(This is an excerpt from an article I originally published on Seeking Alpha on June 21, 2014. Click here to read the entire piece.)

“There is no mechanical formula.”

This is the response Federal Reserve Chair Janet Yellen gave to a reporter who tried to press her on the rules and timing for the first hike in interest rates. This was also the final statement in the press conference to the latest policy decision, and I think it sums up the entire event. Yet, despite the Federal Reserve staying on-message, some observers managed to get all twisted in disappointment, dismay, and even surprise. I claim that two camps in particular were likely frustrated with the Fed’s seeming refusal to talk directly about accelerating the presumed schedule for rate hikes (currently projected around the second half of 2015): stock market bears and several major central banks.

A Trigger Lying In Wait for Market Bears

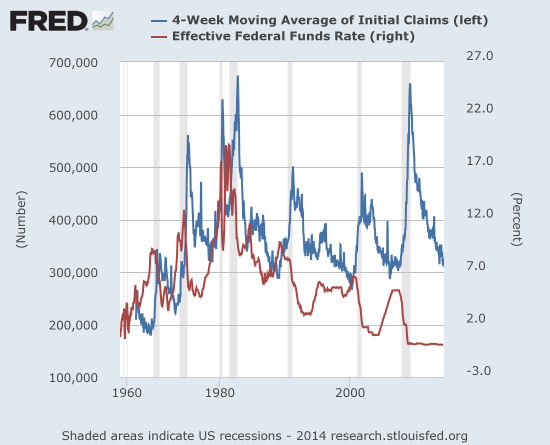

{snip} Below, I post a chart I first produced last December to explain potentially why the market was all hot and bothered over tapering (see “A 1-Chart Explanation For The Market’s Obsession With Fed Tapering And Tightening“). The 4-week moving average of unemployment claims has just about reached the lows of all the economic cycles since the late 1970s. A rising rate environment at this point has pretty consistently preceded a recession just over the horizon.

Source: St. Louis Federal Reserve

In other words, bets against the stock market could bear a lot more fruit once the Fed finally indicates it is truly serious about hiking rates. A stock market at all-time highs and major lows in volatility strikes me as particularly vulnerable to talk of higher interest rates.

Antsy Central Bankers With Stubbornly Strong Currencies?

I am really stretching the speculation by claiming major central banks are also getting frustrated with the Federal Reserve, but I think the rationale deserves consideration.

{snip}

{snip}

{snip}

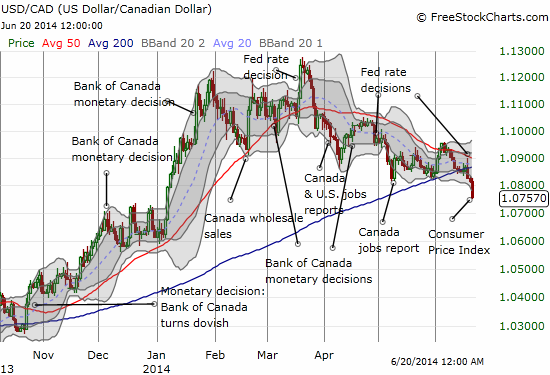

The Bank of Canada has consistently projected the U.S. as a beacon of economic strength for the global economy in 2014 while downgrading its outlook on the Canadian economy. Governor Stephen Poloz does not talk about purposely pressuring the Loonie (FXC), but his rhetoric has helped to weaken the currency and provide some much needed relief for Canadian exporters. His effectiveness is reflected in a recent Bloomberg article that pointed out:

{snip}

Poloz has a major challenge ahead with the double whammy of a non-cooperative Federal Reserve AND May consumer price index readings which came in unexpectedly high on Friday, June 20. {snip}

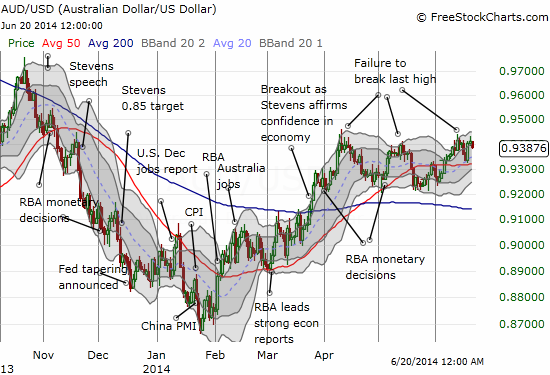

The most frustrated central bankers may be down in Australia where Governor Glenn Stevens and crew have regularly expressed their surprise that the Australian dollar (FXA) remains so high. {snip}

{snip}

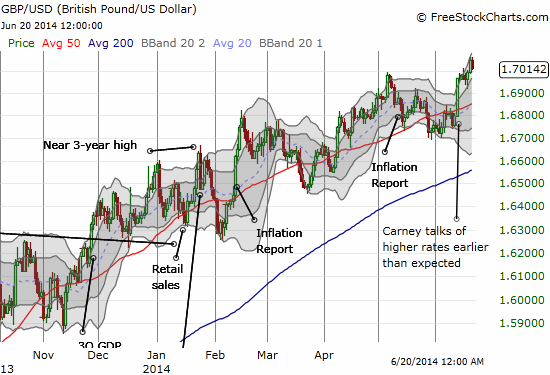

Source for charts: FreeStockCharts.com

Another Over-Reaction to the Federal Reserve

So now I bring this full circle back to the Federal Reserve’s last decision on monetary policy. The reaction to this decision is indicative of a market groping for a catalyst that changes the balance of power in financial markets; something that provides some excitement (aka volatility) even. I was so surprised at all the hand-wringing over a “business as usual” policy statement that I rolled the tape on the press conference. Wondering what I missed, I actually listened to the conference call a second time (yes, it was painful). The experience made me even more convinced the market over-reacted just as much as it did when Yellen carelessly suggested rates might increase earlier than the late 2015 market projection.

{snip}

So, even as gold and silver surged the day after the Fed’s decision, I contained my excitement. I was even quite bemused and amused by the readiness of gold-haters {snip} to jump on that pop as confirmation that the Fed is indeed behind the curve. {snip}

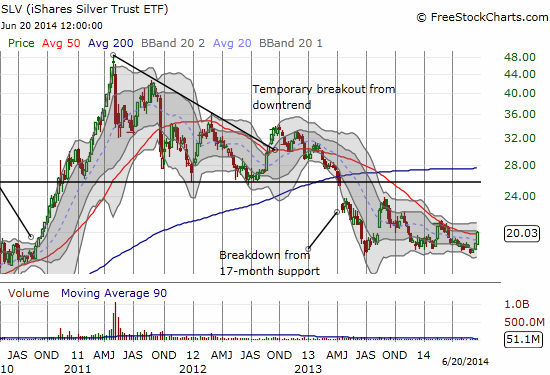

{snip} While little has fundamentally changed for gold, silver is in even worse shape…

Source for charts: FreeStockCharts.com

{snip}

To me, the data do not support the notion that broad-based inflation is taking hold in the economy. We do not even have wage pressures, not to mention all the slack that remains in the economy as evidenced in part by extremely low levels of housing production. I will not even be surprised if late 2015 comes and goes without a single rate hike. Indeed, Yellen informed the crowd that there is a lot of uncertainty in monetary policy:

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on June 21, 2014. Click here to read the entire piece.)

Full disclosure: long GLD, SLV. In forex, I am long USD/CAD, net short the Australian dollar, net short the euro, net long the pound.