(This is an excerpt from an article I originally published on Seeking Alpha on January 6, 2014. Click here to read the entire piece.)

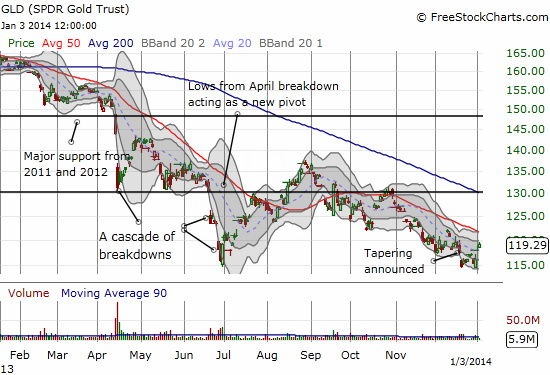

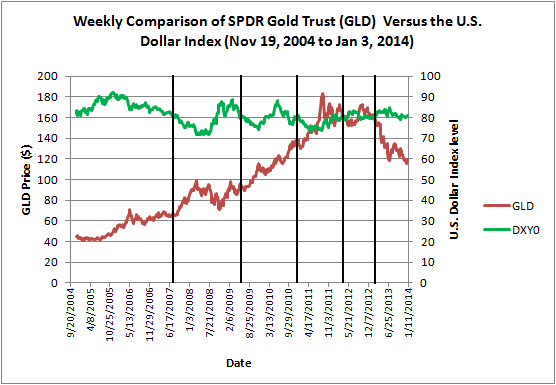

This year started off with a strange combination of trades. One of the more surprising was to watch the U.S. dollar index (UUP) start the year strong at the same time gold (GLD) experienced a rare bit of relief.

The U.S. dollar index has rallied over the last three days to a one month high and is finally at a new post-tapering high.

At the same time, GLD has rallied the last three days to close at a post-tapering high.

Source for charts: FreeStockCharts.com

GLD’s bounce is particularly important because it comes at a time when it surely should have cratered through 2013’s low in the wake of what some are interpreting as the beginning of monetary tightening by the Fed.

The Fed of course is eons away from tightening, at least rhetorically. The last Federal Reserve statement reminded the market that the Fed will remain extremely accomodative: “…the Committee today reaffirmed its view that a highly accommodative stance of monetary policy will remain appropriate for a considerable time after the asset purchase program ends and the economic recovery strengthens.”

The Fed has also given itself a LOT of latitude in determining when to finally hike interest rates (emphasis mine):

{snip}

The end result is what I call a “sample of tapering.” The Fed’s move is far from tightening, but it does officially put tightening on the radar of market participants. {snip}

On January 1, 2014, CNBC ran a story headlined “Why gold bugs should brace for an ‘awful’ 2014.” The international desk interviewed Dominic Schnider, Head of Nontraditional Asset Classes at UBS Wealth Management, who provided an end-of-year target for gold at $1050. {snip}

My ears REALLY perked up at the following pronouncement: “Right now, you don’t really need to have any insurance assets like gold against all kinds of economic or financial tail risks.” {snip}

The good news is that these developments set up opportunities to accumulate gold at much better prices. It makes more sense to buy insurance for lower prices than higher prices. I hope to be well-positioned to accumulate at $1050, even $1000.

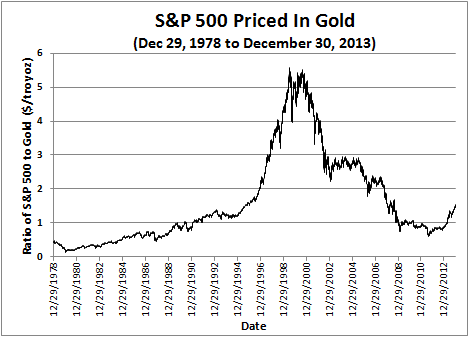

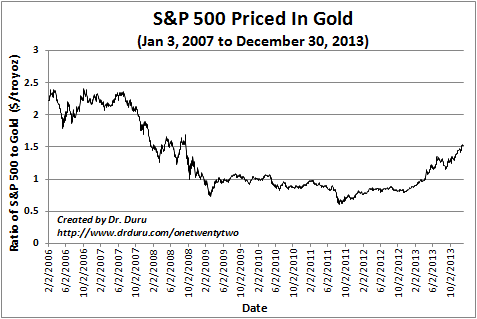

The soaring stock market is helping to breed more comfort with overall financial conditions. {snip}

Source for data: World Gold Council and Yahoo Finance

{snip}

{snip}

Source for prices: FreeStockCharts.com

So, overall, I see every reason to believe Schnider’s forecast even if some of the components of the forecast somewhat conflict. {snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 6, 2014. Click here to read the entire piece.)

Full disclosure: long GLD