(This is an excerpt from an article I originally published on Seeking Alpha on October 1, 2015. Click here to read the entire piece.)

{snip}

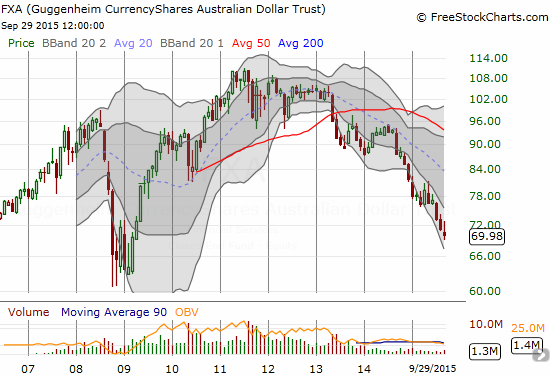

RBA Governor Glenn Stevens found a clever way to imply that the decline in the Australian dollar (FXA) still has a ways to go. First, he implied that the terms of trade will likely revert to (or at least approach) the 20th century mean before its decline ends. Second, he noted that the exchange rate is adjusting to the terms of trade. By my calculation the two statements add up to weakness for the Australian dollar for the foreseeable future.

Source: FreeStockCharts.com

{snip}

The decline in the terms of trade is mostly about commodities as they represent Australia’s main export. Stevens emphasized the long-term nature of the decline in the terms of trade by implying that the decline in resources capital spending may still have another 2 1/2 years to run its course…{snip}

{snip}

As this decline drags on, I expect the Australian dollar to remain biased toward weakness. In other words, the weakness in the Australian dollar could easily continue for another two years. Presumably, the currency will start to strengthen as traders begin to anticipate the end to Australia’s disadvantage in global trade and then begin to see enough shreds of evidence to support the optimism.

Two years is an eternity in currency markets, so I will stick to half an eternity by looking out into 2016.

{snip}

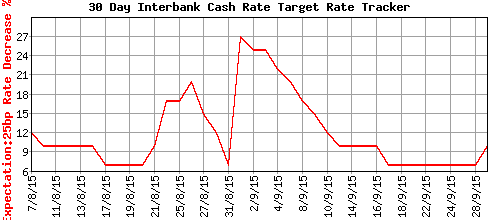

Source: ASX RBA Rate Indicator

{snip}

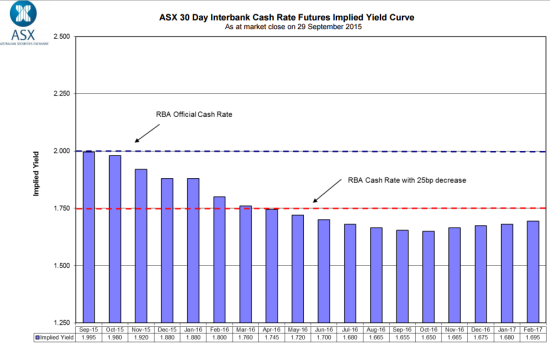

Source: ASX RBA Rate Indicator

In total, the data all seem aligned to an extended run of weakness for the Australian dollar for at least the next 9 months if not longer. {snip}

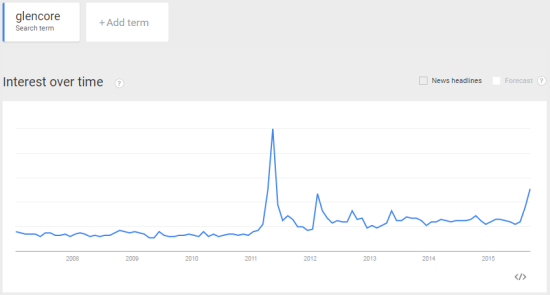

This downward path may not last as long if the descent accelerates for some reason. One catalyst I continue to watch is the on-going, broad collapse in commodities prices. The sudden plunge of mighty Glencore by 30% to start this week did not generate a big move by the Australian dollar. At the time of writing, Glencore is already experiencing a strong relief rally from Monday’s massive loss after the company issued a press release to reassure nervous investors – we have seen this story oh-so-many times before, right?). Regardless, I would not be surprised to see fresh contagion around the world of commodities if Glencore’s misfortunes deepen.

{snip}

Source: Google Trends

Be careful out there!

Full disclosure: short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on October 1, 2015. Click here to read the entire piece.)