(This is an excerpt from an article I originally published on Seeking Alpha on March 11, 2014. Click here to read the entire piece.)

After employment in residential construction put on a surprisingly strong showing amidst a generally dismal January employment report, I decided to keep closer tabs on this important indicator of health in the home building industry. As expected, the February jobs report did not feature blistering month-over-month growth again for residential construction, but year-over-year growth remains strong (0.5% and 8.4%, respectively, off seasonally adjusted numbers). This growth still outpaces overall job growth in the economy. I still expect at some point soon the strong year-over-year growth numbers will start cooling off.

{snip}

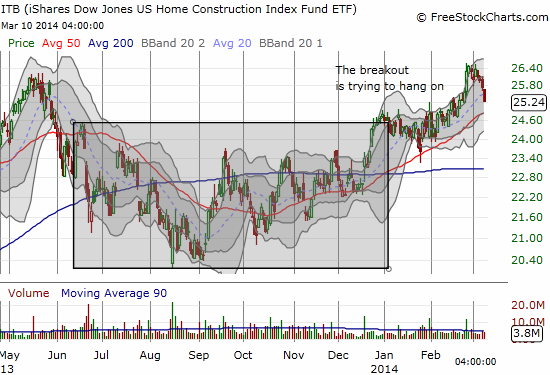

Perhaps the 3 days of selling in ITB even as the general market flatlined was in anticipation of today’s downgrades. {snip}

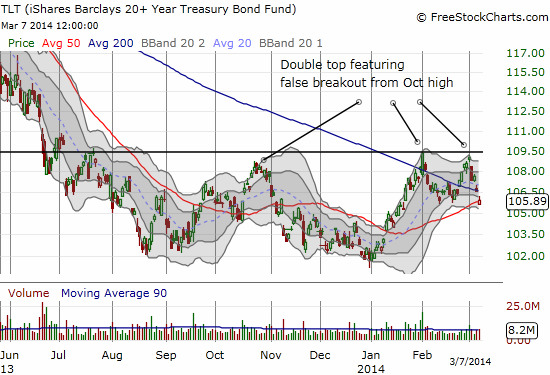

In parallel with ITB’s small dip before Monday was an on-going dip in the iShares 20+ Year Treasury Bond (TLT) that looks like the completion/confirmation of a double-top for the year. {snip}

Source for charts: FreeStockCharts.com

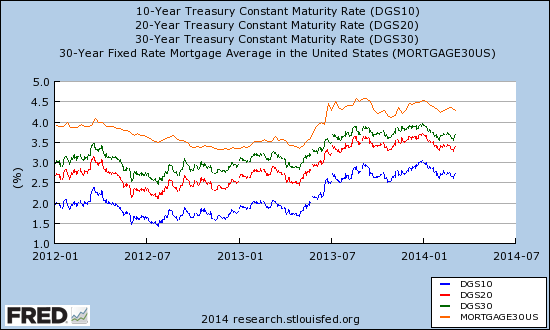

TLT is apparently peaking for now in the context of an on-going stabilization of rates that is yet to show the upward pressure that seems very likely to come in 2014.

Source: St. Louis Federal Reserve

ITB’s last positive catalyst was unexpectedly strong January new home sales data reported on February 26th: 9.6% above December’s revised estimate and a 2.2% gain year-over-year. The supply of new homes for sale was a paltry 4.7 months of supply. ITB has rolled back those gains. Such a reversal is always a yellow flag, but for now, I am treating it as another buy-the-dip opportunity for select positions.

{snip}

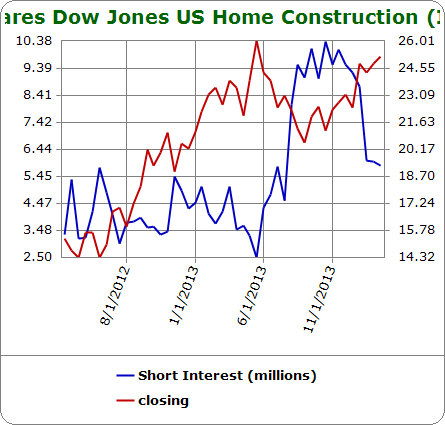

Source: Schaeffer’s Investment Research

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on March 11, 2014. Click here to read the entire piece.)

Full disclosure: long ITB call options, long DHI shares