published on Seeking Alpha on November 1, 2015. Click here to read the entire piece.)