(This is an excerpt from an article I originally published on Seeking Alpha on August 19, 2015. Click here to read the entire piece.)

I have spent a lot of time over the past four years touting the attractiveness of stocks in homebuilders. The ride has offered a lot of bumps along the way but my single mantra coming out of the housing trough to “buy the dips” has served me well. {snip}

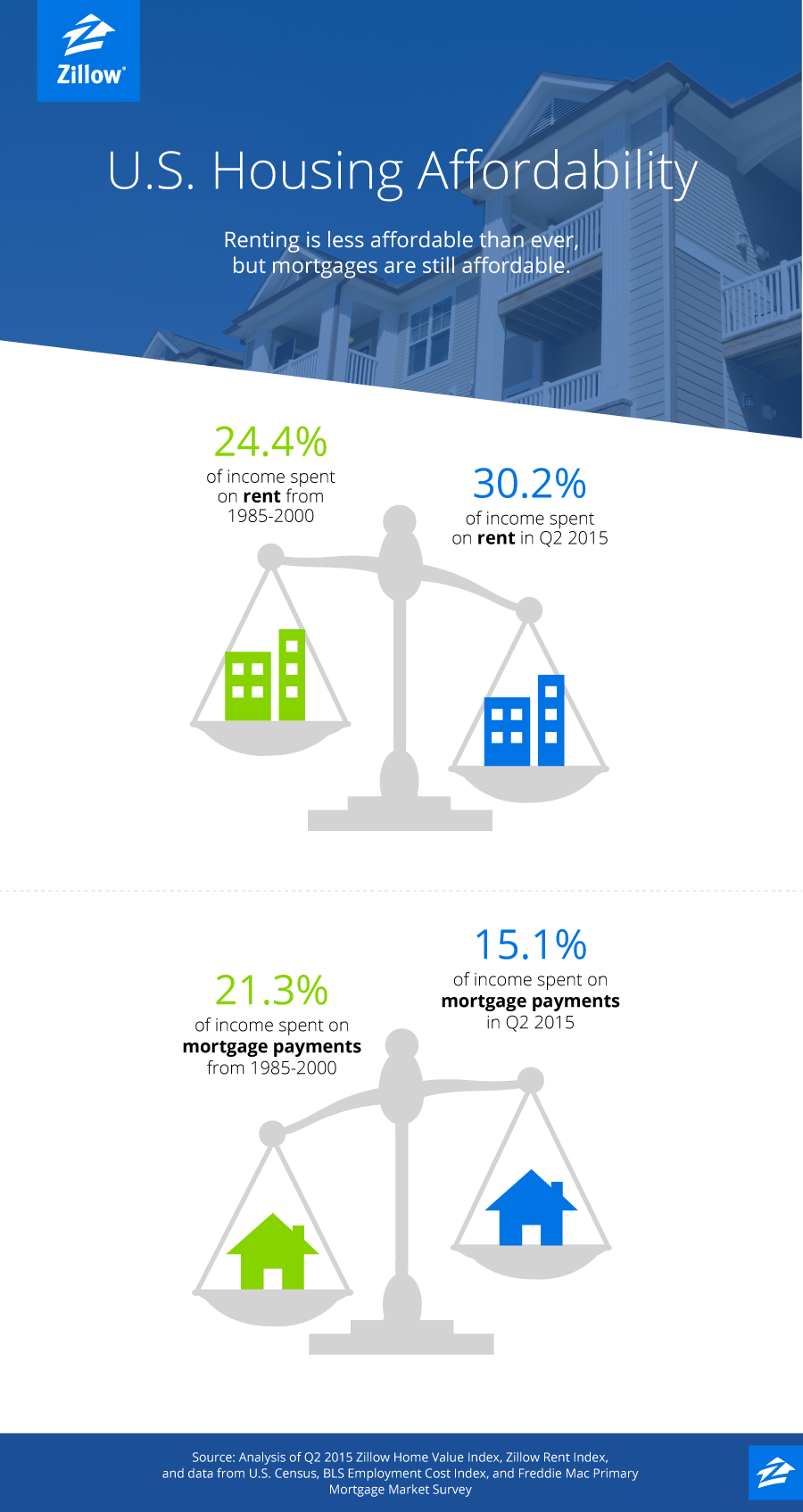

Source: FreeStockCharts.com

This ride’s poignant lesson is that neither euphoria nor despair have long shelf lives among most homebuilder stocks. The market is at a particularly interesting euphoric phase with ITB trading at 8+ year highs and once again out-performing the S&P 500 (SPY). {snip} ITB has a relatively poor record of sustaining such moves (no surprise for almost any equity), so I decided it was time to unload my shorter-term holdings into the current euphoria. I sold my call options on ITB and Toll Brothers (TOL).

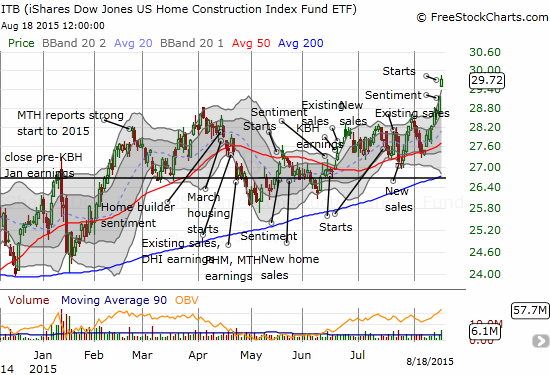

TOL has become a trading favorite because the stock is supported by a healthy buyback. {snip}

Source: FreeStockCharts.com

For braver traders who still see more short-term upside I offer up KB Home (KBH). {snip} With the company apparently hitting full stride on several important California communities, especially in Northern California, my interest is rising again. I will be closely watching earnings on September 24th to confirm a return of positive momentum.

Source: FreeStockCharts.com

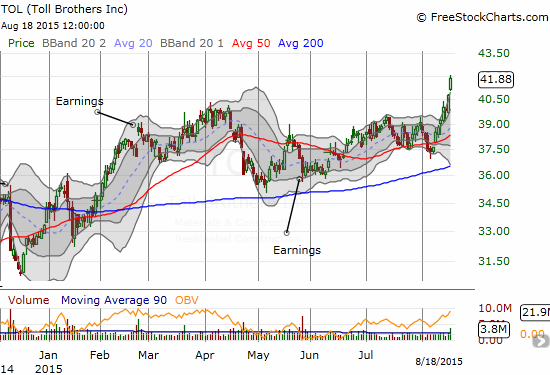

This encouraging vote of confidence for homebuilders comes just ahead of what is supposed to be the first rate hike from the Federal Reserve on its way to policy normalization. The potential for a rate hike is coming just as housing looks like it is finally achieving sustainable upward momentum. {snip}

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, August 18, 2015.

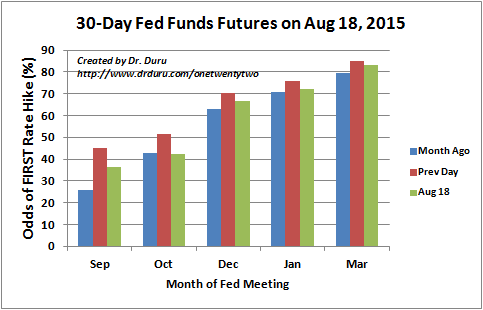

The debate on the timing for a Fed rate hike is quite distracting, but it is important for assessing the potential for the market’s movement in coming months. {snip}

Source: CME Group FedWatch

There are even valid reasons for doubting the Fed will hike at all in the near-term. {snip}

{snip}

All the accompanying uncertainty makes it all the more prudent to take some profits on some homebuilder positions and have the cash ready for any subsequent buying opportunities. {snip}

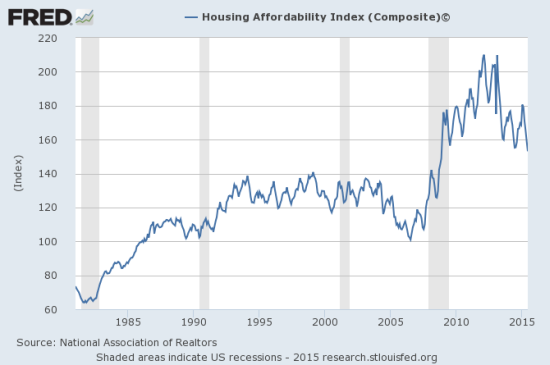

Source: National Association of Realtors, Housing Affordability Index (Composite)© [COMPHAI], retrieved from FRED, Federal Reserve Bank of St. Louis, August 14, 2015.

{snip}

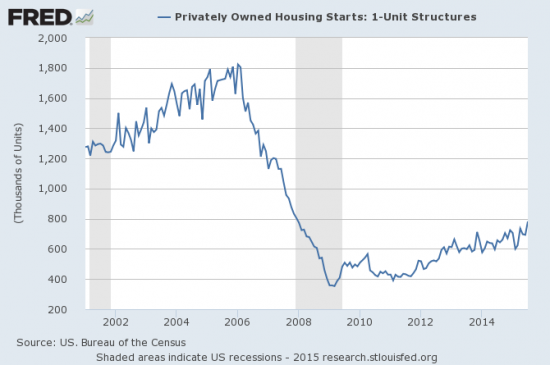

Source: Zillow

This contrast may seem like a perfect driver for ramping up sales of housing. However, the exorbitant levels of rent are slowing down the ability of many households to save for downpayments in an environment where credit remains relatively tight. {snip}

The bottom-line is that housing is at a very critical juncture given all the points described above. While I stick by the overall bullish thesis on housing as described in earlier pieces and supported by one earnings report after another, selling some housing stocks here provides some cushion to help ride out whatever is coming. If recent history holds, the current rush into housing stocks will soon be followed by a nearly equal retreat before the rapid cycle repeats.

Be careful out there!

Full disclosure: no positions – see earlier pieces for the cases for core positions

(This is an excerpt from an article I originally published on Seeking Alpha on August 19, 2015. Click here to read the entire piece.)