(This is an excerpt from an article I originally published on Seeking Alpha on February 19, 2014. Click here to read the entire piece.)

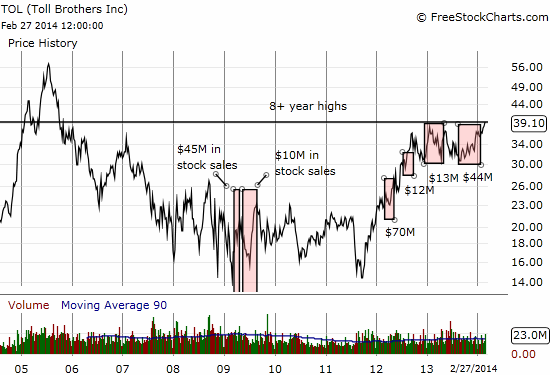

Back in 2009, I was as bearish on housing as anyone. For example, I wrote two pieces pointing to massive insider stock sales at Toll Brothers (TOL) as evidence that company executives did not really believe their own words about an imminent housing recovery (see “Spring Home-Selling Is So Good that the Tolls Are Selling” and/or “Insiders At Toll Brothers Continue to Dump Shares Ahead of Reported Housing Recovery“). Indeed, solid signs of a recovery did not appear for another two years or so. Although TOL’s stock mainly traded in a wide range from 2009-2011, I felt vindicated. However, looking back on the data from my bullish vantage point, I have realized that in the larger scheme of things, these stock sales were practically meaningless. If anything, the tens of millions in dollars sold by the Toll brothers and other corporate insiders demonstrate how much money there is to be made as a shareholder in a public home builder.

{snip}

Source for chart: FreeStockCharts.com. Source for stock sales: Yahoo Finance.

The 2009 data come from the articles I referenced earlier. Once I stopped being so bearish on housing (more on that below), I unfortunately stopped tracking the data. Yahoo Finance only goes back two years, thus the gap in my representation of sales in 2010 and 2011.

My recovery from housing bearishness was almost an accidental one. It was my youngest brother who shook me up and eventually convinced me to start looking for the positives rather continue to dwell on the well-known negatives. {snip}

Now, I have select holdings in home builders that I have written about over the past two years; all short-term trades have been from the bullish side. TOL has not been one of my holdings or trades, but, as I said, I have not been nearly as bullish as I should have been in the early phase of the housing recovery. 2012 turned out to be an extremely fast reversal in negative housing sentiment; it was like all the imminent good news for 2013 was priced in 2012. 2013 became a year of consolidation. In early January, I pointed to what I thought were signs of a breakout for home builder stocks. That breakout seems to be unfolding…no matter how many shares the Toll brothers are selling in their golden years.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on February 19, 2014. Click here to read the entire piece.)

Full disclosure: no positions in TOL