(This is an excerpt from an article I originally published on Seeking Alpha on January 5, 2015. Click here to read the entire piece.)

Three and a half years ago, I started a series that I called “the Commodities Crash Playbook” in an effort to take advantage of an investing and economic theory promoted by money manager Jeremy Grantham. {snip}

I was so convinced by this story that I decided to put my own investing and trading wrapper on Grantham’s work. I started with a two-part piece titled “Preparing for Profits in a Resource-Constrained World” and “Profiting from Physical Assets in a Resource-Constrained World – Rules and Picks.” {snip}

Moreover, China’s imminent economic collapse has proven to be one of the most highly anticipated calamities of the cabal dabbling in apocalyptic thinking. There will be a LOT of eager and many postponed “I told you so”‘s whenever it is China’s economy takes a notable stumble. Regardless, this seeming “resilience” of the Chinese economy started a rethink on the commodities crash playbook. {snip}

As it turned out, Grantham wrote his letter, and I developed my wrapper, just as commodities had indeed hit a peak. {snip}

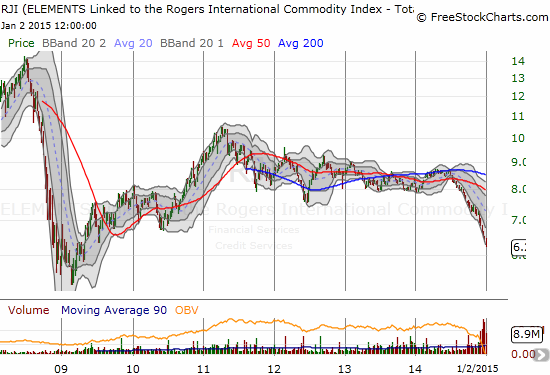

Source for charts: FreeStockCharts.com

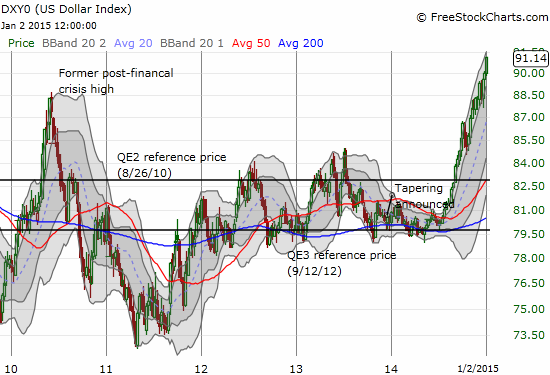

While the declines looked synchronized, each commodity had unique and interesting stories and drivers. It was impossible for me to identify a unifying theme except that prices were in a sustained, albeit volatile, decline. However, as the U.S. dollar index (UUP) continued to rise, it finally dawned on me that currency and monetary dynamics could be a core driver, something that Grantham did not contemplate. In fact, it was not until the dollar index failed to weaken in the aftermath of QE3 that it I truly absorbed what could be underway.

Source: FreeStockCharts.com

{snip}

Yet, even with the unifying foreign exchange theme, it is difficult to draw direct correlations. {snip}

Some of my lessons have been learned the hard way. Rare earths delivered one of my most forceful lessons. {snip}

Source: FreeStockCharts.com

REMX includes “strategic metals” that are not rare earths, but the ETF still serves the illustrative purpose. There were some times to ride high where short-term trades worked out exceptionally well, but overall, I was forced to essentially admit defeat by early 2013. I never did write an official mea culpa, so THIS rethink piece will have to do. The height of my hubris came in a piece I wrote called “Seagate Not Likely to Find ‘Ruthenium-Like’ Relief From Soaring Rare Earth Prices.” {snip}

Indeed, rare earths imploded in many worse ways that I will not repeat here. Suffice it to say that this experience helped me grow a healthy skepticism about the sustainability of high commodity prices. Importantly for the commodities crash playbook, I could not point to an implosion in China’s economy as a core driver for rare earths. {snip}

The tipping point which crystallized my new thinking came in February 10, 2014 after listening to a podcast on Econ Talk titled “Paul Sabin on Ehrlich, Simon and the Bet.” The podcast included a discussion about the market dynamics of commodities where innovation continues to produce surprising sources of supply, methods of supply substitution, and adaptations in demand. {snip}

{snip}

As they say, timing is everything. With commodities swinging widely from one extreme to another, such an adage could not hold more true.

The final milepost on the way to a rewrite of my rules came in the form of a timely December 2nd article in Seeking Alpha (hat tip to a friend of mine): “Don’t Buy And Hold Commodities, Trade Them.” {snip}

{snip}

So, with that expansive background, here are my new, and hopefully improved, trading rules for the commodity crash playbook. At the playbook’s core, I retain an assumption that a global, economic calamity will eventually take commodity prices much lower, but I now hold no expectation or projection on when or where it will start or even how widespread or significant the event will become. (And to be clear, I would greatly prefer a world where economic calamities never occur). I retain a STRONG preference to OWN rather than sell (short) commodities. Readers should consider this a lingering bias from my wariness over the ultimate impact of global monetary policies that have flooded the world with paper currencies with more to come.

{snip{

Meta-rules: STAY OPPORTUNISTIC, RESPECT TRENDS, AND DEVELOP DEEP KNOWLEDGE

{snip}

Short-term: THE TREND REMAINS BEARISH BUT WATCH FOR BOTTOMING PROCESSES

{snip}

Medium-term: EAT AGRICULTURE

{snip}

Wildcard: WATCH OUT FOR CURRENCIES AND MONETARY POLICY

{snip}

Source: St. Louis Federal Reserve

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 5, 2015. Click here to read the entire piece.)

Full disclosure: long EEM put options, long REMX, long CORN, long NIB, long ERY, long call options in JOY, long BAL, short the Australian dollar