(This is an excerpt from an article I originally published on Seeking Alpha on December 21, 2014. Click here to read the entire piece.)

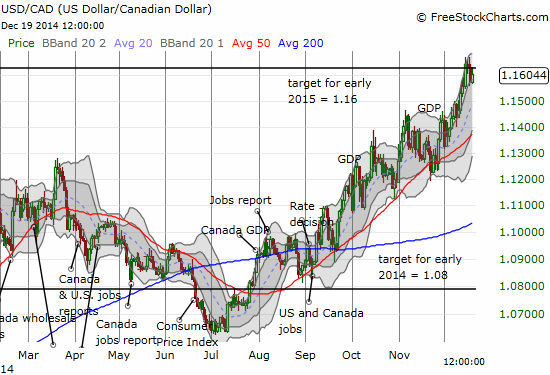

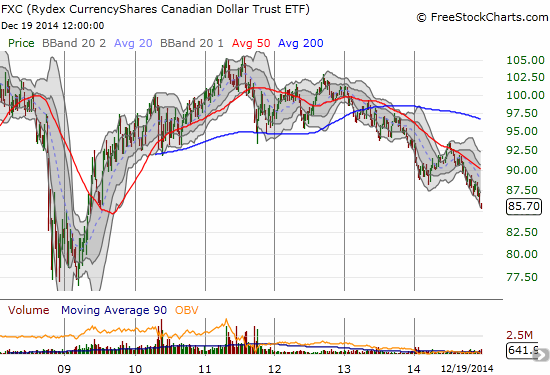

A year ago, the Canadian dollar (FXC) hit my then annual 1.08 target for the USD/CAD currency pair. I next contemplated setting a much more aggressive year-long target of 1.16. In February of this year, I made that target official. This past week, the Canadian dollar (FXC) hit my 1.16 target on USD/CAD.

Source: FreeStockCharts.com

Instead of generating an even higher target for next year or early 2016, I have finally turned bullish on the Canadian dollar. For me, the earlier decline in the Canadian dollar helped strengthen the Canadian economy through a resuscitation of exports. As this is happening, the unemployment rate is finally showing notable improvement again. Add in healthy GDP growth, I felt justified in finally turning bullish on the Canadian dollar even ahead of achieving my 1.16 target for USD/CAD.

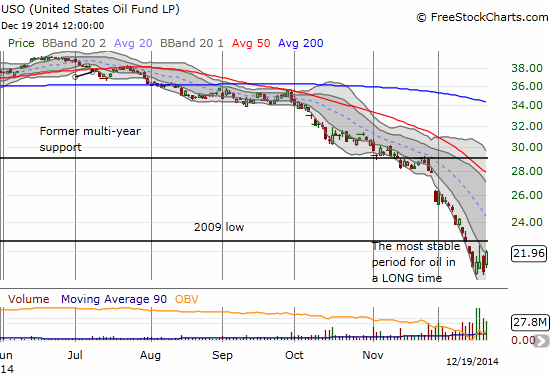

This bullishness of course looks out of step with the on-going collapse in oil prices (USO)…

…and the persistent strength of the U.S. dollar index (UUP) since the summer…

{snip}

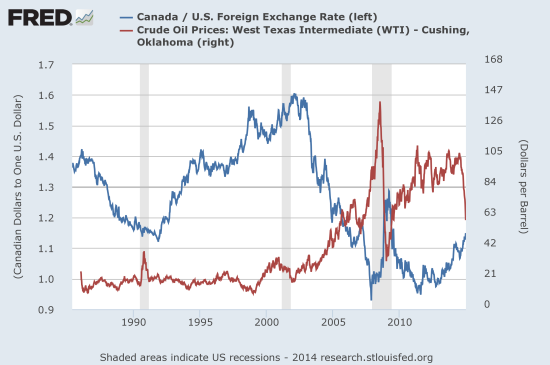

The conventional assumption says that Canada has a commodity-driven economy and thus has a “commodity currency.” However, in September for example, “mining, quarrying, and oil and gas extraction” was just 8.4% of GDP. “Agriculture, forestry, fishing and hunting” was another 1.5%. Energy as a sector is 9.7% of GDP. (Granted, these numbers do not untangle dependencies across sectors or address the heavier dependence of certain provinces on commodities). {snip}

{snip}

Source: St. Louis Federal Reserve

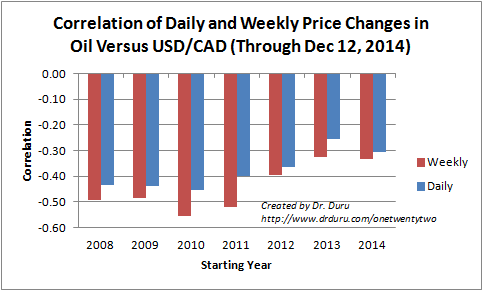

The exact correlations tell a more nuanced story. {snip}

Source for data: St. Louis Federal Reserve

The weekly correlations are consistently stronger (more negative) than the daily correlations…{snip}

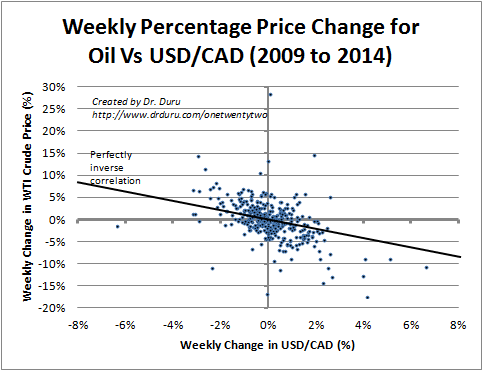

The following scatterplot further emphasizes the lack of a strong (inverse) correlation between USD/CAD and oil (WTI).

Source for data: St. Louis Federal Reserve

{snip}

I also checked for the potential of a one-day or one-week timelag in the correlation with oil as the cause and USD/CAD as the effect. I consistently found absolutely no correlation across all the years since 2009. This finding suggests that the direct correlations are at least meaningful.

The overall lesson here is that the Canadian dollar COULD weaken further on lower oil prices, but there is a lot more to the story especially when measuring the Canadian dollar against the U.S. dollar. If Canada’s economy continues on its path of strengthening as I expect, the drama unfolding in the oil patch will become more and more of a sidebar rather than the main plot line.

{snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: short USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on December 21, 2014. Click here to read the entire piece.)