(This is an excerpt from an article I originally published on Seeking Alpha on September 24, 2015. Click here to read the entire piece.)

{snip}

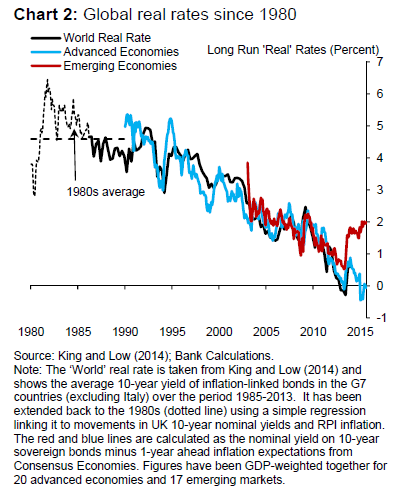

After reading the actual speech by Andrew Haldane, titled ominously “How low can you go?,” I realized that the BBC had overly focused Haldane’s concluding remarks. I can understand the temptation to overlook the body of Haldane’s speech because it was a very technical examination of the long-term prospects for monetary policy. However, it is exactly in the core of the speech where Haldane was most profound in predicting a continuation of the secular decline in long-term bond yields around the globe. The implications for currencies and the pressures on central banks are equally important.

{snip}

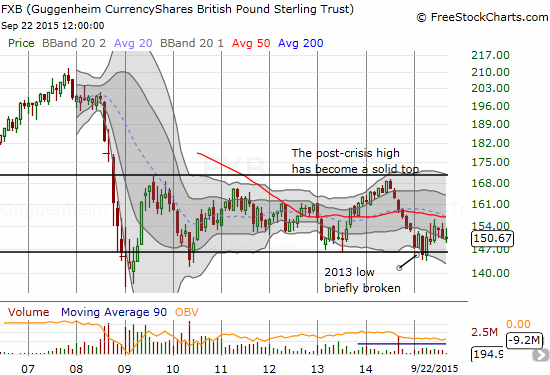

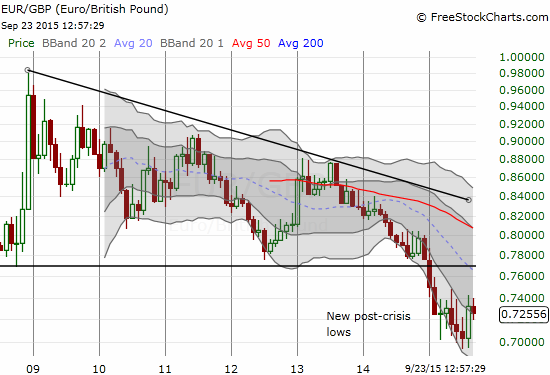

The Bank of England has recently made a point to finger the British pound’s role in producing disinflationary forces. {snip}

{snip}

Source for charts: StockCharts.com

Haldane broke from typical BoE soft-pedaling and made plain that the strong currency is not desirable and is working against effective monetary policy. {snip}

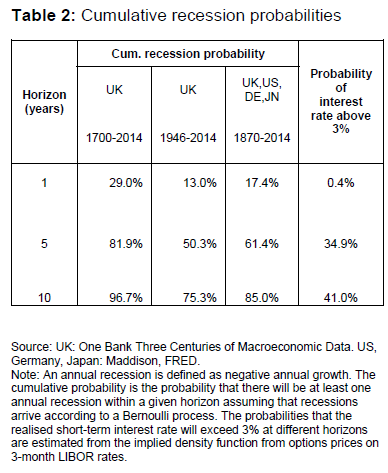

Make no mistake, Haldane did NOT insist that the BoE needs to lower rates now. He instead pointed out the direction of risk. Haldane implicitly prefers conditions that would allow the BoE to get moving on hiking rates. Haldane is deeply concerned that as time drags on with rates at the zero lower bound (ZLB), the central bank becomes more and more likely to face the next economic downturn with rates too low for typical rate-cutting to provide stimulus. {snip}

Source: Bank of England

{snip}

Putting it all together, Haldane argues that the odds for a recession combined with the trend for interest rates make it VERY likely that rates will still be exceptionally low by the time the Bank is pressed to provide the economy more stimulus.

{snip}

If the next recession occurs while rates are still low, central banks may face a kind of trapping state: “central banks may find themselves bumping up against the ZLB constraint on a recurrent basis.”

Faced with these risks, Haldane wants central banks to prepare for the range of policy options in this new world of stubbornly low interest rates…

{snip}

Haldane considered three main options for central banks whose backs are up against the ZLB:

- Raise inflation targets

- Submit to the ZLB and standardize or normalize quantitative easing (QE) as a tool for monetary policy. That is, consider it as more than just an emergency measure in response to a financial crisis.

- Impose negative interest rates on currency – most likely by levying fees for carrying money or forcing currency into a digital form that facilitates taxation.

{snip}

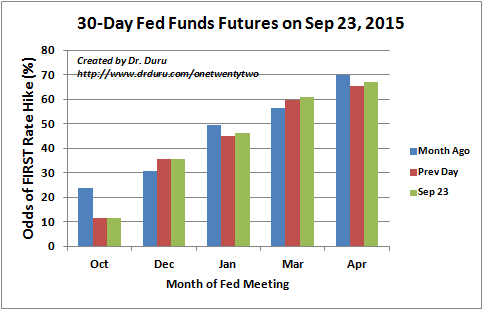

Source: CME Group FedWatch Tool

{snip}

Source: Bank of England

Be careful out there!

Full disclosure: long and short the British pound against various currencies

(This is an excerpt from an article I originally published on Seeking Alpha on September 24, 2015. Click here to read the entire piece.)