(This is an excerpt from an article I originally published on Seeking Alpha on October 27, 2014. Click here to read the entire piece.)

Wednesday’s terrorist attack in Canada disrupted life in Ottawa on the same day the country’s central bank was scheduled to hold a press conference to discuss its latest monetary policy decision. The Bank of Canada cancelled the meeting until further notice, but the introductory statement and October’s Monetary Policy Report were posted. The introductory statement is of great interest on its own. A rescheduling of the press conference is definitely in order because I suspect journalists and the like will have a LOT of questions for Governor Stephen S. Poloz.

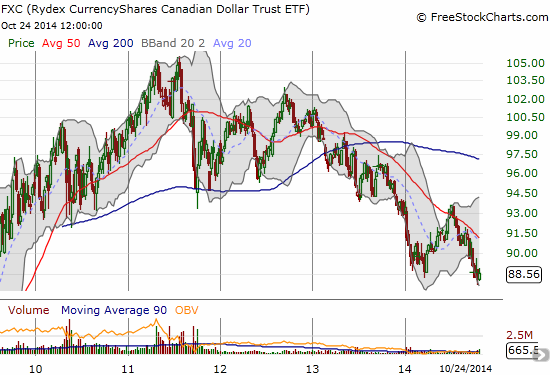

Commentary related to the Canadian dollar (FXC) was limited but of interest nonetheless. Poloz noted that Canadian exports are finally doing well, partially thanks to a weaker Canadian dollar. The Bank of Canada has completed a detailed study on exports that demonstrates that the export sector still has a long way to go to return to its previous health:

{snip}

The implication here is that Canada’s exports have suffered from a lack of competitiveness. {snip}

Interestingly, the statement did not contain any reference to the surprisingly strong jobs report two weeks ago. {snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on October 27, 2014. Click here to read the entire piece.)