(This is an excerpt from an article I originally published on Seeking Alpha on August 12, 2015. Click here to read the entire piece.)

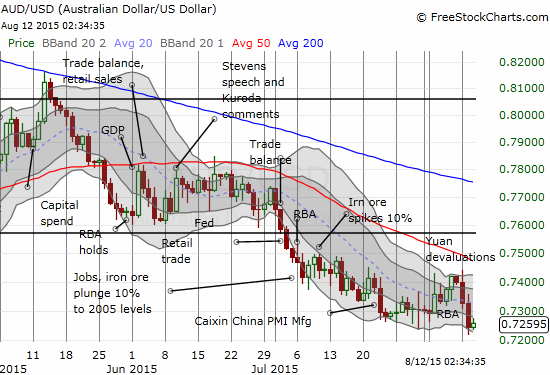

I was just getting ready to think through my latest piece on the Australian dollar (FXA) as a story about the currency’s resiliency likely thanks to an on-going rebound in price of iron ore. Iron ore reached a 1-month high on Tuesday, August 11, 2015 in Asian trading. This milestone came on the heels of a rally that reached a gain as high as 3.8%. The most salient market narrative relied upon hopes for a pick-up in steel production in the coming months. Steel exports hit a record high of 10.29M tonnes in January and July came close to that record with exports of 9.73M tonnes.

The Australian dollar was doing particularly well given another round of weak economic data points from China to start the week.

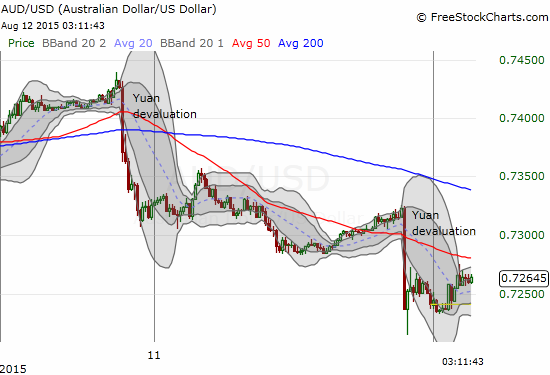

However, not long after I reviewed the news on iron ore, much bigger news hit that China had devalued the yuan by changing the pricing scheme. The Australian dollar sold off immediately. However, most of the selling momentum had fizzled by the time of trading in the U.S. {snip}

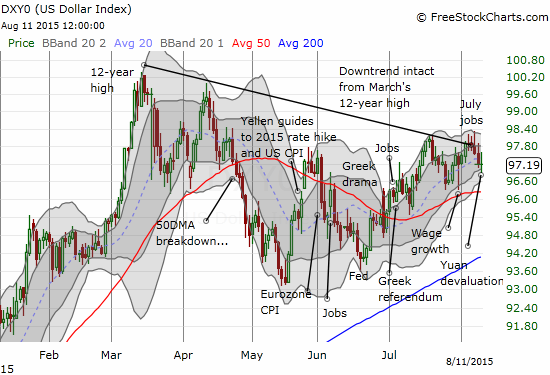

This chart of the U.S. dollar index suggests that the weakness in AUD/USD is from the Australian side of the ledger and not the side of the U.S. dollar…

Source for charts: FreeStockCharts.com

The trigger selling is understandable: if this latest step in China’s efforts to revive its economy reveals that conditions are even worse than feared, then Australian has a very tough time coming. {snip}

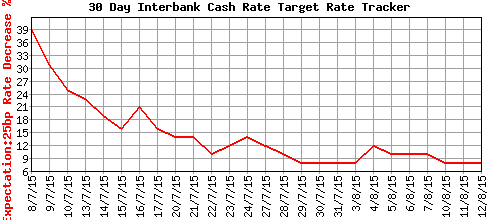

Source: ASX RBA Target Rate Tracker

I do not expect this apparent resiliency in the Australian dollar near 6-year lows to translate into a blistering rally. {snip}

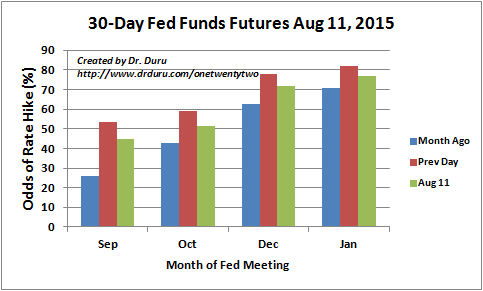

Source: CME Group Fed Watch

(Note that the CME Group has apparently changed methodology and/or presentation of the data on the 30-Day Fed Funds Futures. Last week, odds for September were excluded. Before that, odds for September sat at zero for several weeks. I have an outstanding inquiry seeking more information and details.)

Be careful out there!

Full disclosure: long and short the Australian dollar versus various currencies

(This is an excerpt from an article I originally published on Seeking Alpha on August 12, 2015. Click here to read the entire piece.)