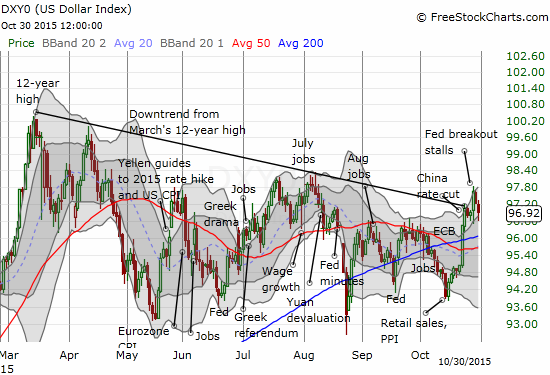

The market wasted no time. Within two days, currency markets reversed all the losses the euro (FXE) suffered in the wake of the Federal Reserve’s October decision on monetary policy. In that decision, the Fed cleverly crafted words to convince the market that its first rate hike is indeed imminent.

With renewed signs of strength in other major currencies, the U.S. dollar index’s breakout came to an immediate halt.

Source of charts: FreeStockCharts.com

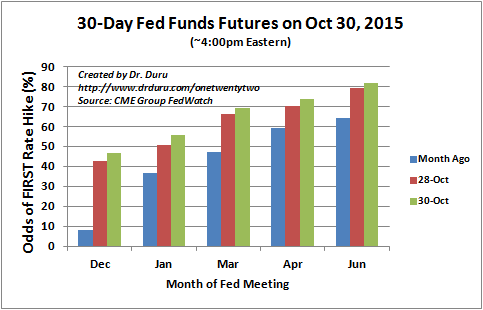

The stall occurred even as the futures market further firmed up the odds for a first rate hike in January, 2016.

Source: CME Group FedWatch

Clearly, the markets are not going to travel a straight line to the Fed’s first rate cut. The zigs and zags continue to open up valuable trading opportunities. In this latest case, I quickly pounced on a fade of EUR/USD. I am looking for an eventual return to 1.09 and likely 1.08 in the near future.

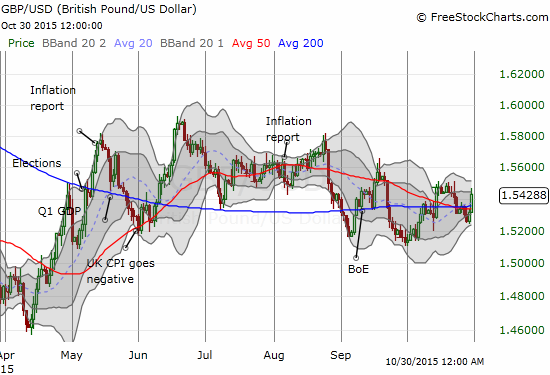

Last week’s Hard Currency podcast from the Financial Times gave some other related trading ideas. Thursday’s guest Steven Saywell of BNP Paribas noted that the Bank of England is under a lot more pressure than the Fed to raise rates. Even though Governor Mark Carney clearly wants to wait to hike rates until the Fed goes first, rising wage pressures in the United Kingdom may not afford him the luxury. Saywell’s observation appears to validate my on-going strategy to buy the British pound (FXB) on dips. I happened to listen to the podcast after I already locked in profits on my latest buy-the-dip trade on GBP/USD.

Source of charts: FreeStockCharts.com

I am now also much less likely to hedge longs on the British pound when I execute a buy-the-dip trade. I am still holding onto some on-going hedges that I will look to unwind in the coming week or so.

Be careful out there!

Full disclosure: short EUR/USD