(This is an excerpt from an article I originally published on Seeking Alpha on December 27, 2013. Click here to read the entire piece.)

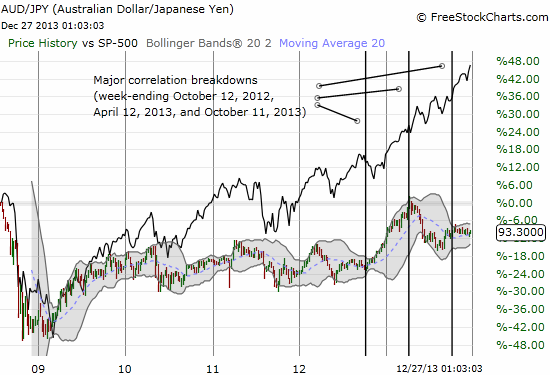

In “A Major Test Awaits The Australian Dollar In 2014 As 2013 Delivered New Correlations” I discussed this year’s strong (inverse) relationship between the U.S. 10-year Treasury yield and the Australian dollar (FXA). Another relationship that has caught more of my attention is that between the Australian dollar and the Japanese yen (FXY). {snip}

Source: FreeStockCharts.com

{snip} This year turned everything around: the Bank of Japan (BoJ) forced the issue of yen devaluation in early April with its massive monetary easing program. Once AUD/JPY ended a quick streak higher, it topped out at a level not seen since. Once the Reserve Bank of Australia (RBA) cut interest rates the following month, the devaluation advantage swung back to the Australian dollar. {snip}

From here, I am guessing AUD/JPY heads higher in due time. Such a move is consistent with the overall post-recession uptrend. Such a trade presents an intriguing ply on wide rate differentials given the RBA is not likely to reduce rates further absent an economic emergency. {snip}

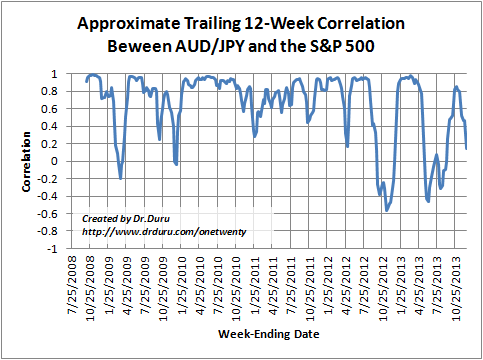

As 2014 unfolds, I will be watching closely to see whether the resolution of AUD/JPY’s tight range comes with a new correlation with the S&P 500. In particular, if AUD/JPY manages to break away higher, the recent history says that the S&P 500 is very likely to move higher in parallel…or in due time. A downward resolution for AUD/JPY will be a red flag awaiting confirmation.

The chart below suggests that current cycle of little to no correlation is roughly halfway finished. So, an approximate target for observing increasing correlation again is late January to mid-February.

Source for price levels: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on December 27, 2013. Click here to read the entire piece.)

Full disclosure: long AUD/JPY