(This is an excerpt from an article I originally published on Seeking Alpha on Jan 2, 2015. Click here to read the entire piece.)

On December 23rd, Statistics Canada reported another strong showing for Canada’s GDP. This time it was manufacturing that produced the unexpectedly strong result. Real GDP increased 0.3% in October. {snip}

Given the on-going plunge in oil prices, my focus remains on the performance of Canada’s energy sector. {snip} So, at least in October, Canada proved quite resilient in the face of declines in the oil patch. Of course, one way to interpret this increase in production is that it contributed to the decline in oil prices within the context of an over-supplied market.

Canada’s strong GDP report was of course well over-shadowed by the U.S.’s strong 5.0% performance – a persistent pattern of strength over strength in the past few months. {snip}

Source: FreeStockCharts.com

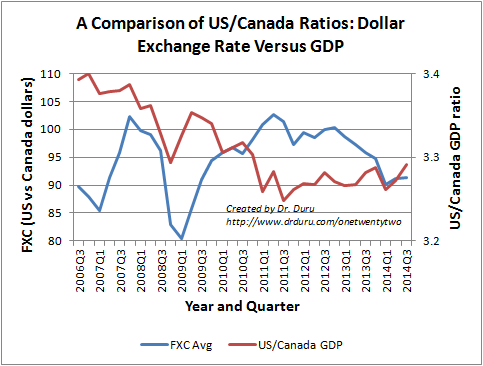

It is easy to overlook Canada’s GDP growth as a catalyst for the currency because Canada’s GDP is so closely tied to U.S. GDP. In February, 2013, I wrote a piece explaining my bearish bias at the time on the Canadian dollar. I showed the remarkably high correlation between US and Canada GDP on a per capita basis. {snip}

{snip}

Sources: Statistics Canada and the U.S. Bureau of Economic Analysis

The first striking part of this graph for me is seeing the volatility in the exchange rate even as relative GDP has changed so little between the US and Canada. Even with the GDP ratio staying almost exactly the same since 2011, the year commodities in general peaked, FXC has fallen about 10%. This makes me a lot less inclined to use GDP results as a driver for trading the Canadian dollar.

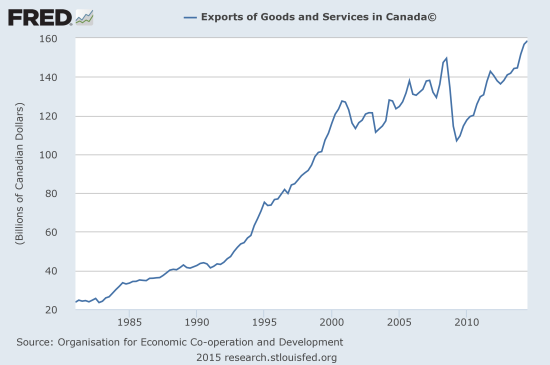

That February, 2013 piece hinged on exports. I made a claim that Canada’s weak export performance was partially a product of the strong currency at the time. Even when Canada produced an exceptionally strong export performance in Q1 of 2014, I wondered aloud whether the report was an aberration. I did not consider the possibilities of a major turning point. Now, looking back, it does indeed appear that Canada’s exports have achieved a major turning point. On a nominal basis, exports have reached new all-time highs.

Source: St. Louis Federal Reserve

Canadian exports first hit new all-time highs in the first quarter of 2014. That was also the time the U.S. dollar reached levels against the Canadian dollar last seen in the summer of 2009. The Canadian dollar experienced a brief relief rally into the summer before resuming its weakness. Now, the Canadian dollar is at fresh 5 1/2 year lows against the U.S. dollar and exports have continued higher.

This performance raises an interesting cause-effect problem for my original analysis. Now that it SEEMS a weaker Canadian dollar has improved exports (also acknowledged by the Bank of Canada), it seems premature to assume that the Canadian dollar will quickly strengthen in response to stronger exports. In other words, it is difficult to approximate how much further the weakening will continue. While the plunge in oil prices is hurting sentiment on the Canadian dollar, I earlier showed it is far from clear that traders should expect the Canadian dollar (or the economy for that matter) to suffer greatly from the oil glut.

{snip}

{snip}

Taken together, my fresh bullishness on the Canadian dollar must stay tentative. {snip}

Be careful out there!

Full disclosure: short USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on Jan 2, 2015. Click here to read the entire piece.)