The recent plunge in Eros International (EROS) is finally getting some mainstream media attention in the U.S. Bloomberg ran a story on Friday, October 23. This attention finally prodded EROS management to issue a statement about the latest drama in its stock. Reuters quickly followed with a story on that press release. Forbes Asia did its own follow-up on October 27th. From EROS:

“With reference to letters received from BSE & NSE with regards to article appearing in “The Economic Times” dated October 25, 2015 captioned “Eros International under Wells Fargo’s scanner, stock downgraded”, We believe that the recent movement in share price volatility at our NYSE listed parent level and today at Indian stock exchanges are based on speculative media reports…

We would like to reassure our shareholders that there has been no material change to the previously announced strong fundamentals of the company…

Our Q1 results have been strong and nothing has materially changed since then, in fact a further string of hits by the Company such as ‘Bajrangi Bhaijaan’ in Q2. We will be announcing what we expect to be a strong second quarter results in the first half of November (specific date to follow), and that will be another opportunity for us to answer further questions regarding all aspects of our operations and finance during that earning’s call…”

The press release also referenced an October 23rd Wells Fargo analyst report that is apparently driving the renewed selling in EROS. The company essentially dismissed the negative implications of the report by pointing out that the analyst did not change earnings estimates or the price target. The company further pointed out that a Macquerie analyst sang praises for EROS on the same day with an outperform rating and $25 price target.

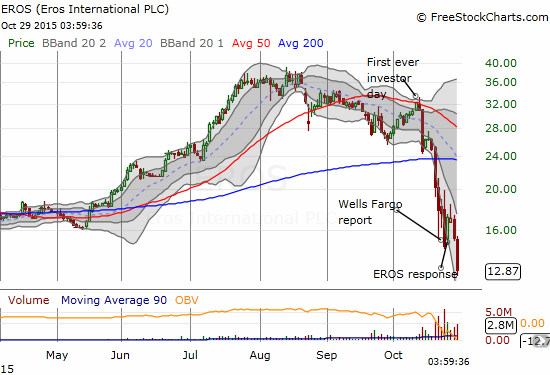

This press release was good enough for a gap up and strong close off recent 52-week lows. The buying interest was not sustained. At the close of trading on October 29th, EROS closed at levels last seen around March, 2014.

Source: FreeStockCharts.com

The continued selling speaks volumes about the lingering skepticism facing EROS. Traders and investors are clearly unwilling to wait until yet another company meeting to find answers to the nagging questions about the company’s business.

There appear to be two main issues dogging the company:

- A credible explanation for the rapid growth in revenue from the United Arab Emirates (UAE): from $14.5M in 2013, t0 $45.6M in 2014, and so far $103.8M this year. EROS has yet to address this head on.

- A clear quantification of its user base. EROS reported that it has 30M registered users. The Forbes piece references an EROS press release (I could not find it myself, even in SEC filings) clarifying “…its base of 30 million registered users is a combination of web, WAP and APP customers – acquired organically and through an acquisition.” However, this COULD mean EROS is double-counting.

These doubts reminded me that I neglected to note in my first piece on EROS that the selling in the stock could be the result of an ABSENCE of information. With these additional details, it seems indeed that the Investor Day was a complete failure for EROS. Failing to receive answers to questions and doubts in a satisfactory manner, investors are choosing to assume the worst and bail.

Given this drama, I do not think EROS can be treated as an investment – meaning buy these shares on the “cheap” and then hold on (or buy even more shares) through all the uncertainty and likely additional selling hoping that the company delivers in November’s meeting where it did not earlier this month. However, there are potential trading opportunities here that offer good risk/reward assuming that the outcome for EROS is close to a binary one: either 1) the company turns out to be fraudulent and EROS collapses into the low single-digits, or 2) all the ruckus just reflects management’s poor communication abilities and EROS soars toward previous heights.

Options are a great tool in these cases. As an example, here is how I have traded EROS…

After seeing the buying interest in EROS on Friday, October 23, I bought shares married to put options expiring November 20th and a $12.50 strike price. This placement SHOULD give me enough runway to the company’s next presentation. I held the position even after the shares gained enough value on Monday’s rally to pay for the put options – I did not want to miss out if the rally was sustained. It was not. On today’s 16% plunge I went back into the red, but I am fully covered on any additional downside and start to make a net profit if EROS falls into single digits. So, I took the opportunity to double down on the trade with a fresh batch of options and a lot more shares. My assumption is that at these levels, the potential upside is far greater than the downside. The next batch of options also expire November 20th but are at a $10 strike price. For additional coverage, I sold March $17.50 call options against some of my shares. Now, I have paid for a portion of my put options. I left some shares uncovered to benefit if EROS, for example, hits analyst price targets at some point.

The basic idea is that any trade has to be hedged, whether bullishly or bearishly. Options are best for the short-term hedge, shares to match the longer-term bias and provide maximum flexibility and liquidity. I am currently biased towards the bull case since I think EROS is in a great market. So, I am buying shares and put options. The catalyst of the November meeting is the presumed trigger point of a binary outcome. If the meeting does not trigger the binary outcome, I will have to develop a longer term configuration. I have done a little more longer-term preparation by selling the March out-of-the-money call options against the shares. Hitting the $17.50 strike price would deliver significant profits for the trade.

If you are biased bearish, short shares and buy call options. This is a mirror image of the trade I described for myself. However, given the potential for great loss if EROS soars, it makes sense to quickly cover shares if significant profits develop. In other words, do not be a greedy bear!

Here are two other ideas if you are not convinced that EROS faces a likely binary outcome but want to limit potential losses betting on the company…

- If you are very bullish, sell out-of-the-money put options. This is best done at the end of a day like today when fear accelerates and drives option premiums a lot higher. The premiums are very high given the volatility and uncertainty in the stock. Be prepared to own the shares if the stock does indeed collapse further. Upside is limited to the premium sold in the put options.

- If you prefer low risk and are not trying to make money in an extreme (binary) outcome, buy shares and sell call options against them. Use the premium on the call options to buy put options. This trade neutralizes most of the additional premium inflating the options because of current volatility. This trade limits downside with a cap on the upside as a trade-off. This trade is also called a collar and is biased bullish.

In all these trades, the positions fully respect the risks involved in a story like EROS and seek to limit potential loss while allowing for enough profit to justify the risk. If executed properly, a trader need not be either bullish or bearish when specifically targeting a binary outcome. Note well that I am NOT staking a specific claim on whether the market’s concerns are justified or not.

If you have any other trade ideas or questions, feel free to post below or hit me up on StockTwits or Twitter.

Be careful out there!

Full disclosure: long EROS shares and put options, short call options