(This is an excerpt from an article I originally published on Seeking Alpha on November 9, 2014. Click here to read the entire piece.)

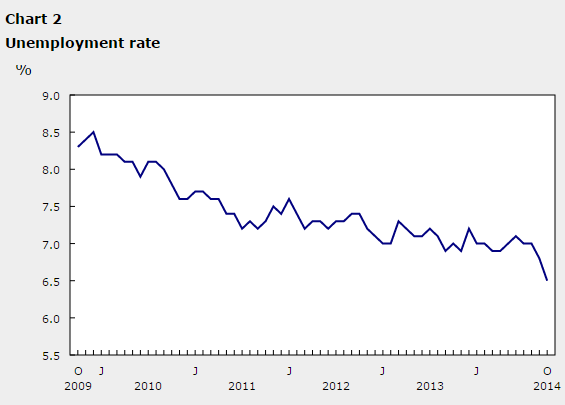

Suddenly, prospects for the Canadian dollar (FXC) are presumably improving with unemployment making a dramatic turnaround over the last two months. September’s good news was drowned out by October’s sharp sell-off and a surging U.S. dollar (UUP). However, October’s good news caught the attention of traders and helped CurrencyShares Canadian Dollar ETF (FXC) bounce 0.8% off a 5-year bottom.

Source: FreeStockCharts.com

Statistics Canada reported a second straight month of extremely strong job growth in Canada. September and October now account for an incredible 2/3 of all the employment growth over the last 12 months. {snip}

Source: Statistics Canada

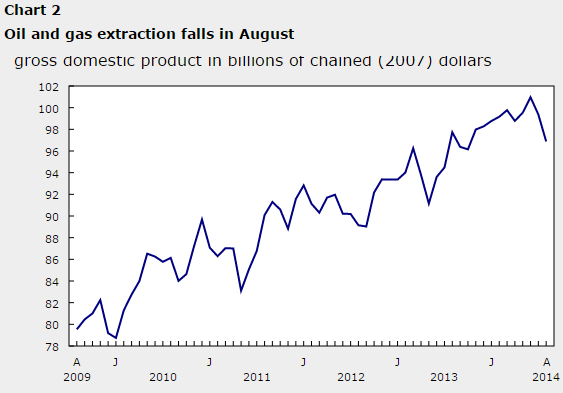

Muting the potential excitement was a relatively weak August GDP report the week prior. {snip}

Source: Statistics Canada

{snip}

Overall, I think there is enough “daylight” in the economic numbers to finally switch my bias on the Canadian dollar from bearish to (tentatively) bullish. {snip}

I am very tentative because I am wary of fighting the upward trend in the U.S. dollar index. This trend has taken a life of its own where good news in Canada may continue to matter little in the face of what traders see as the bigger domestic catalysts in the U.S. Accordingly, I continue to trade VERY bullishly on the U.S. dollar against most other major currencies. Hopefully, that will prove to be enough of a hedge while I wait for a confirmed turn-around in the Canadian dollar.

Be careful out there!

Full disclosure: long the Canadian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on November 9, 2014. Click here to read the entire piece.)