(This is an excerpt from an article I originally published on Seeking Alpha on January 21, 2014. Click here to read the entire piece.)

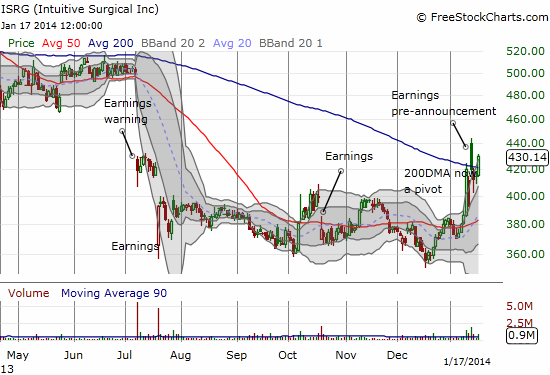

Intuitive Surgical (ISRG) recently caught my attention again. The maker of the da Vinci® Surgical System has experienced a tumultuous week or more of trading leading up to and following a preliminary announcement of fourth quarter and full year earnings. I fully expect the actual earnings release to catalyze even more volatility.

It just so happened that ahead of the recent volatility, I noticed that the latest issue of Obstetrics & Gynecology (January, 2014, volume 123, Number 1) from the American College of Obstetricians and Gynecologists (ACOG) included four articles dealing with robotic surgery. I became motivated to slog through these articles to explore whether ISRG was worth more than some short-term trading. That is, I wondered whether last year’s plunge in the stock represented a unique buying opportunity. After reading these articles and reviewing some of the citations, I am convinced that ISRG is indeed a buy on the dip kind of stock.

{snip}

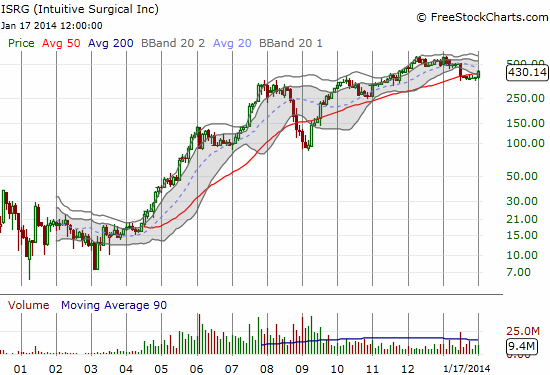

Source: FreeStockCharts.com

{snip}

My interest in reading the Obstetrics & Gynecology articles only grew seeing that ISRG fingered a slowdown in benign gynecologic procedures as a prime culprit in the company’s current change of fortunes. {snip}

{snip}

The articles I referenced here are a small part of an ever-growing body of work studying the impact of robotic surgery. Overall, these articles, including their rich set of references and citations, demonstrate to me that the field of study of the efficiency, efficacy, and value of robotic surgery remains a wide-open field. There seems to be enough evidence to suggest that the future remains promising even as several areas of caution and skepticism continue to receive attention and get addressed. At the right price, perhaps at current levels (depending on what ISRG has to say this week!?), ISRG is a great way to invest in this future. If benign gynecology is what ISRG’s weak point looks like, then I can only imagine the compelling stories being told from its stronger points.

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on January 21, 2014. Click here to read the entire piece.)

Full disclosure: no positions