(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2015. Click here to read the entire piece.)

The only thing the Sydney Morning Herald (SMH) missed in its amazingly accurate preview of the May decision on monetary policy from the Reserve Bank of Australia (RBA) was that the central bank would take a page out of the playbook of the Bank of Canada. The RBA concluded the May statement by essentially saying that it is keeping its options open on further rate cuts as insurance for buffering and bolstering domestic demand:

{snip}

Overall, I think the RBA provided one of its weaker explanations for a change in interest rates…{snip}

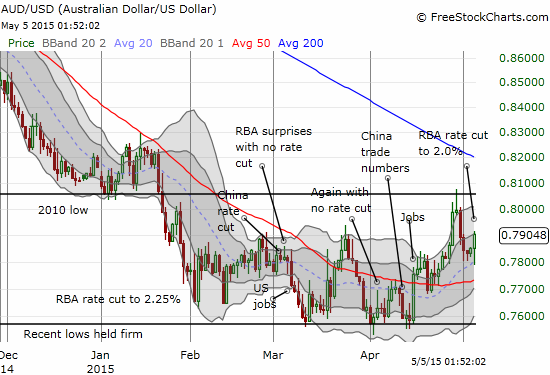

For anyone who believes that commodity prices, particularly oil and iron ore, have finally found their bottoms, this connection drawn by the RBA implies, even confirms, that the Australian dollar is bottoming as well. {snip}

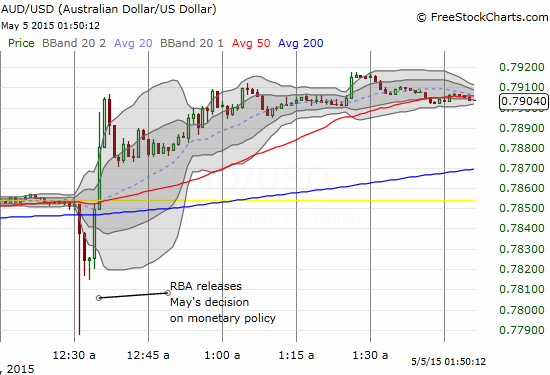

Source: FreeStockCharts.com

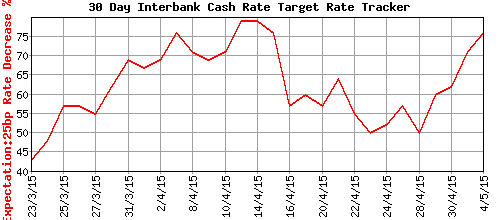

This early strength seems to vindicate my position that going long ahead of this decision – despite the SMH’s revelations which helped drive market odds of a rate cut to 76% ahead of the decision – was the better risk/reward strategy.

Source: ASX RBA Rate Indicator for May, 2015

The currency market is likely starting to anticipate the end of the RBA’s rate cutting cycle and has less desire to price in an extended campaign of additional monetary accommodation. {snip}

If the RBA is serious about the necessity of a lower exchange rate, it will likely need to get more direct with its monetary policy. I think the latest statement contains some hints that the RBA is getting ready to take rates as low as it needs to go, similar to the style of the Swiss National Bank (put aside the reality that the SNB still ended up with a much strong currency). {snip}

Be careful out there!

Full disclosure: net long the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on May 5, 2015. Click here to read the entire piece.)